Precision engineering in Southeast Asia

A lucrative investment opportunity

"We expect SEA to further benefit from supply chain shifts in precision engineering. In recent M&A transactions, the regional footprint and ability to serve especially US-customers from SEA has been a key issue to assess"

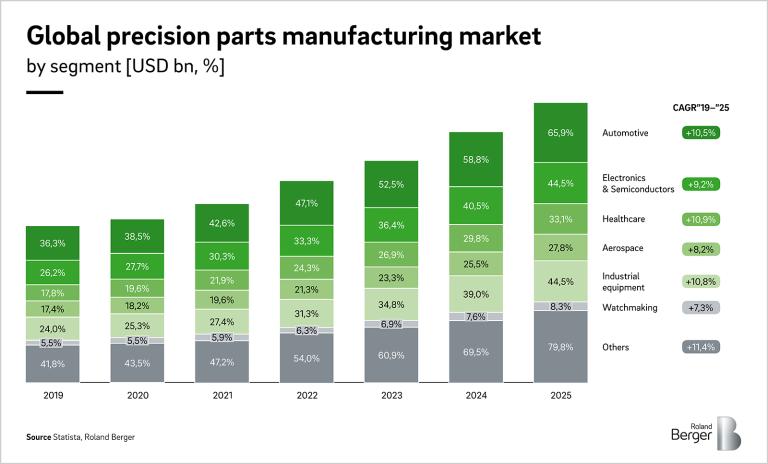

Precision engineering has emerged as a lucrative investment opportunity in Southeast Asia (SEA), with robust growth, government initiatives, supply chain shifts, and emerging technologies driving its potential. The global precision engineering market is projected to reach USD 304 billion by 2025, with Asian markets accounting for nearly half of the market volume, i.e. APAC is projected to sum up to USD 147.7 bn and grow at 10.8% in 2025. Industry analysts predict that this upward trajectory will continue, and Asian markets are expected to even outpace EMEA and Americas in annualized growth rates until 2025.

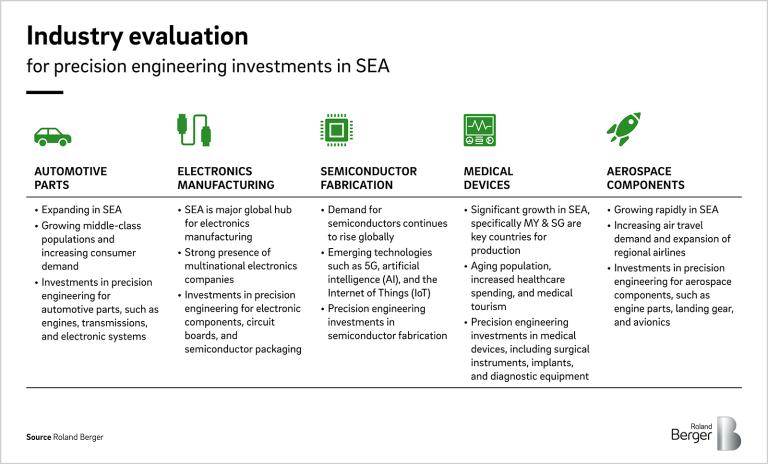

One of the driving forces behind the growth is the region's expanding middle class and rising disposable incomes. This demographic shift has fuelled demand for high-precision components across various industries, such as aerospace, automotive, electronics, and medical devices. As consumer expectations for quality and performance increase, the demand for high-precision components will continue to grow.

In addition to the strong market demand, favorable government initiatives and policies have played a pivotal role in attracting investments to the precision engineering sector, specifically in SEA. Governments across the region are actively promoting precision engineering through incentives, tax breaks, and supportive policies. For instance, Singapore's Precision Engineering Industry Transformation Map (ITM) provides a comprehensive roadmap for industry growth and development. These initiatives encourage investment and foster an enabling environment for precision engineering companies.

