Identifying and harnessing synergies can be highly challenging in post-merger integration (PMI) processes. We present 15 common pitfalls and how to avoid them.

Post-merger integration

How we help companies to realize the full potential of their post-merger integrations

Transaction services, especially merger and acquisition deals and post-merger integrations (PMIs), remain an essential aspect of corporate strategy. PMIs pave the way for corporate excellence by offering a valuable tool for realizing a strategic vision, accelerating implementation and ensuring maximum value.

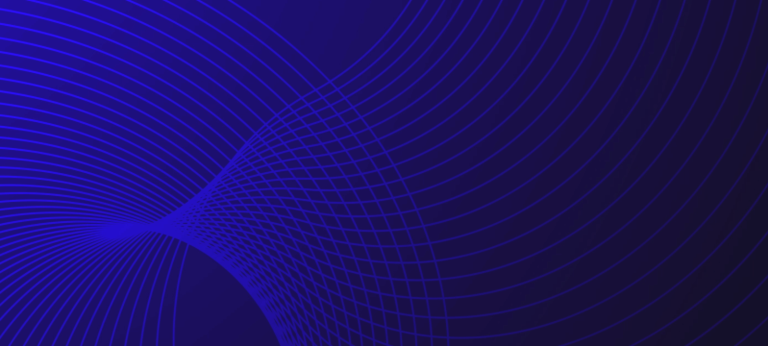

For many companies it can be overwhelming to try to manage successful integration after a merger or acquisition and at the same time steer the new company forward. Indeed, the majority of post-merger integration projects either fail to capture the full value potential or they even destroy value. There are several well-documented reasons for this: first, the portfolio strategy may not be properly aligned with the company's strategy; second, the company may be overwhelmed by the complexity of the transaction; and third, merging companies tend to underestimate the amount of cultural integration and communication needed – these are key aspects of the post-merger integration and play a crucial role in any project.

At Roland Berger, we believe that PMI projects must avoid these pitfalls in order to capture the full value of the transaction and realize all the synergies. We offer support in the following areas:

- Value creation: Capture the full value of the integration and the best of both worlds

For all stakeholders, our commitment is to maximize the value of your combined organization with regards to its market positioning, product/service offerings, capabilities and organizational setup. We help you ensure alignment with your overall strategy, business continuity following the merger or acquisition and accelerated synergy realization. We support you from concept to implementation, making sure the full potential of the deal is realised and translating this potential into a visible impact on your profit and loss account. - Project governance: Reach your milestones and consider all relevant aspects

Post-merger integration projects are all about expecting the unexpected and ensuring readiness throughout the integration. Thorough planning and dedicated, empowered resources are key to ensuring all relevant aspects are considered and milestones reached after the merger or acquisition. We support you with our best-in-class toolsets and in-depth experience in post-merger integration, from deal preparation to Day-1 implementation, enabling you to reach all your goals. and strike the right balance between pragmatism and attention to detail. - People and culture: Enable the buy-in of key stakeholders and prioritize people and culture

The most common pitfall we encounter is a lack of cultural integration and effective communication with all relevant stakeholders, which are among the most crucial aspects of the integration process. We help you ensure that key stakeholders are on board, well prepared, and that any cultural differences or gaps are closed in order to maintain enthusiasm and motivation within the organization.

"We support PMIs holistically from start to finish. This entails defining a clear strategic target picture, defining the right integration concept and governance, balancing synergy realization with business continuity as well as successfully integrating different values and cultures."

Corporate foresight and our guide to PMI excellence

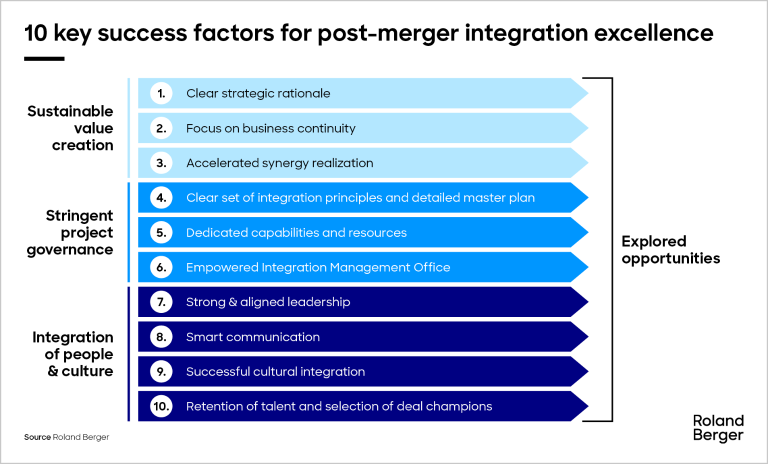

At Roland Berger, we believe complex post-merger integrations must be managed by a dedicated integration team with the utmost attention and corporate foresight. Bringing together two companies, each with its own strategic position and vision, structures and processes, management style, organizational culture and values is no easy task. But what should the integration team focus on? And how can excellence in post-merger integration be achieved?

