Capital goods winners study: Construction equipment

Challenges persist with few signs of recovery before 2030

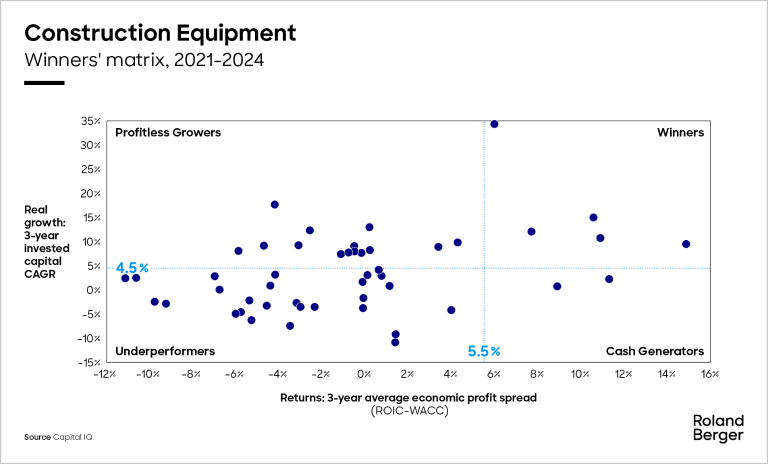

Performance

Several challenges combined to produce a strong market decline in the segment in 2024. In particular, the slowdown in the Chinese market and higher CAPEX costs had a significant impact. These pressures were exacerbated by the long lead-in times required for infrastructure projects, with Germany especially affected.

"Recovery in construction equipment remains distant, with resilience and strategic focus crucial through 2030."

Trends & challenges

Indicators point towards a recovery, albeit a slow one. We expect that the construction equipment market will not return to 2021 levels until at least 2029/2030. In the meantime, several trends continue to weigh on the segment. CAPEX costs remain high and the US market, which has a high import ratio of, for example, equipment from Asia, is becoming more challenging as customers wait for further clarity on trade restrictions. Performance measures are likely to be required to maintain high profit levels

More positively, the push for sustainability has slowed, allowing companies more time to prepare.

CEO action plan

- Set clear priorities to transform successfully step by step, for example, on ERP, modularization, digitalization and performance contracts in service

- Monitor order intake patterns

- Despite the easing of sustainability pressures, ensure the topic remains on the agenda.