Hydrogen Valleys are locally integrated mini hydrogen ecosystems that combine hydrogen supply and demand to increase scale, maximize asset utilization and reduce costs.

Switching from Grey to Green Hydrogen in the UK

H2 production in a high commodity price environment

Green hydrogen has captured the attention of many industry players, investors, and policymakers as a low-carbon solution to a number of industrial and commerical uses. Until recently many considered the prospect of large scale adoption of green hyrdogen unlikely well after 2030. However the Russian invasion of Ukraine, resulting in skyrocketing natural gas prices and proliferation of renewables across many jursidictions, has raised a question mark on the cost-competitiveness of grey and blue hydrogen to green hyrdrogen.

![Prices of natural gas [various units, indexed, Jul 2017 = 1]](https://img.rolandberger.com/content_assets/content_images/captions/Roland_Berger_INS_902_Green_Hydrogen_in_the_UK_GT_image_caption_none.png?v=770441)

![Sources of hydrogen production in the NZE, 2020-2050 [Mt H2]](https://img.rolandberger.com/content_assets/content_images/captions/Roland_Berger_INS_902_Green_Hydrogen_in_the_UK_GT2_image_caption_none.png?v=770441)

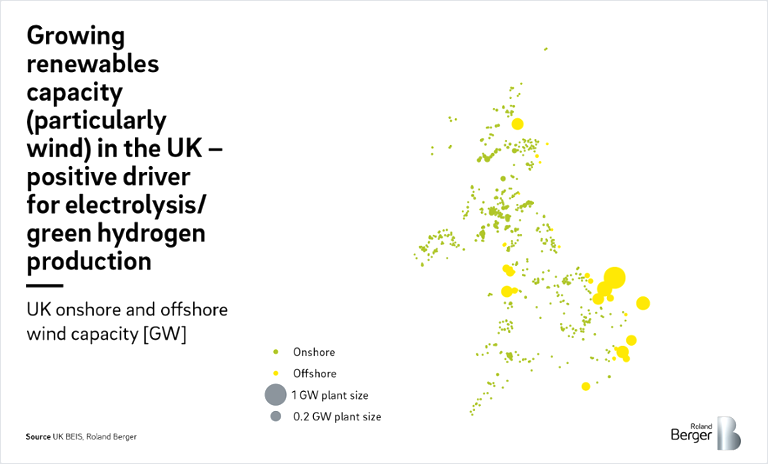

The levelised cost of energy (LCOE) for unsubsidised solar PV and wind has improved significantly over the last decade and is now comparable to combined cycle gas turbines in many jursidictions. Renewables accounted for ~40% of electricity generation in the UK in 2021 - a global leader in offshore wind with a pipeline of ~86 GW. In addition to the accessibility of ample renewable energy, the green hydrogen sector in the UK will also benefit from the government launching the GBP 240 million Net Zero Hydrogen Fund (capex, devex support) and the GBP 100 million Hydrogen Business Model to kick-start electrolytic projects.

The green hydrogen sector in the UK has attracted interest from a range of companies - oil & gas supermajors (BP), renewable companies and utilities (Orsted, Cerulean Winds, Source Energie) and investors (HydrogenOne). In addition, the UK has a well developed green hydrogen supply chain and offers the near-term potential for replacing grey hydrogen. The timing and achievability of other use cases for green hydrogen in the UK, e.g., mobility, industrial heating, buildings and power generation, is contingent on a variey of economic, technological, and policy considerations which are hard to predict.

Considering the 5.7 GW pipeline of green hydrogen projects in the UK vis-a-vis the government's stipulation of at least 5 GW of electrolyser capacity (by 2030), it is possible that sustained levels of high natural gas prices can tilt the balance and accellerate the adoption of green hydrogen.

With skyrocketing natural gas prices, there is a great deal of enthusiasm globally with regard to green hydrogen. In the short-term, green hyrdogen could replace grey hydrogen in industrial use cases, e.g., refining, fertiliser, and ammonia production. Uptake in other cases, e.g., mobility, buildings and power generation, is contingent on a number of technological, economic and policy factors which are hard to predict. The sector is at a nascent stage and wide-scale switching from grey to green hydrogen is not necessaily straightforward. There are a number of challenges with regard to transportation and limited room for immediate uptake in use cases outside industrial applications. Some of the key takeaways worth highlighting are:

-

- The UK government's support mechanism for hydrogen - The Net Zero Hydrogen Fund and Hydrogen Business model - is key to unlocking private investment into the sector, albeit the quantam is lower compared to some other hydrogen-focused nations.

- In the absence of further government funding, there is the potential to introduce alternative forms of support to spur investment, e.g., accelerated/heightened tax reliefs and capital allowances.

- The business models for transportation and storage of low-carbon hydrogen - key to large scale adoption, are yet to be articulated by the UK government (likely to be by 2025).

- Access to renewable energy sources (with highly competitive LCOE) coupled with a sophisticated supply chain and producer/developer landscape, is key to developing the green hydrogen sector in the UK.

- The current pipeline of green hydrogen projects in the UK exceeds the government's target of at lease 5 GW electrolyser capacity by 2030. The vase majority of projects (99%) however, are at various stages of development, with only ~4 MW operational.

- Collaboration is key. Hydrogen valleys or industrial clusters connecting producers with localised off-takesr are imperative to kick start this nascent industry and drive adoption.

Register now to download the full report with key takeaways, including the UK government's role in supporting hydrogen transition, access to renewable energy sources, investment, and the current pipeline of green hydrogen projects.