Tokenization to reshape asset funding, trading & management, impacting all sectors. Market value may surpass $10tn by 2030. This article discusses basics, uses & business considerations.

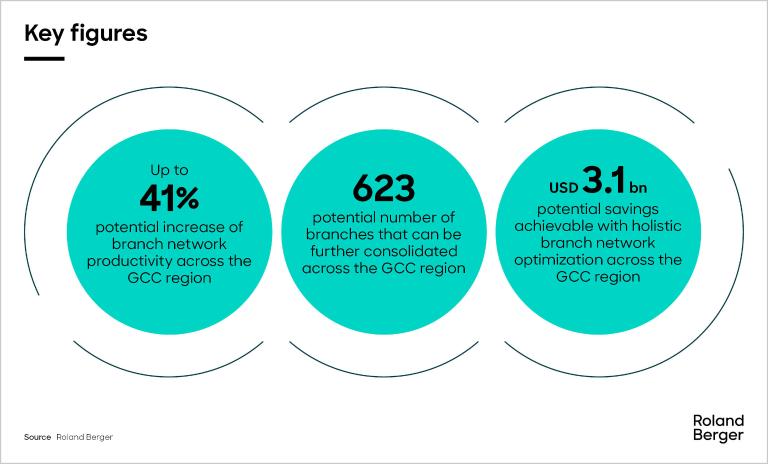

Do banks still need branch networks?

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/Roland_Berger-23-2236-Branch_Optimizations-DT_download_preview.jpg)

This study explores the impact of the current changing environment on the traditional paradigm of banking branches, with a particular focus on the GCC region.