Reboot: Preparing for the new normal in technology-based industries – A summary

Scenarios on economic recovery after the coronavirus crisis and the perseverance of globalization

Technology-based industries been driving fundamental value-chain shifts and disrupting established businesses on a global scale. While the long-term impact of the SARS-CoV-2 corona virus and the Covid-19 pandemic remains uncertain, it seems likely to hugely accelerate this change. Companies need to rethink the way they do business in what will become the ‘new normal’ in technology-based industries. We undertook a study to develop potential scenarios to help tech companies and their suppliers navigate this new landscape. This article provides a summary of its findings.

"A short-term GDP impact will drive a reduction of technology / innovation investments of around USD 80 billion in the US alone over the next two years. This is equivalent to the amount Intel, Microsoft and Google spend on innovation in two years."

Three themes: How the coronavirus will affect technology-based industries

Roland Berger sees three key themes in the technology industry that were pre-existing but will now be amplified by the crisis.

The first considers how the short-term economic impact and the type of recovery will drive investment in innovation, which determines the speed of technological change. The crisis will result in falling GDPs, reducing demand and forcing technology industries to cut R&D investment. The duration and type of economic recovery, whether fast or slow, will be a decisive factor in the depth of these cuts. We predict that a short-term GDP impact will drive a reduction of technology / innovation investments of around USD 80 billion in the US alone over the next two years. This is equivalent to the amount Intel, Microsoft and Google spend on innovation in two years. But companies can still succeed if they manage R&D cuts while maintaining their critical technology and product roadmaps.

The second theme looks at how the crisis has accelerated the pre-existing shift towards a digital world, creating new opportunities. Almost overnight, the coronavirus has accomplished a rapid digital transformation. Many businesses will prosper from this, including cloud-based services, online entertainment, digital infrastructure, industrial automation , pharma and medtech , fintech, mass surveillance and ID and tracking industries. In addition, semiconductors and software will play a growing role. However, the speed of technological progress can only be maintained if technology-based industries' critical need for scale, partnerships and global networks can be sustained.

"The speed of technological progress can only be maintained if technology-based industries' critical need for scale, partnerships and global networks can be sustained."

The third theme examines how the crisis and its effects on global trade will force a rethink of localization of value chains and innovation in different regions. In the US, limitations on international travel are likely to hinder global collaboration, and national economic and security concerns have led to a ban on the purchase of some Chinese-made telecoms equipment, and export limitations on US-made semiconductor equipment. In the EU, after the Brexit drama, concerns over closed borders, distorted supply chains and the Euro remain unresolved. Meanwhile, China has announced its own technology funding programs and continues building strategic domestic technology-based industries, including executing a National Semiconductor Plan.

Scenarios: What the ‘new normal’ may look like

We developed four scenarios that outline the possible effects of the crisis on technology-based industries, based on two key dimensions: the type of economic recovery and degree of free trade.

The Back to business scenario largely assumes a return to the status quo. However, we believe there will be a persistent shift of focus in digital technology investments to enable virtual, in-the-cloud, touchless, automated and tracking applications.

We named the next scenario New winners as these will prosper during the prolonged recession, exploiting the continued globalization. New winners will show agility, adopting a flexible good-enough, fast-enough approach, scaling affordable standardized solutions, maintaining investment and driving a wave of industry consolidation.

In the Deferred innovation scenario, we see three effects. First, innovation will be difficult due to restricted information and talent flows. Second, there will be a slowdown in the way international standards are developed, hurting the addressable market. Lastly, protectionist policies will make building resilient local supply chains key.

A War for technology is the most severe scenario, the outcome of a prolonged recession combined with a trend towards localization and protectionism. It could involve a complete breakdown of globalization in technology-driven industries. At worst, separate, competing technological universes will evolve, as was seen during the Cold War.

Recommendations: A post-crisis agenda for technology-based companies

To prepare for the scenarios, we recommend that industry players take action in six key areas, outlined below.

Strategic direction setting: Among other actions, check the viability of your business model, evaluate the dynamics of the underlying markets and the necessity for quantitative and qualitative adaptions to your strategy.

Portfolio decisions: Review your R&D investments to evaluate the most critical projects and capabilities to maintain in difficult times. In particular, look at investments in technologies that will be accelerated by the crisis.

Protectionism and national security: Identify potential dual-use technologies and plan for the impact of restrictions on product sales and technology transfers. Review access to global talent and labor pools.

Funding for innovation: In protectionist scenarios, large sources of government funding may open up. Be prepared to tap into these, get acquainted with the necessary processes and look for potential partners.

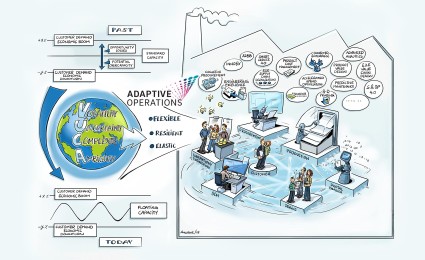

Operational transformation and risk assessment beyond cost: Assess your innovation and manufacturing footprint as well as your supply chain to assess the impact of potential trade and other innovation barriers.

M&A: New winners that have the agility to adopt and preserve their financial strength through the crisis have an opportunity to consolidate their industries and strengthen their technology position through M&A.

We conclude that technology-based industries have good prospects for recovery provided protectionist measures are well mitigated.

If you would like a more comprehensive analysis as a PDF, we will be happy to send it to you after the registration below.