Ranking the banks

Roland Berger is a leading expert on the banking sector. For over ten years, we have aggregated the results of more than 50 banks worldwide. The Roland Berger Banking Database offers a unique look at the results of 20 European banks, making it possible to compare them and put their results into perspective. Every year, Roland Berger presents the latest results of these banks and provides insight into which are outperforming and which may be falling behind.

Overall, the performance of European banks has remained stable, although the average return on equity (ROE) dropped from 7.7% to 7.1%. This was largely driven by flat profitability at higher RWA and capital levels. Dutch banks again demonstrated relatively strong performance compared to their European counterparts, taking second, third and fourth place in 2019.

2020 will be all about how to manage COVID-19 on top of other chronic challenges. Banks already face mounting loan loss provisions (LLP) and volatile financial markets. The overnight switch to a remote way-of-working has brought additional challenges, a fact of life that will likely persist for the rest of 2020.

To manage this acute pressure on profitability, liquidity and solvability, banks need to have a clear long-term view of client needs and their financial position. This will require looking beyond the immediate effects of government subsidies and understanding the difference between short-term and structural long-term impact on clients due to COVID-19. Although the present challenges are considerable, we believe that banks do not have the luxury to focus only on what is right in front of them. Ultimately, the winners in this landscape will be the banks that turn COVID-19 into an opportunity to accelerate their digital ambitions: on the one hand to meet the accelerated growth in client demand for digital solutions, and on the other hand to seize the opportunity to make their operating models more efficient.

Key facts & figures

Positive developments:

- 14 out of the 20 banks improved their scores overall

- 13 banks improved their OPEX-to-assets ratio

- 14 banks increased their leverage ratio, with an overall average increase of 4%

- 17 banks increased their capital position (CET1 ratio)

Adverse developments:

- 15 banks saw worsened LLP ratios; overall average increased by 11%, driven by change in regulation on calculating LLP. The current crisis will further sharply increase LLP ratio's, which is already seen in first quarter of 2020 results.

- 13 banks saw a drop in their ROE, from an overall average of 7.7% to 7.1%

KBC – 1st place

For the fourth year in a row, KBC has kept hold of its position at the top of the ranking. KBC scores above average on almost all KPIs except the OPEX-to-assets ratio. The bank performs exceptionally well on the risk-adjusted CIR, leverage ratio, CET1 ratio and ROE, all 20% above average or more.

ABN AMRO – 2nd place

Although its overall performance saw a slight drop in 2019, ABN AMRO managed to hold second place for the second year in a row. The bank has a strong capital position in particular, with a CET1 ratio of 18%, way above the average of 14.3%. After a strong ROE position in 2017 (13.3%), ABN AMRO's ROE once again deteriorated in 2019 and is now back to its 2016 rate of 9.4%. This drop was mainly driven by plateaued profitability at higher RWA and capital levels.

ING – 3rd place

Our ranking indicates that ING's performance has been consistent for several years. Compared to the rest, ING demonstrates especially strong performance on its OPEX-to-assets ratio (1.2% compared the average 1.4%) and risk-adjusted CIR (60.2% compared to the average 71.4%) ING's CET1 position is less strong than the other Dutch banks, but at 14.6% is still slightly above the average 14.3%.

Rabobank – 4th place

Rabobank improved its position in the ranking from 6th place to 4th place. This is partly due to its stable performance and to the deteriorating performance of Danske and HSBC. Rabobank has a strong leverage ratio in particular (5.7% compared to the average 4.5%). The challenge for Rabobank continues to be growing its profitability, with its 1.9% NIM structurally lower than the 2.3% at ABN AMRO or the 2.1% at ING.

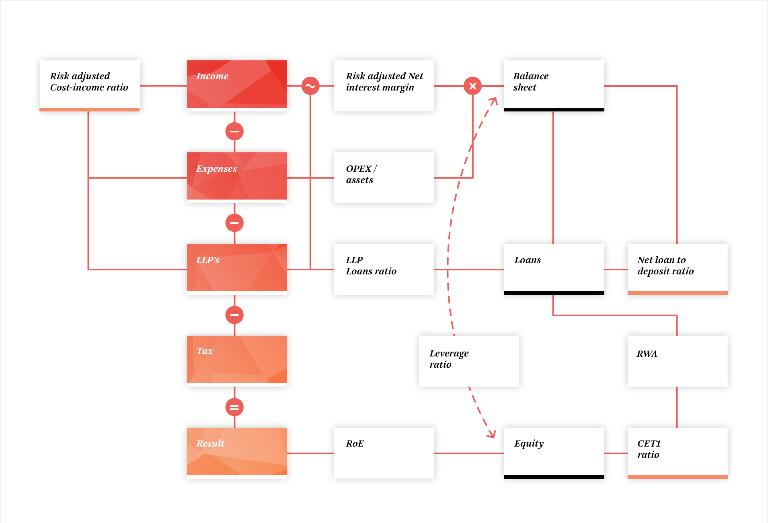

Potential impact of COVID-19 on Dutch banks

COVID-19 will have a huge impact on banks' performance in 2020 and beyond; the first effects have already been seen in the first quarter results.

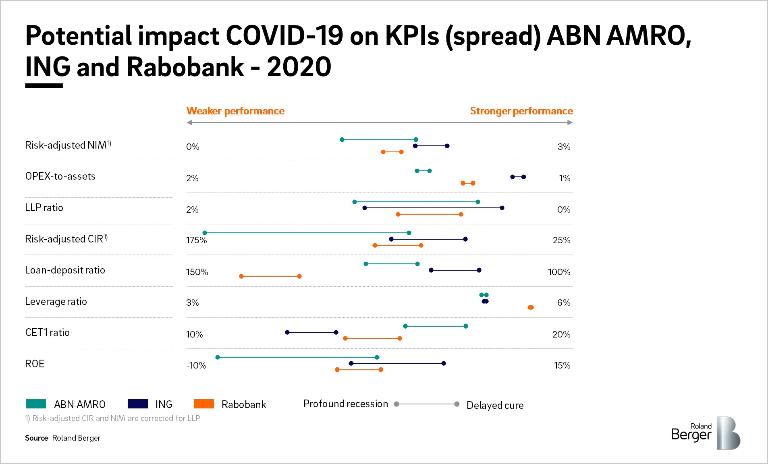

Roland Berger has defined two scenarios for COVID-19's impact on the economy: delayed cure and profound recession. A high-level and outside-in stress test using these scenarios has been conducted on the three Dutch banks. It is our view that ABN AMRO's performance could be the most affected by COVID-19, but the crisis will also strike a blow to ING and Rabobank.

All three banks should closely monitor their resource allocation to maintain profitability, while at the same time managing LLP in the government-subsidized business environment – despite the as-yet-unknown structural changes to the needs and financial performance of their clients.