Transactions are integral value creation elements. Realizing the potential is bound by active portfolio management and making decisions with strategic foresight.

The core value proposition of a merger often lies in the synergies it creates. But it is not enough that these synergies exist in theory – they need to be identified and realized, too. That is easier said than done: CEOs often find it challenging to navigate the post-merger integration (PMI) process. Drawing on our wide experience supporting clients in different sectors, regions and regulatory systems along their PMI journey, we present 15 of the commonest challenges and how to avoid them.

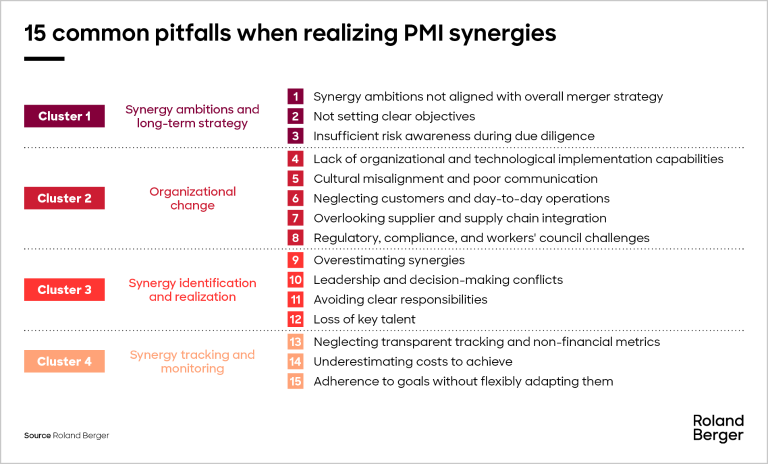

During the integration process that takes place after the merger of two entities, any missteps can significantly impair the benefits anticipated from synergies. To avoid the pitfalls, CEOs must ensure careful execution and clear alignment with the organization's strategic objectives. We have identified the 15 commonest challenges, arranging them in four clusters along the post-merger integration journey – from when the merger is first conceived strategically to when the benefits start flowing in. Below, we discuss each cluster in brief, offering just a few examples of possible solutions to the challenges. For more details, please refer to our full study.

The first pitfall that can beset mergers is that the synergy ambitions are not aligned with overall strategy. This can lead to multiple issues, from missed opportunities for creating value to differing ambitions on the part of management and employees. The solution? The company's leader should set a clear ambition for the synergies, aligned with the overall strategy, to guide the integration efforts and measure the ensuing success. Similarly, the pitfall of not setting clear objectives can be avoided by ensuring that those objectives are SMART – specific, measurable, achievable, relevant and time-bound – while failure to identify all risks during the due diligence can be avoided by the company taking a stringent, methodical approach to regulatory and financial risks, and in addition developing contingency plans for potential adverse outcomes.

Experience shows us that the period of organizational change is fraught with pitfalls. CEOs can avoid cultural misalignment and poor communication by implementing a comprehensive communication strategy that keeps all stakeholders informed and engaged throughout the PMI. At the same time, they must be careful not to neglect customers and day-to-day operations, ensuring customer service and product delivery remain unaffected by the integration.

Another common risk is that the organization overlooks supplier and supply chain integration, which can affect product delivery or quality, damage customer trust and brand reputation, ultimately leading to supply chain inefficiencies, delays and increased costs. Here, we recommend reevaluating supplier contracts and logistics operations to identify any opportunities to negotiate better terms, consolidate supplier bases and optimize procurement processes. Companies can also face regulatory, compliance and workers' council challenges at this stage in the integration; they should act on a number of fronts to avoid this leading to unforeseen costs and complexities.

Identifying and realizing synergies involves meticulous planning and execution to uncover and capture value. Leadership and decision-making conflicts can result from power struggles during the integration process, creating uncertainty within the new organization. Good leadership means keeping employees informed, addressing concerns and updating stakeholders. Overestimating synergies is another challenge often encountered by organizations – one that can be avoided in part by developing a detailed integration plan outlining objectives, timelines, resources and key performance indicators (KPIs) for each process.

One way to avoid a lack of organizational and technological implementation capabilities is to set up a cross-functional integration team with representatives from both entities, in addition to harmonizing IT systems and business processes wherever possible. Another common pitfall at this stage of the process is avoiding clear responsibilities. Furthermore, companies can suffer from a loss of key talent – a problem best addressed by implementing supportive change-management practices and potentially a targeted talent retention program.

Tracking and monitoring synergies is vital for assessing the progress and value creation of PMI activities. A frequent pitfall here is neglecting transparent tracking and non-financial metrics (including KPIs that offer insights into market perception, customer satisfaction and employee engagement post-merger). Companies must also be careful not to underestimate the costs of integration – including "soft" costs such as loss of morale and momentum. Here, business leaders must find the right balance between lean integration management and comprehensive steering. Finally, organizations can fall into the trap of adhering to goals without flexibly adapting them. The solution lies partly in conducting a thorough evaluation after the integration and establishing regular review mechanisms to assess progress.

Avoiding the many pitfalls post-merger is vital to ensure lasting strategic success in today's highly competitive markets. Roland Berger can help you along the PMI journey by supporting your Integration Management Office (IMO) – the heart of the PMI project, responsible for developing functional integration planning, key milestones, tasks, risks, timeliness and ownership. The IMO plays a pivotal role in troubleshooting and facilitating quick decision-making, sets up steering committees and working groups, allocates resources and mobilizes personnel, along with a whole host of other duties. In effect, it ensures that the organization identifies and – crucially – actually harnesses all the synergies expected of the new, post-merger entity.

Register now to access the full study and explore the mastery of synergy realization in post-merger integration. Furthermore, you get regular news and updates directly in your inbox.