U.S. chemicals at a crossroads: Navigating the global trade reset

The global chemicals trade is entering a critical period of transition.

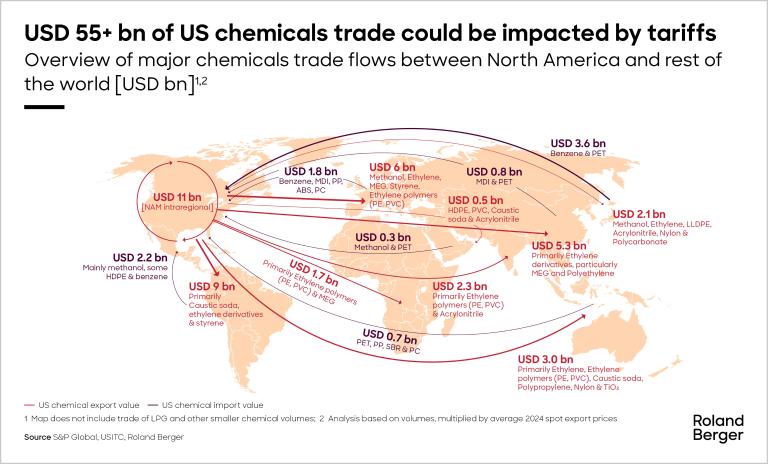

Over USD 55 billion in U.S. chemical trade is now at risk due to shifting geopolitical dynamics, presenting a challenge to existing operating models and an inflection point for redefining competitiveness. We analyzed 35 of the most strategically essential chemical commodities, representing a significant share of global volumes, to assess the implications of these changes and identify actionable paths forward.

A Changing Trade Environment

The U.S. chemicals industry has historically benefited from a structural feedstock cost advantage, particularly in ethylene and its derivatives, stemming from the shale gas boom. Today, those same exports—polyethylene (PE), PVC, and monoethylene glycol (MEG), among others—are among the most exposed to retaliatory tariff measures. Export flows to key markets in Europe, China, and South America are already showing signs of disruption.

Despite maintaining a net trade surplus of approximately USD 35 billion, the United States faces rising import pressure in several key segments. These include PET, benzene, and MDI products integral to domestic downstream sectors such as automotive, construction, and consumer goods.

Trade Flow Dynamics: Pressure Points Emerging

- USD 45 billion in U.S. chemical exports versus USD 10 billion in imports across priority commodities

- Highest-risk exports include ethylene-based derivatives and caustic soda

- Major import exposure in intermediates sourced from Asia and Latin America

- U.S. downstream sectors face growing cost volatility tied to imported feedstocks

Our regional heatmap analysis underscores the concentration of risk: trade exposure is most acute with China and Asia-Pacific, while intra-North American trade remains comparatively stable due to USMCA protections.

Policy Developments and Exemptions: A Partial Mitigation

While implementing a baseline 10% minimum tariff represents a broad structural shift, several key chemical inputs have been excluded from reciprocal tariffs. Among these are ethane, polyethylene, polypropylene, PET, and epoxy resins—chemicals considered critical to domestic industrial capacity or already covered by other regulatory regimes.

However, the scope of these exemptions is limited. Many producers and downstream buyers remain exposed to cost and supply chain impacts, with tariff implementation timelines creating additional planning complexity.

Strategic Considerations for Industry Leaders

In this context, companies should not wait for clarity from policymakers. Instead, proactive adaptation is required. Roland Berger recommends a focus on:

- Comprehensive trade exposure analysis to map cost impact and supply chain concentration

- Scenario-based contingency planning to account for further tariff escalation or regulatory shifts

- Supplier diversification and nearshoring strategies, particularly for tariff-affected imports

- Optimization of export portfolios to align with exempted products and favored trade corridors

Companies can mitigate downside risk through a structured approach while positioning to capture share in realigned trade networks.

_person_320.png?v=770441)