Roland Berger is a thought leader in environmental issues and the response demanded from organizations. Our publications cover all relevant areas.

E-Mobility booms despite the pandemic

By Stefan Riederle and Wolfgang Bernhart

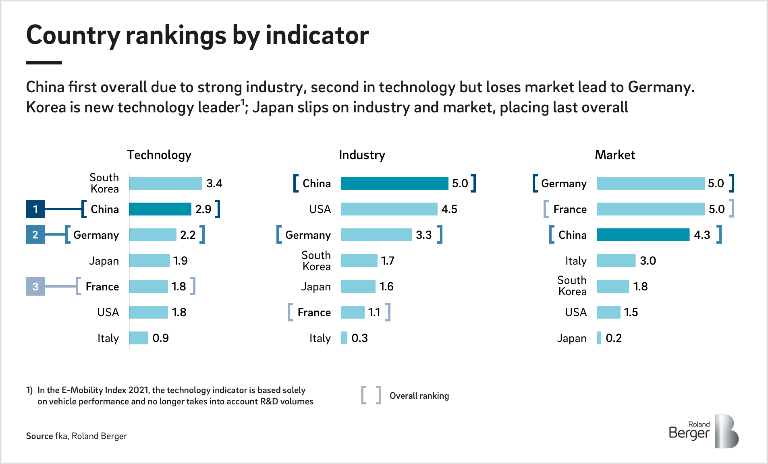

E-Mobility Index 2021: China leads the market, Germany strengthens its position, while the USA experiences minor growth

"20.5 percent market share in December 2020 shows that the trend toward e-mobility is also unstoppable in Europe."

Bucking the trend: While automotive markets around the world were heavily disrupted by the Corona pandemic last year, sales of electric vehicles – particularly in Germany – rose sharply. According to the authors of the "E-Mobility Index 2021" study, the German automotive industry should, for the most part, be able to meet the ambitious CO2 targets set by policymakers. The study shows that the global situation is more disparate. Japan, for example, recorded a slump in electric car sales in 2020, while the market for electric vehicles in China and the United States grew moderately.

The latest "E-Mobility Index 2021”, which was jointly developed by Roland Berger and fka GmbH, is based on three indicators: technology, industry and market. These indicators enable an objective view of the status quo of e-mobility in the leading automotive nations: China, Germany, France, Italy, Japan, South Korea and the USA.

E-mobility achieves a breakthrough

In Germany alone, nearly 400,000 electric vehicles were sold in 2020, compared to just 112,000 in the previous year. This means that electric car sales more than tripled, and the share of electric vehicles in Germany in the overall market rose to 12.6 percent (2019: 2.9 percent). Germany is now the world's second largest market for electric vehicles, behind China.

E-mobility also experienced a huge boost last year in the two other European markets included in the study. 194,000 (2019: 69,000) electric vehicles were sold in France and 61,000 (2019: 18,000) in Italy. Such positive development of e-mobility in Europe can primarily be attributed to government support for electric vehicles in the form of purchase bonuses. In Germany, for example, public authorities and manufacturers subsidize the purchase of fully electric vehicles by up to 9,000 euros, and plug-in hybrids by up to 6,750 euros.

Supply of electric vehicles grows

The ever-growing range of electric vehicles has also contributed to the rise in e-mobility. Corresponding electric cars are now available for purchase in every vehicle class, and almost all automotive manufacturers launched new models in 2020 – in Germany, 15 fully electric vehicles and 20 plug-in hybrids. This year, the German automotive industry plans to introduce another 14 fully electric vehicles. Only the U.S. is ahead of Germany, with an expected introduction of 20 all-electric models for 2021. China and France each plan to introduce 11 fully electric models this year.

"Lifecycle assessment leads to the situation that automobile manufacturers and suppliers should already think about additional measures that they can take to improve their emissions balances."

As in the previous year, automotive manufacturers increased production capacity for electric vehicles in 2020. Despite this increase in vehicle production, public demand for electric cars could not always be met. Waiting times of up to one year and delivery stoppages for certain vehicles prevented e-mobility from growing at an even faster rate.

Stricter climate targets as a challenge for the industry

The authors of the study presume that the overall positive market development will enable European automotive manufacturers to meet the average fleet emissions target of 95 g CO2/km. All newly registered vehicles in the EU from 2021 must comply with this target.

However, three developments relating to e-mobility pose challenges for the automotive industry:

- The EU Commission wants to further adjust climate targets for vehicles. Accordingly, newly registered vehicles should emit an average of 50 percent less CO2 in 2030. Previously, new vehicles were expected to emit 37.5 percent less CO2.

- Studies on plug-in hybrids found that most markets’ real consumption rates are two to four times higher than in the laboratory. As a result, politicians and climate groups are increasingly calling for a reduction in tax incentives for plug-in hybrids compared to electric vehicles.

- In the future, regulatory authorities will pay more attention to the lifecycle assessment of a car. This means that on top of emissions during use, emissions arising further upstream – in the extraction of raw materials or the production of vehicles – will also play a role. Since car manufacturers only account for around 10 to 20 percent of production emissions, all suppliers in the value chain will be obliged to improve their carbon footprint in electric vehicle production.

To learn more about the current state of e-mobility, download the full study here now:

E-Mobility booms despite the pandemic

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/Roland_Berger_STU_715_E-Mobility_Index_Cover_download_preview.png)

The "E-Mobility Index 2021" shows that the industry is booming. This is due to higher sales figures, increasing production capacities and more models.

Sign up for our newsletter and get regular updates on Smart Mobility topics.

_image_caption_none.png)