COVID-19: Implications for Indonesian Retailers

Retail is one of the sectors most vulnerable to disruption

The world, including Indonesia, is currently facing an unprecedented challenge and the retail sector is not immune. While the human and economic impact of the ongoing pandemic has been devastating, we have seen from past experiences and from other markets that it is possible to survive and even thrive in the chaos. However, doing so will require quick decisive actions and creative thinking from all stakeholders. The crisis will force retailers to streamline their strategies, but each lesson learned will push retail players forward to a more sustainable future.

What is the impact of COVID-19 to the global and Indonesian economy?

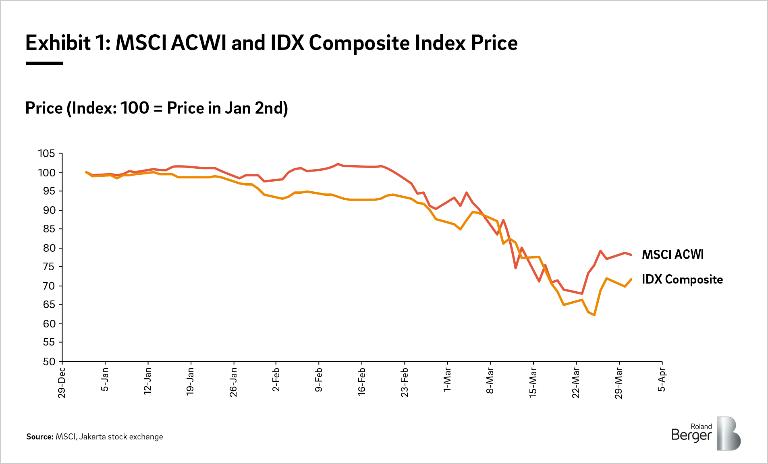

With over 1.4 million confirmed cases across the world, the COVID-19 pandemic is the biggest threat to financial markets today. It has wiped out nearly 22% of global stock markets in the first quarter of 2020 and ushered the global economy into a recession. Forecasts of GDP potentially contracting up to 1% in 2020 signal a reversal from earlier forecasts of 2.5% growth by the United Nations.

Indonesia is not immune to the impact of this crisis either. The overall IDX composite index has fallen by approximately 28% since the start of the year to March. March alone has contributed to over 50% of the total decline. According to estimates by the Finance ministry, the Indonesian economy is now projected to grow by 2.3% in 2020, marking a downward revision from an initial estimate of 5.7%, and might even shrink by 0.4% in the worst-case scenario.

How are Indonesian retailers going to be affected?

Retail is one of the sectors most vulnerable to disruption. Though full impact of the pandemic is yet to be seen, it has already changed consumer behavior, interaction and expenditures. Contraction in retail seems inevitable. Along with it, there will be asymmetrical demand shock, an accelerated shift towards digital, and supply chain disruption.

Retail contraction with asymmetrical demand shock

Countries that experienced the outbreak early, such as China and Singapore, have seen steep declines in their retail sales in the months following the outbreak, with ~20% and ~7% declines in January and February compared to the same period last year. Indonesia reported its first cases on March 2nd, much later than China and Singapore. As such, the country had experienced a relatively muted impact to January and February retail sales, of -0.3% and -1.9% y-o-y respectively.

As the COVID-19 outbreak in Indonesia is expected to peak in Q2 and Q3, the National Intelligence Bureau estimates that the retail industry could experience a 5-15% contraction. The number of mall visitors in Jakarta has in fact dropped by nearly 50% within the two weeks following the first announcement of a positive COVID-19 case. Many mall operators have decided to cease operations temporarily amid the outbreak following recommendations from the government and a substantial reduction in mall traffic. For example, Lippo Group has closed its entire portfolio of 23 malls and 7 retail spaces from early April for 2 weeks.

Furthermore, the anticipated Lebaran festival in May, an occasion where retailers usually record a 50-100% jump in monthly revenue, would potentially not provide much uplift this year. This is because the government has suggested to postpone 'mudik' (going home) and continue with more aggressive social distancing measures to combat the virus from spreading.

