Capital goods winners study: Machine tools

By Oliver Herweg and Philipp Schmitt

Output and orders decline as Chinese players ramp up competition

Performance

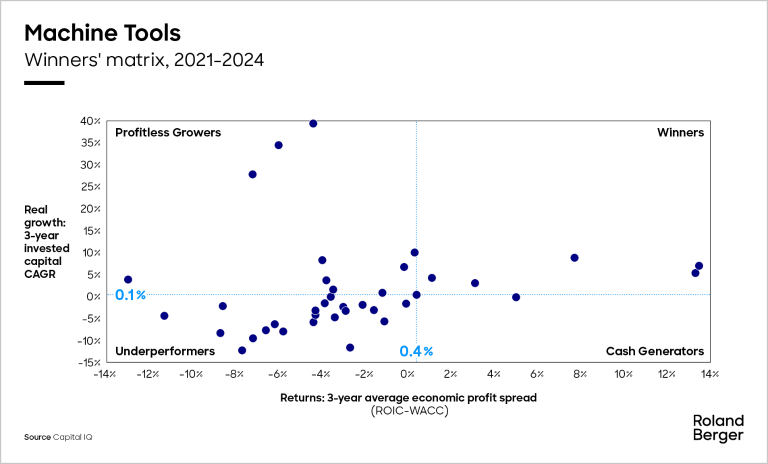

The global machine tool market declined by about 5.5% in nominal terms in 2024, driven down by the wider geopolitical crises, economic uncertainties (especially affecting SME customers), stagnation and transformation in key target industries (in particular, automotive), and the slowdown in China. Incoming orders in Germany, the second-largest producer after China, fell by 19% (nominal); globally, the figure was more than 20%.

The USA has gained in importance for the machine tool industry, but the market outlook is uncertain in view of the escalating trade conflict, especially as none of the Western manufacturers have localized development and production to any great extent

"In machine tools, great technology is nowadays just not enough anymore. Customer centricity is becoming the new right to play."

Trends & challenges

We expect that the global machine tool sector will see a 3-4% fall in production in 2025, with orders unlikely to rebound before the second half of the year. An additional problem for Western producers is the rise of Chinese machine tool/factory automation players. They have secured a strong position in certain manufacturing technologies, especially electric vehicle-related technologies (battery assembly, electric motor assembly etc.) with clear cost advantages. Western players are struggling to regain share in these applications. The German industry, for example, expects a recovery in order intake in 2025, but a 10% real-term decline in production.

There are three main challenges. First, securing incoming orders in the short term (to avert a potential restructuring situation with loss of skilled workers, etc.). Second, maintaining price competitiveness in the important US market. The US-led trade war means the market outlook remains uncertain in the US, especially as no Western manufacturers have localized development and production to any great extent. And third, defending against Chinese competitors, who are aggressively internationalizing their business in the light of their domestic slowdown, and focusing on Europe due to the trade war.

CEO action plan

- Implement a

sales push

to drive hit rate of smaller sales pipelines and generate new leads

Develop a US localization strategy beyond assembly (localization must be expanded to avoid negative impacts from import tariffs)

Further increase customer centricity and solution offerings to differentiate from Chinese competitors (which do not yet have strong customer relations and infrastructure in Western markets).