Fully digitalized supply chains in response to retail challenges

Future-proof retail: How to get there

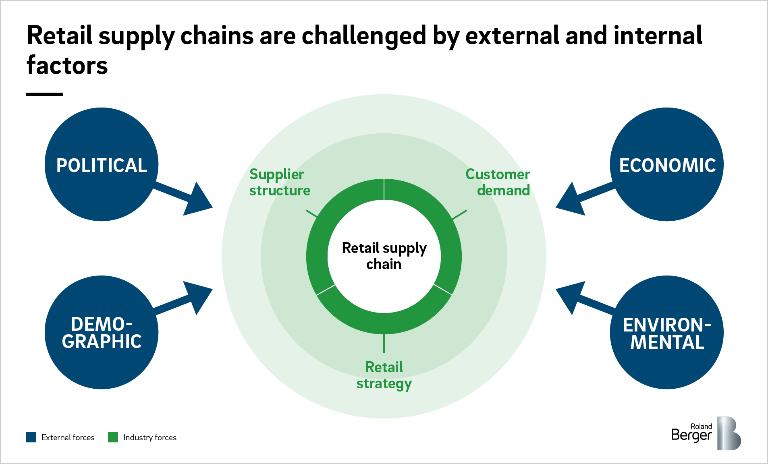

The retail sector and especially its supply chains are facing drastic changes: Political and social uncertainties, the effects of climate change and demographic trends, new products and business models, as well as changing customer demands – these and other factors, internal and external, are forcing companies to rethink their supply chain strategies and adapt to the transformation going on around them. We have identified eight key supply chain paradigm shifts that retailers should make. The end result must be a radically digitalized supply chain. That said, simply jumping on the latest technology bandwagon is not the way to go. Retailers need to develop the right overall strategy for them, based on where they are now, and take the necessary steps to implement it.

Supply chains are the beating heart of the retail trade – only when they run smoothly can companies meet the demands of their customers and operate successfully. Indeed, the importance of highly effective and efficient processes cannot be overstated. Especially when considering that today's supply chains are virtually always networks of an international or even global nature, making them susceptible to a multitude of disruptive factors. Such disruption is more and more frequent nowadays, coming from the outside environment and from inside the sector alike, and it exerts a substantial influence on supply chains individually and collectively.

External factors include the political environment: An increase in nationalist and anti-globalization tendencies worldwide has brought trade conflicts, higher customs duties and added costs for companies. Not only that, but stricter climate protection laws, uncertainty and added data protection regulations and employee rights also affect the retail trade and its flows of goods, and there is often a lack of legal framework for newly emerging technologies or products. Economic development is another factor: Growth in the retail sector is now taking place primarily in emerging markets, while the concept of limitless consumption is increasingly being questioned in saturated Western markets. There are also differences in income levels, which influence demand regionally, coupled with challenges such as labor shortages in logistics in countries like Germany.

Climate change poses a challenge for supply chains

Demographics and climate change are also shaping the need for retail transformation: Supply chains contribute to climate change themselves, which means that they must be optimized to produce the least transport-related emissions. On the other hand, factors like weather-related production losses or disrupted infrastructure pose a risk to replenishment in the retail sector, which players must counteract through regional diversification. Demographic trends, for their part, are not only changing the customer base as our populations age and household sizes decline, but they are also creating logistical challenges due to the increase in urbanization worldwide and the resulting overburdened infrastructures.

Areas within the industry itself where disruption is making its presence felt include the retailer's own sales strategy: It must meet the changing needs of consumers rather than online availability, fast and convenient delivery, product experience instead of ownership, sustainability and similar criteria are taking on increasing importance. For retailers, this means more e-commerce, moving toward omnichannel retail, and a growing need for creative new business ideas such as pop-up stores or special shopping events. For this to work, supply chains need to be optimized. At the same time, retailers still have to cope with high price sensitivity from customers as well as the fact that online comparisons are always available. Thus, prices are dictated by the most efficient retailer, and others are forced to achieve a comparable level of efficiency. Added to that, there is growing competition, including from new manufacturers and brands that bypass traditional retail and approach end customers directly through online channels. The growing demand for locally or regionally produced goods, especially in the food sector, as well as ever shorter product cycles also call for new forms of procurement.

