Learn more about the global crisis in automotive semiconductor supply and what near-, medium- and long-term actions Roland Berger recommends.

Semiconductor shortage 2023: A different kind of trouble ahead

Not over yet: Why chip shortages are still slowing automotive and industrial companies

Automotive and industrial companies continue to be confronted by short supply of “legacy nodes” – despite an easing of demand in consumer electronics. Here’s what decision-makers need to know.

"The semiconductor crisis created an urgent mandate for every company to structurally rethink risk mitigation (not only) in their semiconductor supply chains."

For some industries, the ongoing semiconductor shortage shows no signs of stopping. This is especially true for automotive and industrial manufacturers, who depend on “legacy” semiconductor technologies and nodes, according to a new Roland Berger report. Despite an easing of shortages on the consumer side, we expect chip imbalances to affect these industries for several years.

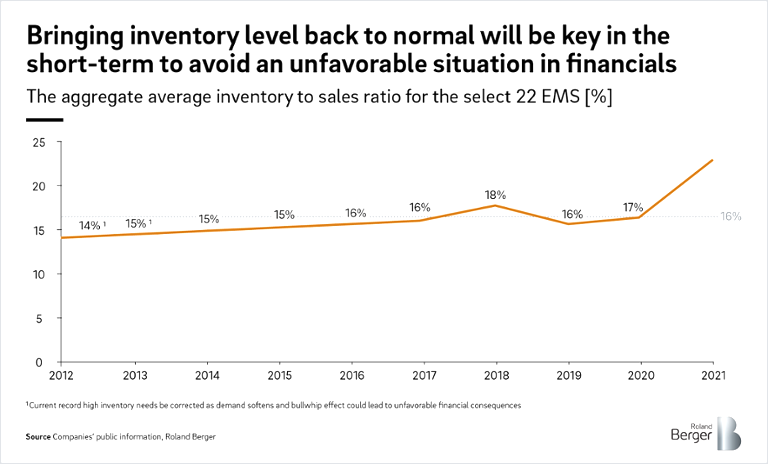

Meanwhile, component users and producers are confronted with growing inventory, financial burdens, and the likelihood of a potential bullwhip effect in supply. This complicates an already tenuous situation. In anticipation of continued “legacy” chip shortages, here’s what automotive and industrial leaders can do to ensure the best possible outcome.

A different kind of shortage

Based upon growing fears of a global recession, consumer demand for electronics has softened by 30% recently. This has freed capacity in some technology areas, and effectively temporarily ended to some extend the short-term chip shortage the world has faced for the last two years. But it hasn’t solved the problem.

While weakening demand in consumer electronics has improved supply of leading-edge and advanced-node semiconductors, it has not (nor will it) improve the low supply of legacy chips (based on 8“ and 6” wafers) that are largely used by automotive and industrial companies.

"Industrial and automotive companies are confronted with a structural shortage which is likely continue to last for several years in legacy semiconductor technologies. At the same time, we see overcapacity and excess inventory in advanced technologies."

This forces today’s semiconductor buyers to walk a tightrope: weathering an inventory correction and ongoing supply bottlenecks at the same time. Excess inventory which semiconductor companies, EMS providers, and some Tier-1 companies recently built up to safeguard production, however, will likely become an issue.

Consequently, we expect a significant bullwhip effect soon. Many affected companies increased their safety stocks from a historic average of 16% to now more than 23% and now need to manage the financial burden especially in view of increasing capital cost

No immediate relief for “legacy nodes”

Although overcoming the chip shortage has been a big issue over the last two years, very little attention, resources, and public discussion has centered on the “legacy node” chips that automotive and industrial companies rely upon.

For example, 62% of the automotive market and 57% of the industrial market relies on analog/mixed signal chips, microcontroller units, or specialty components such as MEMS. As chip manufacturers increasingly look to “future proof” their businesses in more advanced chips, however, these older and more specialized chips will increasingly be in short supply.

Public relief packages offer little to no relief either. The recently passed U.S. CHIPS Act, for instance, only allocates 5% towards legacy node production increases. Similarly, the unclear budgets and guidance found in the European Chips Act will have little impact on the ongoing legacy node shortage affecting automotive and industrial companies. As is, we expect this legislation to have no measurable impact until at least 2024/2025 when market corrections take full effect.

Moving forward, affected companies must use the window of opportunity to move to centralized E/E architectures and design-in semiconductors from modern technology nodes. In addition, they need to focus on correcting and optimizing their inventories to improve their cash balances and eliminate unnecessary costs, all while maintaining bottleneck management of spare parts used in production. To learn more about the short-, mid-, and long-term mitigation measures, including seven key supply strategies, please read, Semiconductor shortage: A different kind of trouble ahead.

For specific questions related to your supply challenges, please contact us — we are here to help and bring decades of experience in the automotive and industrial sectors.