The chemical industry needs a more circular approach to embedded carbon. This requires new solutions to technological, economic, and infrastructural hurdles.

Sustainable growth in chemicals for capital goods players

By Sven Siepen and Ruirui Zong-Rühe

How equipment providers can ride the sustainability wave

In today's volatile business environment, finding reliable growth markets poses increasing challenges for capital goods companies. Yet amid global economic uncertainties, the chemicals industry emerges as a remarkably resilient opportunity—one that continues expanding even as other sectors contract.

"The chemical industry presents a compelling USD 220 billion annual opportunity for capital goods suppliers, offering both scale and resilience in an uncertain global economy."

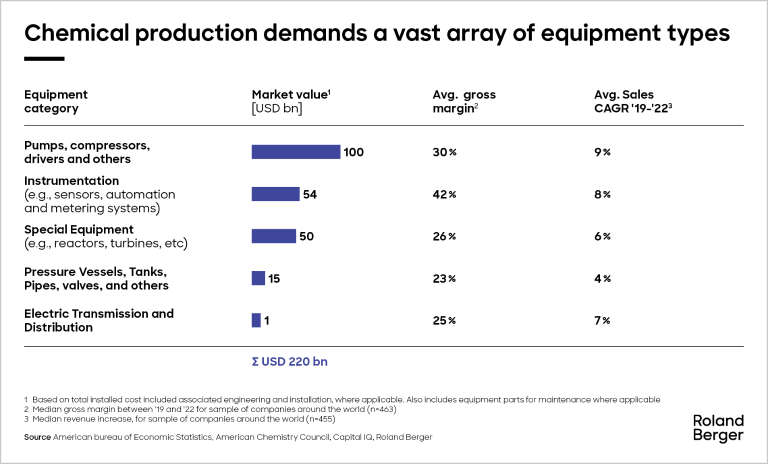

A $220 billion opportunity for capital goods suppliers

The chemical industry presents a compelling USD 220 billion annual opportunity for capital goods suppliers, offering both scale and resilience in an uncertain global economy. This market's attractiveness extends beyond its sheer size, with several distinctive characteristics that create strategic advantages for well-positioned equipment providers.

One is the diversity in its equipment requirements, which creates multiple entry points for capital goods players. Technology-intensive products such as specialized compressor pumps for high-purity applications and advanced instrumentation systems command premium margins exceeding 30%, while also opening pathways to lucrative service relationships. Similarly, advanced sensor technologies required to monitor and control process automation in real-time also command stronger margins. These categories demonstrate faster growth rates than larger, more commoditized equipment such as pressure vessels and tanks.

Further, chemical companies prioritize suppliers who can demonstrate strict adherence to technical specifications, provide comprehensive support capabilities, and maintain long-term relationships. This emphasis on technical expertise creates natural advantages for specialized providers who can deliver value beyond the initial equipment sale through ongoing support and optimization services.

Lastly, while overall growth stagnates in advanced economies, chemical, petrochemical, and refining companies continue investing heavily in maintenance (30% of CAPEX in mature markets), efficiency improvements, and strategic capacity expansion. This investment creates opportunities for capital goods suppliers focused on plant efficiency optimization and obsolescence management.

"By combining strategic foresight with operational flexibility, equipment suppliers and technology providers can become trusted partners of the chemical industry during the energy and sustainability transition."

Sustainability is driving the next wave of chemical industry investment

In particular, sustainability represents one of the most promising growth avenues in Chemicals, as the sector faces mounting pressure to reduce its environmental footprint while meeting growing demand for sustainable products. Clean technology investments have grown approximately 13% between 2023 and 2024, approaching USD 1 trillion in 2024.

However, given complex regulatory environments, geopolitical uncertainty, and shifting customer expectations toward 'green premiums,' capital goods firms must carefully select their sustainability investments. By developing a comprehensive understanding of market demands and customer transformation timelines, leaders can manage uncertainties while positioning themselves for long-term growth in the evolving chemicals sector.

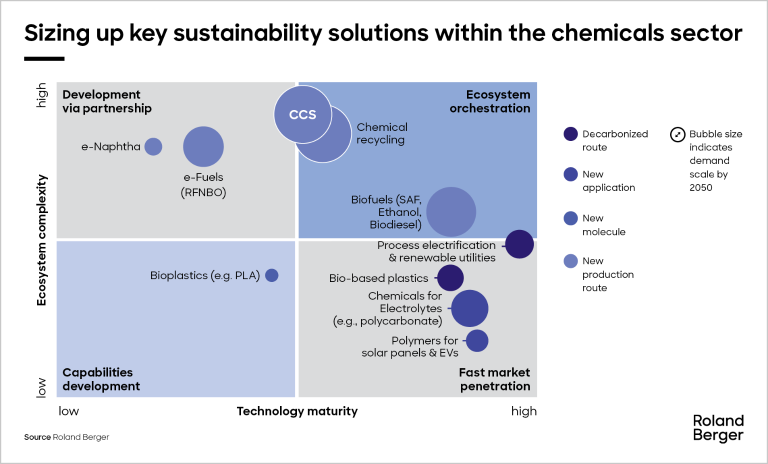

Numerous sustainability technologies are approaching maturity levels that enable commercialization within the next decade but it is important to understand the technology maturity, ecosystem complexity, and the value pool size of these technologies to contextualize the potential opportunity. Although each market faces its own unique headwinds, the most promising mid-term opportunities for capital goods providers lie where high demand intersects with higher technology maturity.

Three technologies stand out as potential strategic focus areas for capital goods players:

- Carbon capture and storage (CCS)

- Chemical recycling

- Biofuels (including sustainable aviation fuels, ethanol, and biodiesel)

These high-potential technologies warrant additional consideration as they are each part of complex ecosystems yet represent promising growth avenues in the chemical industry's sustainability transition.

To learn more about the potential tailwinds and headwinds for each of these three technology areas, download the full report below. Our experts also share strategic recommendations for Capital Goods players seeking to participate in the fast-growing sustainability sector.

Hugo Bruno Vieira contributed to this study.

Register now to access the full study and explore insights how equipment providers can leverage sustainability trends in the Chemicals industry. Furthermore, you get regular news and updates directly in your inbox.