Roland Berger advises the aerospace, defense and security industries. We support OEMs, suppliers, agencies and investors.

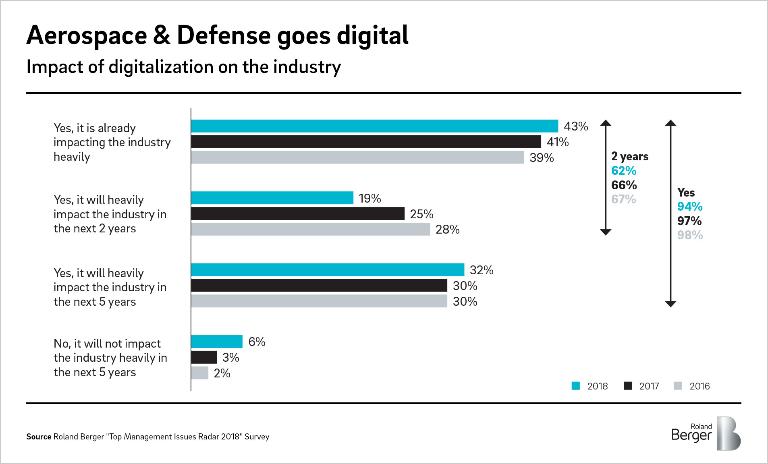

Aerospace & Defense Top Management Issues Radar 2018

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/Roland_Berger_Aerospace_Defense_Radar_Cover_1_download_preview.jpg)

Roland Berger's poll of more than 200 senior industry executives from 90 companies in 15 countries offers an insight into the key challenges and stand-out trends in the A&D industry and how companies are dealing with them.