Swiss building materials players: Prepare for market slowdown

Companies that act early and decisively can even prosper in a downturn

After ten years of growth (2.5% p.a.) in the Swiss construction industry, there are increasing signs of a consolidation in 2019 with a cautious outlook thereafter. Companies in the Swiss building materials market should draw up a contingency plan today in order to be optimally prepared for the expected slowdown.

Both major Swiss construction forecasters expect a severe slowdown in construction activity. BAK Economics predicts that structural construction output in 2019 will shrink vs. the previous year (-0.9%) for the first time since 2008 and expects no return to previous growth in subsequent years either (only 0.1% p.a. 2019-24). The ETH KOF (part of the Euroconstruct network) forecasts a severe drop in construction output growth rates in the coming years vs. their reported historical data (0.7% p.a. 2019-21 vs. 1.4% p.a. 2014-18; incl. underground). Both foresee the slowdown as most pronounced in the residential segment. Capital markets have already reacted: Despite satisfactory financial results, the valuation of Swiss construction material suppliers has seen a decrease during the last 12 months.

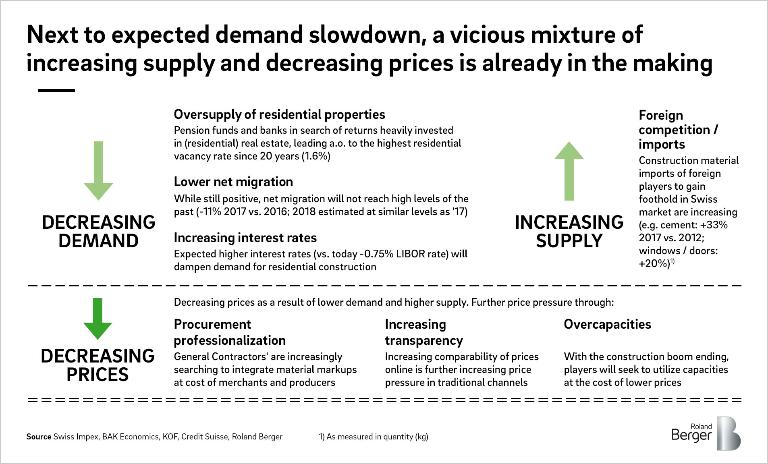

Accompanying the expected demand slowdown, a vicious mixture of increasing supply and decreasing prices is in the making. Falling demand has led to an oversupply of residential properties – a segment in which pension funds and banks in search of returns are heavily invested – resulting in the highest residential vacancy rate in 20 years (1.6%). While still positive, net migration that accounted for a lot of new demand will not reach the high levels of the recent past (-11% 2017 vs. 2016; 2018 estimated to be at similar levels as 2017).

Additionally, an expected rise in interest rates (vs. today -0.75% LIBOR rate) will dampen demand for residential construction. At the same time, foreign producers of construction materials are attracted by higher price levels in Switzerland (e.g. cement imports: +33% 2017 vs. 2012; windows/doors: +20%), leading to decreasing prices. Further price pressure stems from general contractors increasingly interested in achieving material markups at the cost of merchants and producers, better comparability of prices in online channels and more and more idle capacity that needs to be utilized to compensate for fixed costs.

"Companies in the Swiss building materials market should draw up a contingency plan today."

Swiss market depends strongly on large-scale new build projects

Unfortunately, it is a fact that the Swiss market strongly depends on large-scale new build projects with long-term investment horizons, which will be impacted by the downturn (55% share of construction volume). Therefore, we strongly believe it is important to react to this harsh market environment. Companies in the Swiss building materials market should already be drawing up a contingency plan today if they want to be optimally prepared for the expected slowdown. This time we can learn from the lessons of the past crisis in 2008. Companies that act early and decisively can not just survive but even prosper during a downturn.

Four areas need to be considered: Top line, bottom line, balance sheet and spirit/culture:

For a contingency plan to be implemented successfully, it is crucial that there is a strong sense of urgency within the organization. In our view, this is a key prerequisite for drawing up a powerful contingency plan that is supported by the entire organization. This contingency plan will contain various bundles of measures with an impact on the P&L, balance sheet and corporate culture/spirit. In addition to responsibility, investment requirements and earnings contribution, KPI-based trigger points will be defined for each measure. The achievement of these measures triggers the implementation of subsequent lever.

As restructuring and implementation experts, we have given intensive thought to how such contingency planning should be approached. This includes, in particular, avoiding mistakes made in previous crises, such as in 2008.