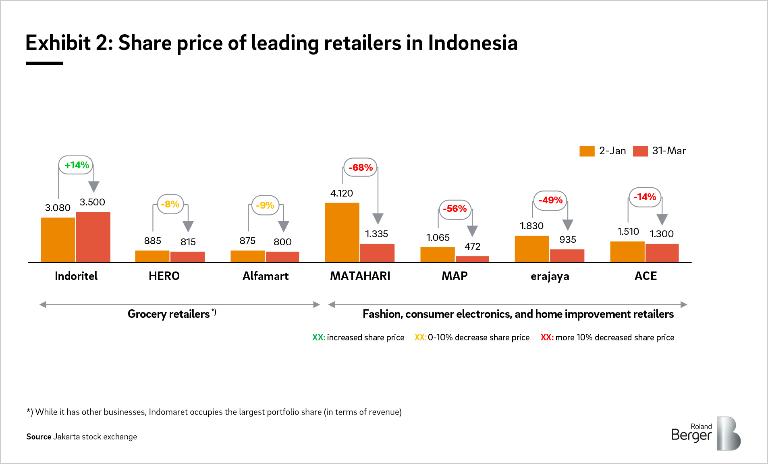

The impact will be felt differently across retail categories. Retailers for non-discretionary items, such as grocery retailers and health/ pharmaceutical retailers, will be less impacted. In fact, non-discretionary items are already experiencing demand spikes due to pre-emptive panic-buying as well as increased efforts at self-protection. In China, apart from a huge demand spike for face masks, hand sanitizers and health supplements, there has also been a surge in cooking ingredients/ seasonings sales.

February saw a 20% y-o-y growth. Similarly, UK's grocery sales have increased by 21% y-o-y in March as people chose to stay home.

We estimate that Indonesia will experience a moderate increase of at least 10-20% y-o-y in the grocery categories (food, cooking ingredient, etc.) during the months of the outbreak. Some retailers in Indonesia have already reported a positive impact on their revenue. Indomaret, the largest minimarket chain in Indonesia with over 17,000 stores nationwide, recorded 7-10% sales increase from February to March, especially in Jabodetabek where a work-from-home policy is in place.

On the other hand, retailers for discretionary items such as fashion & accessories, F&B, beauty cosmetics, and consumer electronics will likely experience a decline in sales due to supply disruption and reduced consumer spending. Among the hardest-hit in China were retailers in fashion and smartphone categories, with both segments reporting 33% and 56% y-o-y decline in February. iPhone sales in China plunged by 60% y-o-y in February.

We forecast a comparable decline in Indonesia's fashion and smartphone segments, estimated at 30-60% y-o-y, during the peak month(s) of the outbreak. Leading retailers in these categories, such as Mitra Adi Perkasa, Matahari Department Store, Erajaya Group etc., have already experienced a significant drop in their share price.

Accelerated shift to digital

COVID-19 will accelerate retailers' transition towards online channels and digital payments. As young populations are more receptive towards adopting new technologies, China and Southeast Asian countries (including Indonesia) have already seen rapid digital adoption.

In the first 10 days of February alone, China's largest online retailer JD.com saw an increase of 215% in online shopping grocery sales. Meanwhile, China's UnionPay reported a 45% increase in their digital payment business. Similar effects are taking place in Indonesia. In March, online retail and digital payment transactions surged by 20-30% m-o-m in several regions of Indonesia.

We expect the digitalization trend to accelerate, positively benefiting digitally-enabled retailers and pure digital players. To capture this rapid demand shift, e-Commerce players such as Tokopedia, Bukalapak and Shopee have been offering various promotions, such as zero delivery fee, cashback programs, and discounts for selected categories.

Supply chain disruption

Retail supply chain operations which are globally interconnected will see widespread disruption. Categories that are locally sourced or produced in Indonesia, such as packaged/ instant goods, will be less impacted compared to categories that rely on foreign imports, such as consumer electronics.

Travel restrictions, closed borders and surge in demand for essential items will put pressure on inbound and outbound supply chain ecosystems. Production and distribution activities will slow down as government orders mandatory closures and quarantine. This will prompt retailers to either find alternative supply sources or reduce their SKUs.

Consequentially, as retailers attempt to diversify their suppliers to minimize stockout risks, new opportunities for local suppliers in Indonesia to take a share of the pie will be created.

How can retailers adapt to these challenging times?

