Customer lifetime value: not just a formula

How do you reallocate cross-channel spend to improve the effectiveness of customer acquisition? How do you pivot customer service efforts toward your most valuable customers? What products do you need to develop to appeal to tomorrow’s best customers? These are some of the questions managers ask in their quest to enhance customer value.

Sophisticated implementation of customer lifetime value (CLV) can help answer these questions. This means going beyond the widely known but rather reductive CLV equation:

CLV = Annual profit contribution per customer x Average lifetime – Acquisition cost

The typical CLV approach

The conventional CLV approach calculates the net present value (NPV) of all contribution margins (revenues minus spend) over some timespan of a given customer. Its basic rule is that customers with a positive NPV should be kept, the rest dropped. But this is a static calculation which only supports decision-making at the moment it is made, and only once. In the dynamic business environment, however, decisions like this must be made repeatedly, continuously, and at different points in the value chain – they need a more sophisticated approach.

Dynamic CLV

We have seen and tested several ways to apply CLV in many different types of businesses. And what we have found is that there is no single, best way to embed CLV. There are, however, a number of activities that are essential to a successful approach:

- Determine profitability drivers (financial and non-financial) via regression analysis on a training sample (random 20% of customer base)

- Segment customer base into homogenous sub-groups by using profitability drivers as predictor variables: Many methods and tools are available for segmentation (e.g. K-means clustering in R or CART analysis). One can choose them by balancing the required level of sophistication and ease of use. The scores of various independent variables reveal the characteristics of the customer group

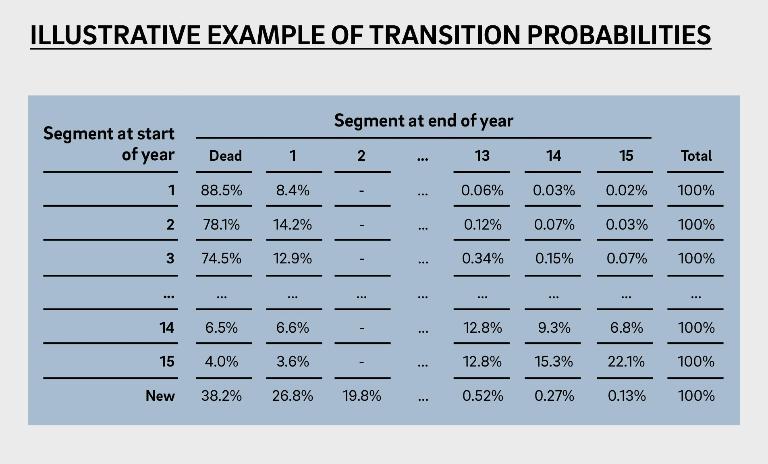

- Estimate transition probabilities using backward training based on the same segmentation of 20% of your customer base, for instance one year earlier

- Calculate the CLV of each customer group as the discounted sum of contribution margins (weighted with their corresponding transition probabilities)

- Validate the model with a test sample (the remaining 80% of your customer base)

- Determine and implement operational rules

Segmentation based on contribution margin is a good starting point for beginning to dig into your company's key opportunity: customer data. As an exercise, it is also a great way to activate a customer-centric mindset. But it will not be spot on right away. It will take time and several iterations before you have a robust predictive model.

Operational rules

Once your customer base is segmented, embedding CLV in your business starts with defining "operational rules" for the organization and its processes. This is the most difficult part, not the least because these rules should also be dynamic. Suppose an insurance company knows that a customer (i) is of a certain age, (ii) was onboarded in the last six months, and (iii) has logged in to their personal page five times in the past three months. If this matches the profile of a customer group with a high CLV, this customer is flagged and a cross- or upsell action is put in motion.

Operational rules follow an automated logic. Based on real-time data, these rules initiate a series of actions that optimize resource allocation, whether it is to attract a particular customer or to keep them with you. Over time, the process will also unearth white spots in your product or service offering, allowing you to create new or more value from your customer base.