The Art of investing in Digital Assets and Web3 companies – A comprehensive framework

Mastering Web3 investments: A comprehensive guide to real value in Digital Assets and Web3 companies

With the rise of Digital Assets and Web3 technologies, the number of investments in the ecosystem has also increased. While this presents many exciting opportunities for innovation and growth, it also creates new challenges related to security, governance, and compliance. A Web3 due diligence framework is needed to help address these challenges by providing a set of best practices and guidelines for evaluating the security, governance, and compliance risks associated with Web3 projects and platforms.

Such a framework can help investors, users, and other stakeholders evaluate risks associated with Web3 projects and platforms, including the risk of hacking, fraud, and regulatory non-compliance. It can also help developers and project teams better understand the risks associated with their own projects and take steps to mitigate those risks.

In this article, we will explore the growing Venture Capital landscape in the Web3 space, the need for a comprehensive due diligence framework, and introduce Roland Berger's very own Web3 Due Diligence framework which can play a fundamental role in ensuring long-term success and sustainability of the Web3 ecosystem.

Growing VC interest in the global Web3 landscape

The Web3 industry, which is the transformation of our existing economy and the emergence of disruptive new business models powered by cryptography and blockchain technology (in addition to AI and IoT), is expected to have implications on nearly every industry. Over the past few years, it has been experiencing rapid growth and the sector is expected to reach a size of USD 9.6 trillion by 2030. Digital asset projects globally have a combined market capitalization of over USD 1 trillion. As of 2023, the NFT market is currently worth over USD 23 billion and over USD 53.63 billion has been locked in to DeFi protocols.

This growth has attracted a significant amount of adoption from retail and institutional investors, and garnered attention from venture capital firms leading to a surge in investments in the industry. In 2021, venture capital firms invested USD 33 billion in the Web3 space globally. Although the investment frenzy has somewhat cooled down following the bear market conditions that have persisted since Q3 2022 and into early 2023, interest in the fledgling sector and into key areas such as DeFi, ReFi, Web3 Gaming, Tokenization and infrastructure projects has increased.

In recent years, UAE has also emerged as a hub for innovation in the digital assets and Web3 space, positioning itself as a global leader in the Web3 landscape. This sector’s growth in the region has been nothing short of staggering, fueled by a conducive business environment, government support, and an increasing number of talented entrepreneurs.

With over 1,450 organizations active in the space employing nearly 7,000 individuals, UAE has become an increasingly attractive market for institutional investors seeking the next big unicorn. The thriving landscape has spurred the expansion of Venture Capital firms in UAE, with over 25 VCs focusing exclusively on Web3 investments. Additionally, leading global Web3 firms are actively investing in projects based in UAE.

While some VCs adopt a sector-agnostic approach, others target specific sub-sectors such as DeFi, Gaming, Web3 Infrastructure, and the Metaverse. As a result, UAE's digital assets landscape has attracted a diverse range of investors, fostering innovation and growth in various niches.

Need for a Due Diligence framework

While the potential rewards of investing in the Web3 space early on are promising, the complexity of these investments sets them apart from traditional asset classes. To succeed in this realm, investors need a unique set of skills and know-how to navigate the intricacies of decentral ledger technology, decentralized finance, smart contracts and Tokenomics, among other factors. To help investors find real value in the vast and intricate Web3 landscape, a robust Web3 Due Diligence framework is essential.

Moreover, the Web3 landscape is highly dynamic, with new projects and technologies constantly emerging. This creates both opportunities and challenges for investors, who must stay informed and adapt to the ever-changing environment. A robust due diligence framework can help investors identify genuine value amidst the complexity of the Web3 ecosystem, providing a structured approach to assessing projects and mitigating risks

Roland Berger’s Web3 Due Diligence framework

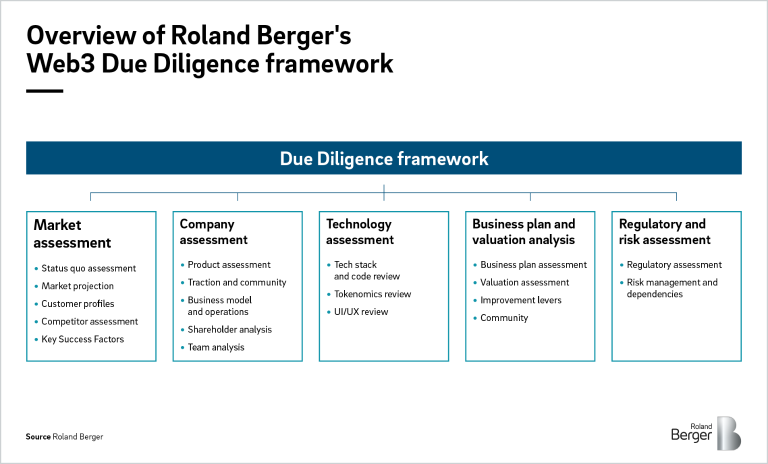

Our comprehensive framework encompasses several critical aspects of Web3 investment, including:

1) Market Assessment: We will gather and analyze information about the Web3 market to determine its size, growth potential, key trends, and other relevant factors that could affect market adoption, such as understanding customer profiles, conducting competitor assessment, and benchmarking global best practices to determine key success factors.

2) Company Assessment: We will evaluate the company's overall performance and potential, including financial health, operations, management, market position, and other factors affecting success such as conducting business model value chain assessment and analyzing human capital availability and potential skill gaps that would need addressing to ensure project success

3) Technology Assessment: We will evaluate the feasibility effectiveness and potential impact of the technology chosen and help understand its potential to scale, provide high performance and be secure against cyber threats. This would entail a deep analysis of the protocol, smart contracts, exposure to bridges, application layer, coding process, and security related aspects. It is worth noting that a detailed view of Tokenomics and a review of the user experience and user interface are relevant in this aspect.

4) Business Plan and Valuation Analysis: We will assess the project strategic roadmap, objectives, as well as product offerings and conduct a financial analysis to help determine the current and potential future project value. Strong understanding of project economic model (in alignment with Tokenomics) is key. We will review the project's community engagement to ensure a clear view on adoption and developer activity beyond the speculative aspect. We will also review whether the project ensures proof of reserves and identify improvement levers relevant to fulfilling the roadmap.

5) Regulatory and Risk Assessment: Regulation is key for Web3 projects to scale. We will evaluate relevant regulatory landscape, requirements, and risks. In addition, we will review the company’s ability to mitigate risks and influence regulatory changes. We will perform a 360 review of the project’s risk management, procedures, and governance, as well as their dependencies on other Web3 projects or layer 1 solutions.

By following this robust Web3 Due Diligence framework, investors can effectively navigate the complex Web3 landscape globally and identify projects with genuine potential (and avoid the next FTX). As digital assets and Web3 space continue to flourish globally, the future looks exceedingly bright for both investors and entrepreneurs.

We have developed this proprietary framework and in-depth underlying analysis tools in cooperation with the digital asset and Web3 ecosystem. We are convinced that it will add significant value to investment decision of funds, corporates, and governments into the sector.

This article has been co-authored by Akshit Adani.