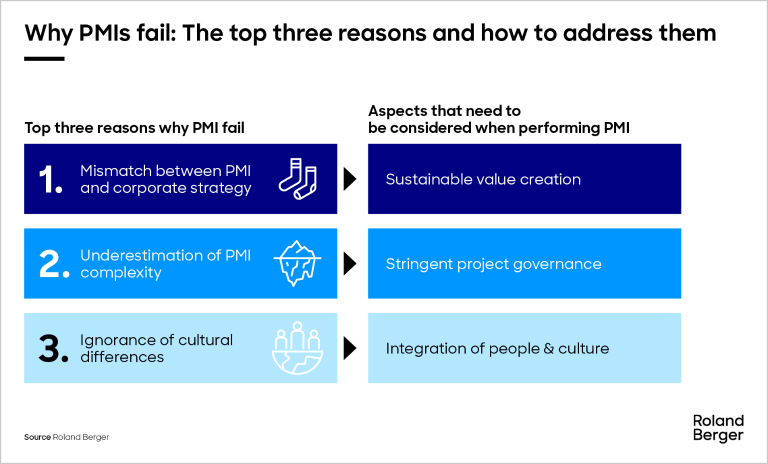

From more than 500 global and cross-industry projects, we have synthesized our experience and identified ten key success factors. They cover the broad areas of value creation, project governance, and people and culture. Together, they form the basis of our guide to post-merger integration excellence.

While all ten of these factors are important, some are more critical than others at certain phases of the change management and integration process. For instance, a high-level, clear strategic rationale should act as the north star from the beginning of any integration work. Communication and aligned leadership are key throughout the integration. A stringent, purpose-built masterplan and integration strategy is crucial to ensure readiness from Day One when integrating, but remains important throughout to ensure the integration work is finalized and synergies are realized.

How we help you make your PMI a success

Roland Berger offers a unique mix of skills and experience to ensure your new organization following the merger or acquisition will be set up for sustainable success, including:

- Our vast experience in integration projects after a merger, helping clients reach milestones and capture full value

- Our extensive industry knowledge and expertise

- Our leading functional expertise, from sales and marketing to operations, helping us quickly identify functional action items

- Our global expert network, ensuring propert cultural integration and local insights in transnational integration projects

- Our complete service offering across transaction services from due diligence to PMI, covering all aspects of the transaction

- Our best-in-class performance and implementation credentials, ensuring changes are implemented and impacts visible in the profit and loss statement

Having the same external support involved in the due diligence and PMI is a built-in synergy.

Thanks to this unique mix, our post-merger integration consultants can help you achieve your integration goals and realize the full potential of your transaction, while ensuring the appropriate communication and industry-specific cultural integration.

We support transactions in all industry verticals, continuously optimizing our PMI approach to match our clients' individual needs. We provide holistic support every step of the way, ensuring you transition smoothly to a new organization and are set up for sustainable success – from the moment the two companies decide to merge, to due diligence, strategy development, Day-1 readiness and right through to post-close support. Speed is essential in any integration project following a merger: With our thorough yet pragmatic approach, our post-merger integration consultants help you reach your post-merger or acquisition milestones promptly, while guaranteeing business continuity and unlocking the full potential of your company.

I think it’s better to go fast rather than move slowly and risk losing momentum and not reaching your goals.

We also ensure efficient resource utilization, keeping integration costs down by closely monitoring and guiding the merger integration from end to end. In practice, programs that start late and experience frequent delays are among the biggest cost drivers. Our post-merger measures serve to continuously ensure stable business operations and give you a firm foundation for compelling communications.

Find out more about our post-merger integration consulting services and how they can help you achieve your post-merger goals. We look forward to hearing from you - and to helping you make your transaction a long-term success story.

Register now to receive regular insights into our Transaction & Investor Services topics.

_tile_teaser_w425x260.jpg?v=1139596)

_person_320.png?v=799507)