In summary, these factors taken together pose four key challenges for retailers and their supply chains: rising uncertainty that stems from political and regulatory instability and the unpredictable impact of climate change; growing complexity, partly caused by the increasing diversity of business models, channels and manufacturers; more demanding customer expectations in respect of quality, choice, price and availability of the full assortment at all times; and sustained cost pressure due to factors such as a shortage of skilled workers and scarcity of resources in the face of rising price pressure emanating from saturated markets and increasing competition.

Only radical digitalization can enable the necessary retail supply chain shifts

These challenges are forcing retailers to rethink the status quo and develop a vision for a sustainable supply chain. They need to cast aside eight paradigms and replace them with new principles:

The eight paradigm shifts needed for a future-proof supply chain

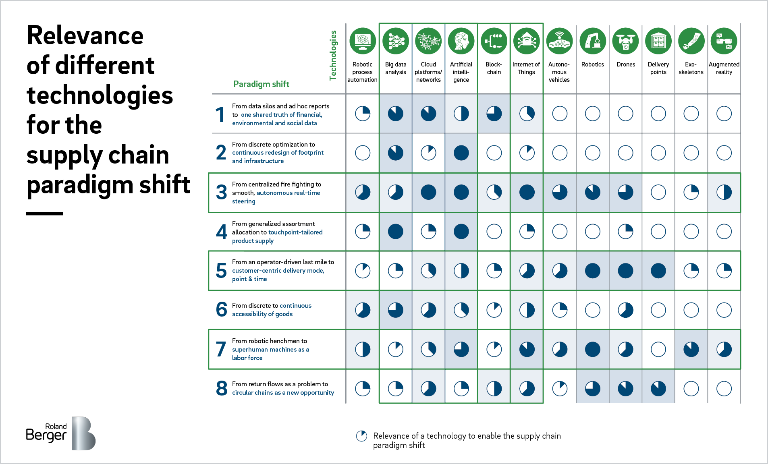

Realizing these paradigm shifts will require retailers to avail themselves of the entire spectrum of digital technologies – from robots and big data analytics to artificial intelligence. Only radical digitalization of the complete supply chain will enable the flow of information and goods to become as efficient, flexible, fast and cost effective as the retail transformation requires (see infographic).

Big data analytics, for example, facilitates a better understanding of customer behavior and allows retailers to predict when and where demand will arise. Armed with this knowledge, they can then tailor different supply chain elements, from production to delivery, to match demand. Artificial intelligence can be used to improve planning and forecasting, ensure an efficient warehousing system and optimize processes like supplier selection. And the Internet of Things enables increasingly autonomous real-time control of supply chain processes.

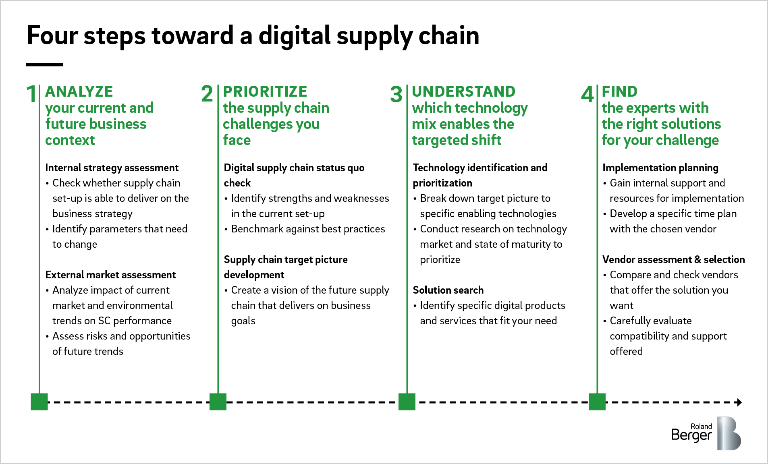

Comparing the available digital technologies against the eight paradigms for a future-proof supply chain reveals that there is no ONE technology that can resolve all of the challenges (see infographic). In this context, the whole is more than the sum of its parts, so a smart combination of the various digital tools is needed in order to get the most out of the supply chain as a whole. The retailer's individual situation must always be the starting point. It is therefore advisable to proceed in four steps – with each one run through not just once but repeatedly in a continuous spiral of optimization:

Doing this will allow retailers to stay in control as they transform their supply chain into a fully digitalized system. Simply following the latest trends will not lead to success in the long run. What they need to do is develop and implement an overarching strategy that can make the beating heart of retail fit for the future.

If you like to get the full study, please don't hesitate to connect with our experts Matthias Hanke