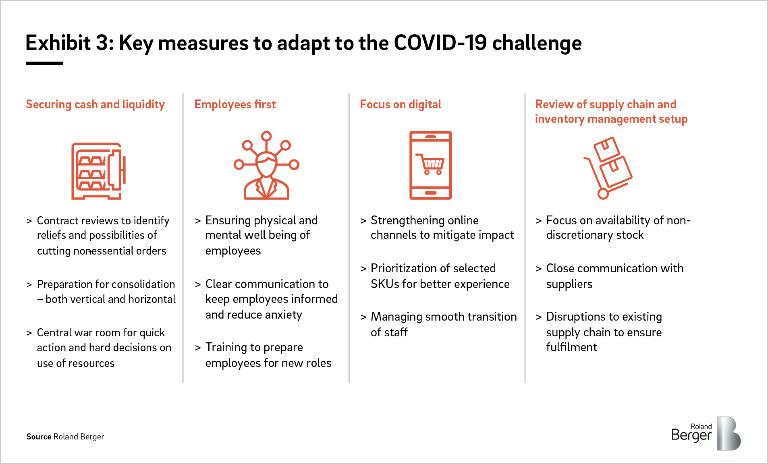

While uncertainty looms large, retailers can implement 4 key measures to navigate these challenging conditions and prepare for the new reality of a post-COVID-19 world.

Retailers can look to China and draw from their experience in tackling both the COVID-19 and the 2003 SARS pandemics.

Securing cash and liquidity

Retailers need to be ruthless in ensuring a healthy cash flow during these uncertain times. Existing contracts should be closely reviewed to identify potential force majeure reliefs, such as rent abatements, extension of payment terms and cancellation of standing orders of discretionary items.

Simultaneously, retailers also need to be cognizant of available government relief packages to reduce or delay payouts and taxes. Other measures such as workforce reduction or shutting down low-traffic stores can be considered, but priority should be on temporary reliefs rather than structural changes that can be difficult to undo once the situation improves post-pandemic.

Ample cash reserves will allow retailers to take advantage of consolidation opportunities and disruptions. Retailers with enough cash can actively explore consolidation both within the industry as well as across neighboring industries to achieve vertical integration. In the face of this highly unpredictable crisis, high liquidity allows for smooth operations and further contingency measures.

As the situation continues to evolve daily, the ability to take rapid yet decisive action is the need of the hour. We urge retailers to establish a central war room and appoint a crisis response team. The appointed individuals should be given authority to act, assess circumstances, and prioritize available resources, thereby facilitating smooth operations.

Employees first

Retailers need to remain cognizant that a pandemic creates a toll on the physical and mental well-being of employees. This crisis has drawn attention to oft-forgotten workplace aspects such as business continuity planning for essential workers and safety practices in workspace.

As a starting point, retailers need to ensure workplace safety for employees (and customers) and enforce strict rules to maintain hygiene. This will include measures such as shortening store hours to accommodate routine sanitization, revising store layouts and introducing physical barriers to comply with social distancing norms, conducting regular temperature and health screenings, and training staff on hygiene standards. Retailers will also need to provide staff with essential personal safety equipment during operation. As experienced in China, retailers had to scramble across the region in order to ensure availability of equipment for their staff in times of global shortage.

Apart from physical health, retailers need to be aware of the impact on employees' mental health. In times of uncertainty, anxiety over job loss and salary cuts will add on to the fear of getting infected. Transparent communication with associates (and partners) is needed to address two areas, namely the organization's overarching strategy and their day-to-day operational concerns such as scheduling. Communication will be the key to allaying some of these fears and keeping key stakeholders abreast of the leadership's response to a rapidly changing situation.

Specifically, in Indonesia, retailers will have to manage the uncertainty around 'mudik' – a mass annual event where ~20 million Indonesians across the country travel home. The mass movement of people will present new health and safety challenges to retail staff. Staffing and scheduling will increase in complexity as domestic travel is likely to be accompanied by a Stay Home Notice (SHN) order from the government.

Finally, many employees will be transferred to different roles to manage the shift in consumer demand during the pandemic. Retailers will need to ensure continuous training of workers during this period of transition.

Focus on digital

Brick and mortar retailers will be badly hit as customers reduce physical visits – either willingly or due to government regulatory enforcement. Conversely, online channels are expected to grow. In comparable large markets such as India and USA, Amazon and other online retailers have seen a surge in demand, particularly in categories such as health, hygiene and high shelf-life groceries. Within Indonesia, online grocers such as Happy Fresh have seen traffic surge 5-10x.

