Booming café and casual dining market in South-East Asia

By Mani Garg

Booming café and casual dining market in South-East Asia

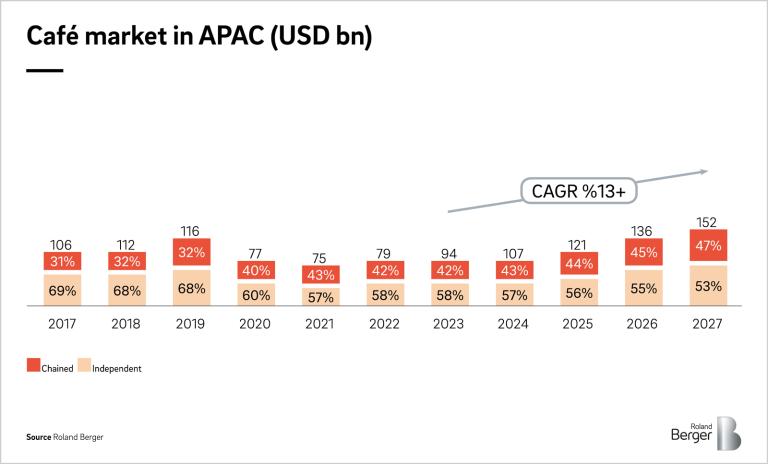

There is no doubt that COVID-19 has significantly impacted consumer industries globally, but the food service industry has been one of the worst hit. It experienced a decline of approximately 20% in APAC markets in 2020 compared to 2019. This downturn drove many businesses, mainly small-scale and independent players, out of the market. However, it also led to some fundamental shifts in consumption, with increased in deliveries and takeaways. As of 2023, the market is still expected to underperform compared to 2019, and it is only by 2024 that we can expect growth beyond the 2019 levels.

"Successful local players are challenging international giants by focusing on affordability, localization, and operational efficiency."

Within various segments in the food service industry, fine dining stands out compared. Fine dining has already recovered in 2022 compared to 2019 in most markets and is leading the turnaround of the food service industry. On the other hand, more everyday places like casual eateries, fast-food spots, and cafes have recovered at a slower pace post COVID-19. This lag can primarily be attributed to the erosion of income sources, particularly among the less-affluent demographic during the pandemic, and a suppressed consumer sentiment on spending on non-essentials. Despite these challenges, consumer sentiment is improving, signaling optimism. As we look to the future, it is crucial to closely monitor macroeconomic factors that significantly impact the food services industry, such as GDP growth, real disposable household incomes, inflation, especially of essentials, and tourism.

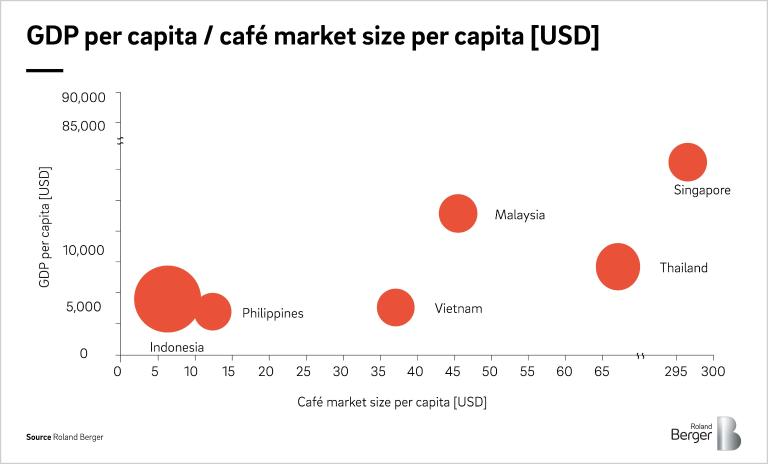

As we zoom into Southeast Asian economies, we see massive diversity in the penetration rate and the types of outlets in the food service industry. The current penetration rate shows higher growth potential in Vietnam, Indonesia, and Philippines, compared to more mature markets such as Malaysia and Singapore.

Furthermore, cuisine preferences and eating habits differ widely by country, so there is no singular approach to winning in all markets, and successful international chains often modify their menus to cater to local food culture and consumer preferences.

What is the change in consumer behavior?

- With increasing urban disposable income and changing fast-paced lifestyles, consumers are interested in combining convenience with high-quality personalised products.

- The changing dynamic of dining-out culture and the impact of social media.

- A growing appetite for healthier options in Southeast Asia.

Opportunities for investors

The landscape of the casual dining market in Southeast Asia presents ample opportunities for investors. The expected rebound and growth beyond pre-pandemic levels by 2024 hint at a recovering sector ready for strategic investments. Here are some of the potential opportunities that investors should consider:

- Market Penetration and Expansion: With the diverse and burgeoning economies of Southeast Asia, there is significant room for growth, especially in underpenetrated markets. Investors can capitalize on emerging economies with growing middle-class populations that show an increased propensity for dining out. This demographic shift, coupled with urbanisation, provides a fertile ground for expanding existing chains or introducing new concepts.

- Technological Integration: The rise of the Online-to-Offline (O2O) model underscores the importance of digital engagement in the food service industry. Investment in technology can streamline operations, enhance customer experience, and open up new revenue channels. Investors can play a pivotal role in equipping casual dining chains with the necessary technology to tap into this digital transformation.

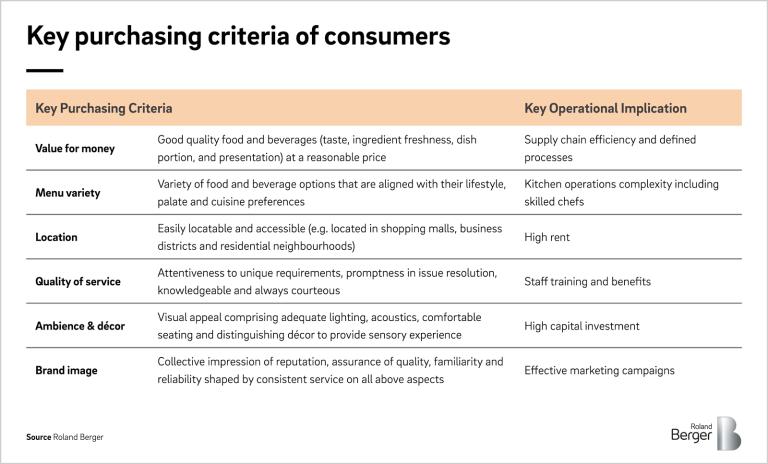

- Operational Efficiency: The need for high operational efficiency is paramount in maintaining profitability while meeting key purchasing criteria. Investors can bring in expertise to optimize supply chain management, reduce waste, improve kitchen operations, and enhance staff training programs. These operational improvements can lead to better margins and a competitive edge in a crowded market.

- Health and Wellness Trend: The shift towards healthier eating provides a niche for investors to develop or back dining concepts that focus on nutrition and well-being. This could involve investing in chains that promote organic ingredients, sustainable sourcing, and wellness-centric menus, tapping into a growing consumer consciousness around health.

- Localisation Strategies: As international brands adapt to local tastes, there is a clear opportunity for investments that focus on regional customisation. Investors can fund research and development of menu items that cater to local preferences, ensuring that international brands remain relevant and appealing to Southeast Asian consumers and build them to reach scale.

Register here to get the full ASEAN Private Equity Newsletter.