Roland Berger is a thought leader in environmental issues and the response demanded from organizations. Our publications cover all relevant areas.

Finding gold in green

Roland Berger helps investors understand the real value and costs of investments in green technology

In recent years, we have seen a dramatic rise in the valuation of businesses offering renewable generation, energy storage, electric mobility and green hydrogen. This trend continues today, driven by factors such as growing policy and popular commitment to decarbonization, abundant and cheap capital, and maturing technologies and markets. Our experts help investors understand the real value of specific investments and the implications for asset portfolios: Should they take on more risk to achieve target returns? Which markets, sectors and technologies are currently undervalued? And what are the regulatory, technological and commercial risks? We also offer services such as commercial and technical due diligence, support during negotiations and assisting post-merger integration.

"Investments in green technology can be golden – but only if the investor's strategy and the valuation of the target match."

Riding the wave

Decarbonization is a global ambition, and one that many countries have publicly signed up to under the Paris Agreement. Government regulation, working in tandem with growing demand, is driving change. As a result, many large infrastructure investors such as Blackrock have now declared their ambition to invest more in green technology. With the valuation of green technology and the companies that manufacture it rising dramatically and cheap capital abundantly available, many players are wondering whether now is the right time to follow. And, if so, where exactly should they put their money? At Roland Berger we help companies understand the opportunities and risks offered by green investments, sharpen their focus, develop convincing strategies, and – crucially – put those strategies into practice.

Challenges and opportunities

The value chain for renewable energy is becoming more and more deconstructed, with project development, plant operation and the financing of large-scale power plants increasingly separate from each other. With the work and risk shared along the value chain, investors can now find the appropriate asset class for their needs depending on their desired risk exposure and the focus of their activity.

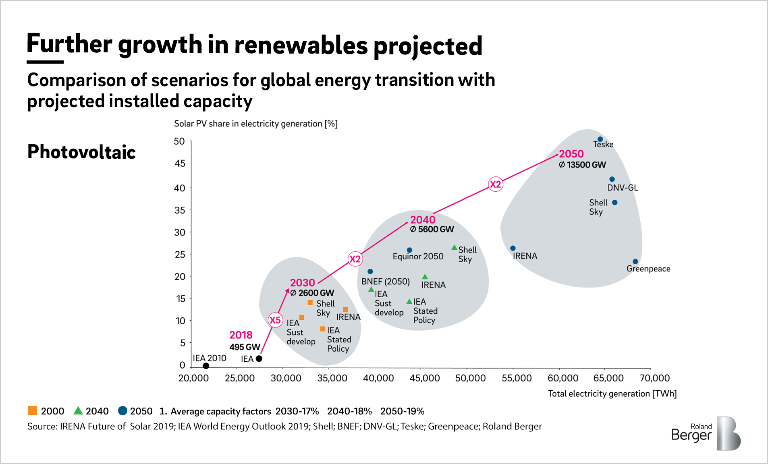

Solar power and onshore wind power are well established, mature technologies with global penetration, as the figures for their installed capacity demonstrate. Thus, solar power (photovoltaics) boasted a global cumulative installed capacity of around 650 GW in 2019, while onshore wind power had a comparable 600 GW or so. Both technologies are projected to continue their upward trajectory. By contrast, offshore wind power is currently about 20 times smaller and the technology itself is more complex. Yet, experience is growing with each new offshore wind project and the attractive yields and frequent economies of scale that can be exploited mean that offshore wind is oftentimes even more attractive than other renewable sectors.

Of course, one of the biggest challenges with renewable energy lies in its volatility. Energy markets are increasingly demanding binding schedules for electricity production, and simple feed-in tariffs for generated MWh are now rare. This risky dependency on the weather is being countered with new technological building blocks, such as local weather forecasts, demand response, and energy storage systems such as batteries and hydrogen.

Dealing with risk

The challenges for investors in renewable energy are diverse and complex. Even though much of the technology is mature, national markets are often still in their infancy. Different ecosystems exist and compete with each other. In addition, new technology is continually arriving on the market, the ramifications of which are as yet unknown. This leaves decision-makers in the dark, trying to juggle different, half-understood factors into their assessments, with the ever-present risk of incorrect strategic and financial assessments hampering their willingness to act.

Our solutions

The consulting services provided by Roland Berger help investors understand the real value – and the real costs – of specific investments in climate-friendly energy solutions, and their implications for asset portfolios. Working at your side, we help develop or review your investment strategies in green technology. We foster a comprehensive view of the entire ecosystem (or competing ecosystems) and identify the most suitable investments regionally or globally. As a consulting firm with a strong emphasis on implementation, we also offer services such as commercial and technical due diligence, support during negotiations and assisting with post-merger integration.

Decision-makers are faced with many questions about this still relatively new field. Should you take on more risk in order to achieve targeted returns? Which sectors and technologies are currently undervalued? What are the regulatory, technological and commercial risks? Which capabilities do you need to build, or which partners should you pursue? When should you act, and how? Our in-house experts and extensive global network of specialists can provide answers to these fundamental questions. Our goal? To help you find gold in green.

Interested in our services?

To find out how you can benefit from our expertise, contact our green technology expert Torsten Henzelmann. You can also download our brochure or sign up for our expertise newsletter here:

Sign up for our newsletter and get regular insights on newest publications related to Energy & Utilities.