Charge Point Operators (CPOs) have been at the forefront of the public electric vehicle (EV) charging infrastructure drive over recent years, but how can they defend their positions and carve our roles as indispensable service providers as the market matures?

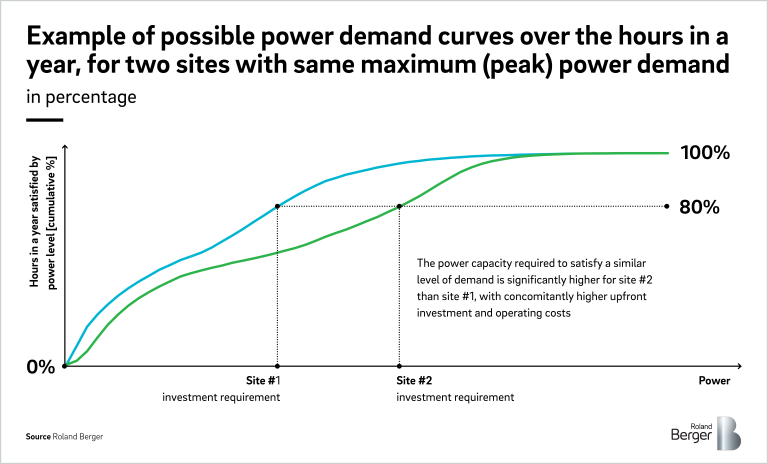

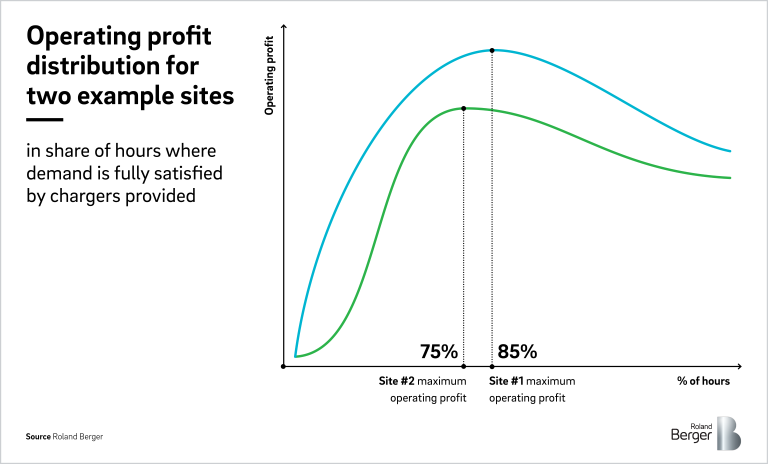

Balancing Demand and Delivery

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/22_8_002_GB_19_Balancing_Demand_and_Delivery_Final_Cover_download_preview.jpg)

How can companies capture growth in EV charging?