These are similar observations to those of the 2003 SARS epidemic in China. As schools, offices and retail centers were closed, the SARS epidemic gave a huge boost to online retailers such as Alibaba and JD.com. Both eventually grew to be among the world's largest e-commerce players.

The impact of the ongoing pandemic is likely to be much more severe. SARS resulted in nearly 8,000 cases and 800 deaths worldwide. COVID-19 pandemic has already seen more than 1.4 million cases, over 75,000 deaths worldwide, and no clear end in sight.

Nonetheless, a switch to a digital model or a strengthening of omnichannel capabilities is not a straightforward effort. It requires a dedicated vision and singular focus from retailers. Online retailers worldwide are facing issues with deteriorating customer experience due to the high surge in demand. Issues include unavailability of delivery slots, high lead times and stockouts, which often result in order cancellations.

Retailers will need to take a step-by-step approach, by prioritizing the fulfilment of essential non-discretionary goods before expanding their SKU portfolio. In the wake of a 21-day lockdown in India, a successful online grocer reduced their number of SKUs to just 2 key items – milk and bread. The grocer then gradually increased SKUs to other grocery items as demand settled down and delivery lines were streamlined.

To strengthen their digital channel offering, retailers will also have to focus on transitioning brick-and-mortar customer-facing staff to new roles under the digital model. Managing profitability and encouraging traditional customer behavior such as impulse buying will be a challenge which require innovative solutions from retailers. In China, Taobao trained more than 10,000 retail salespeople to pivot towards online livestreaming as a new way of selling online. Global sportswear brand Nike waived off the subscription fee for its streaming workout service in China and saw a significant uplift in its digital business driven by greater engagement.

Online retailers in Indonesia must cope with a combination of 2 key issues, namely the archipelago's geography which makes e-commerce logistics inherently difficult, as well as its low consumer banking penetration. Partnering with Super-apps such as Gojek or Grab can be a viable alternative, as they offer a vast network of associates and digital payment solutions.

Popular e-commerce portal Tokopedia is already leveraging its partnerships with Grab and Gojek for this. Customer behaviors such as contact-free deliveries through digital payments, as opposed to cash on deliveries, are likely to be hardwired and outlast this pandemic period. Partnerships with Super-apps will offer long term benefits. Retailers need to be proactive in adopting digital payment methods such as mobile money and internet banking, as well as contact-less shopping methods such as QR codes and self-help point of sales terminals. Proactive steps are needed as these changes will require significant deployment time.

Review of supply chain and inventory management setup

With the skew in customer demand brought on by this pandemic, retailers will have to focus on ensuring the availability of non-discretionary stock in the short term. This could involve reducing product assortment to focus on hero SKUs. Prolonged changes to categories, especially health and hygiene products, will likely be sustained beyond the peak crisis period. Close cooperation with suppliers is critical to ensure an undisrupted and timely supply of essential goods.

Category owners for key products will have to maintain continuous and clear communication with suppliers to help resolve potential roadblocks. In Indonesia, e-commerce players such as Shopee and Tokopedia, as well as convenience store chains such as Alfamart, have jointly identified close communication with sellers and suppliers as a key factor in ensuring continuous availability of essential products.

Some suppliers might also need support in the form of easier payment terms and relaxed delivery guidelines. Retailers will themselves be facing cash flow pressures due to reduced take-up of non-discretionary items. In such a scenario, retailers will have to focus on suppliers who can support them and work out favorable terms. Retailers must relook at their inventory management systems to ensure adequate stock of critical SKUs.

Shelf-space usage needs to be reprioritized for high-moving essential SKUs; less choice will likely be one of the lasting legacies of COVID-19. Managing this sudden change will require transitioning staff to new roles and product categories.

Retailers can also consider upending existing supply chain and logistics by getting suppliers to directly deliver to stores and rebalance critical stock across regions for faster replenishment. In India, retailers were facing shortages of stock and manpower following a strict government lockdown. In response, some retailers coordinated with FMCG suppliers to send their own fleet of trucks and procure stocks, pulling off a reverse supply chain mechanism to fulfil customer demand despite extreme circumstances.

In China, JD.com utilized its own JD Logistics to pick up stock from supplier warehouses, hiring thousands of temporary workers to bolster its own supply chain and logistics operations.

Of course, these strategies are easier to implement with a limited assortment of SKUs. Once the pandemic ends, retailers can then prepare for the surge in demand of discretionary items.