Furthermore, the ongoing risk mitigation regarding China and regional supply chain shifts have presented unique opportunities for precision engineering in SEA. Companies seeking to diversify their supply chains and reduce risks associated with over-reliance on a single market have turned to SEA as an alternative manufacturing hub. The region's strategic geographic location, well-established infrastructure, and skilled workforce have made it an attractive destination for precision engineering investments. Especially Vietnam, Malaysia and Thailand have benefitted from this move. Establishing regional trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP), creates further opportunities for increased market access and facilitates cross-border trade and investment. Investors can leverage these trade agreements to expand their reach and tap into larger markets.

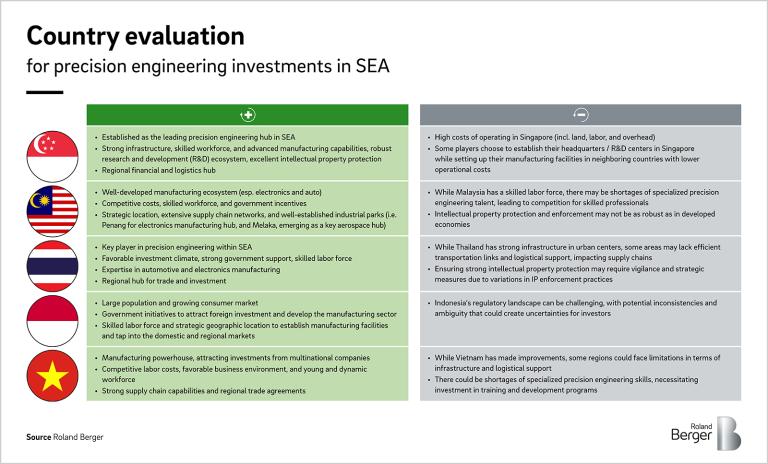

Maximizing precision engineering investments in SEA through country and industry evaluation.

When considering investing in precision engineering in SEA, evaluating it from a country and industry perspective is essential. From a country lens, Singapore stands out with its advanced manufacturing capabilities. At the same time, Malaysia, Thailand, Indonesia, and Vietnam offer their strengths in manufacturing capabilities, business environments, and consumer markets. From an industry lens, precision engineering is vital in various sectors, such as aerospace, automotive, electronics, and medical devices, where demand for high-precision components steadily increases. By analyzing opportunities and growth potential through both lenses, investors can make informed decisions and capitalize on Southeast Asia's thriving precision engineering landscape.

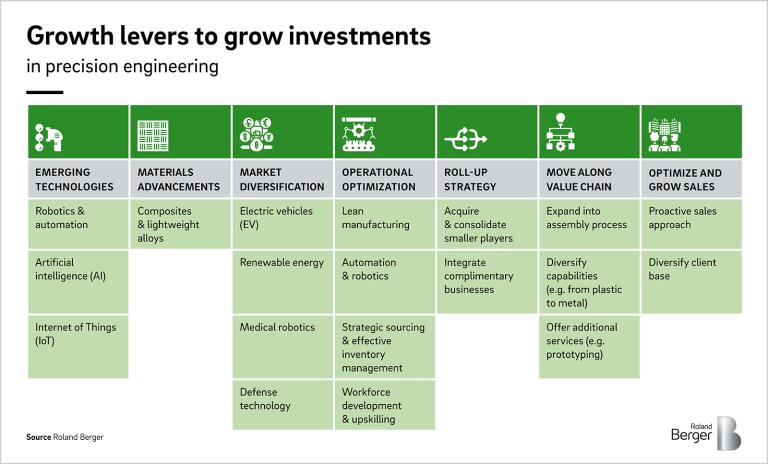

Leveraging emerging technologies, advancements in materials, market diversification, and operational excellence to maximize precision engineering investments.

Once in the precision engineering market, investors can capitalize on growth opportunities in emerging technologies like robotics, automation, AI, and IoT. Staying updated on advancements in materials science, exploring adjacent markets such as EVs, renewable energy, medical robotics, and defense technology, optimizing operations, and considering consolidation strategies can also maximize returns. Companies can consider integrating further steps in the value chain, diversifying capabilities, and offering additional services to enhance their value proposition. Establishing effective sales organizations focused on diversifying the client base can also contribute to growth.

1. Gaining a competitive edge with emerging technologies.

Investors should focus on emerging technologies transforming the manufacturing landscape, such as robotics and automation, artificial intelligence (AI), and the Internet of Things (IoT). These technologies improve operational efficiency, reduce costs, and enhance product quality. Investing in precision engineering solutions that leverage these technologies can provide a competitive edge.

2. Staying up to date in materials advancements.

Staying updated on advancements in materials science is crucial. For example, developing advanced materials, such as composites and lightweight alloys, can revolutionize precision engineering. These materials offer improved strength, durability, and weight reduction, providing investment opportunities in new manufacturing processes and applications. Investors should stay at the forefront of advanced materials and technologies within the precision engineering sector. This can be achieved through partnerships with research institutions, technology providers, and industry experts.

3. Diversifying portfolio in adjacent markets.

Exploring adjacent markets can diversify investment portfolios and tap into new growth opportunities. Adjacent markets include the electric vehicle (EV) industry, renewable energy sector, medical robotics, and defense technology. These markets are experiencing rapid growth and require precision-engineered components and solutions.

4. Operational optimization to improve margins.

To maximize returns, investors should focus on optimizing operations within their precision engineering investments. This multifaceted approach will involve leveraging various levers to enhance efficiency and productivity. E.g., implementing lean manufacturing principles helps eliminate waste and streamline processes, leading to improved margins. Automation and robotics technologies enable companies to increase throughput, reduce labor costs, and enhance overall operational efficiency. Optimizing the supply chain through strategic sourcing and effective inventory management ensures timely materials delivery at optimal costs. Investing in workforce development and upskilling enhances productivity and innovation, contributing to higher margins. By implementing these strategies, precision engineering companies can achieve substantial margin improvements, typically ranging from 5% to 20% or more, depending on industry dynamics and the optimization level.

5. Gain a competitive advantage with the roll-up strategy.

Investors can consider consolidation strategies to maximize returns. The roll-up game involves acquiring and consolidating smaller precision engineering companies to create economies of scale, expand market share, and increase competitiveness. By integrating complementary businesses and leveraging synergies, investors can enhance operational efficiencies, broaden their customer base, and achieve greater profitability.

6. Move along the value chain to stand out.

Companies can consider integrating further steps in the value chain, such as expanding into assembly processes. By incorporating assembly capabilities, they can offer comprehensive solutions to their clients and capture a larger share of the value generated by the final product. Additionally, diversifying capabilities within the precision engineering sector can be beneficial. For instance, if a company specializes in plastic components, expanding into metal fabrication can open up new opportunities and cater to a broader range of customer needs. In addition to expanding capabilities, offering additional services can enhance a company's value proposition. For example, bolstering prototyping and engineering services, which are often overlooked in favor of manufacturing-focused activities. By providing comprehensive prototyping and engineering support, precision engineering companies can differentiate themselves, strengthen client relationships, and become trusted partners in the product development process. This expansion into additional services allows companies to offer end-to-end solutions and capture more value throughout the entire product lifecycle.

7. Optimization to grow sales.

Investors can play a crucial role in setting up effective sales organizations that are focused on winning new clients and expanding into new customer regions. By adopting a proactive sales approach, companies can reduce their dependency on a few large clients, a common risk in the industry. Diversifying the client base through targeted sales opens new revenue streams and reduces vulnerability to market fluctuations. By strategically identifying and pursuing new business opportunities, precision engineering companies can not only enhance their sales figures but also strengthen their overall market position and improve margins.

"Precision engineering investments in Southeast Asia are capitalizing on the region's expertise, innovation, and advanced technologies to drive remarkable growth"

In conclusion, precision engineering in SEA represents an exciting investment proposition with promising growth prospects. The region's expanding middle class, supportive government initiatives, risk mitigation regarding China, regional supply chain shifts, and the integration of advanced materials and technologies all contribute to the sector's growth and investment appeal. To maximize returns, investors should identify growth opportunities in specific sub-sectors, leverage advanced materials and technologies, expand into promising countries, optimize operations, and consider consolidation strategies. With careful analysis, strategic decision-making, and a focus on innovation, investors can reap the rewards of investing in Southeast Asia's thriving precision engineering sector.

Register here to get the full ASEAN Private Equity Newsletter.