After the energy price shock resulted in a subdued start to the year, the EV and EV charging markets sparked back into life in late 2022. Almost all countries featured in the fourth edition of Roland Berger’s EV Charging Index hit record-high scores, with several leaping up the rankings. Also covered in the edition: customer behavior is changing and OEM's strategy for EV charging infrastructure is showing regional differences.

Riding the EV wave in Southeast Asia

By Timothy Wong

A playbook for private sector stakeholders and investors

The global push to reduce carbon emissions has led to a growing trend of electrification in the mobility sector, driven by commitments from countries and corporations. The maturity of electric vehicle (EV) technology and increasing consumer acceptance have further bolstered this trend.

"Recent ASEAN governments’ joint declaration on developing regional EV ecosystem will further accelerate EV growth in the region."

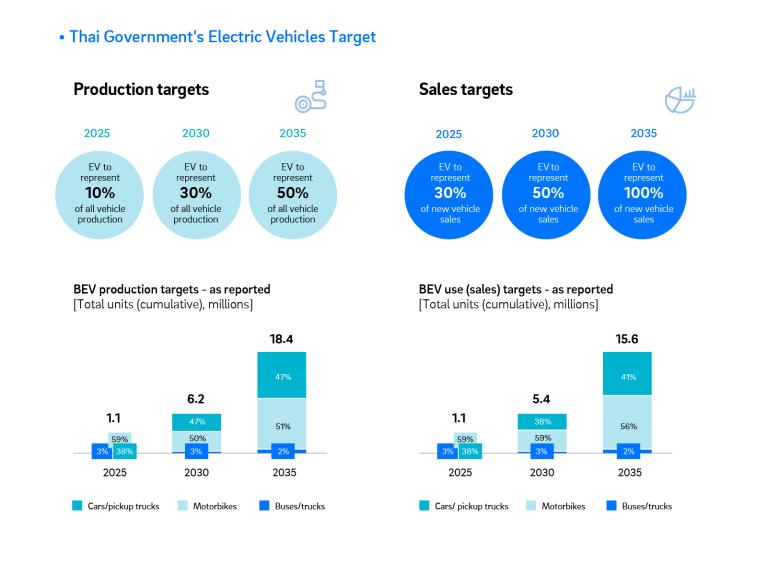

The global push to reduce carbon emissions has led to a growing trend of electrification in the mobility sector, driven by commitments from countries and corporations. The maturity of electric vehicle (EV) technology and increasing consumer acceptance have further bolstered this trend. Many countries have announced or implemented mandates to phase out sales of internal combustion engine (ICE) vehicles, with Norway leading the way with a target of zero ICE vehicle sales by 2025, and China planning to sell only xEV (hybrids and zero-emission vehicles) by 2035. In Southeast Asia, Singapore has set a goal of achieving a 100% clean energy-powered vehicle fleet by 2040, while Indonesia, Malaysia, and the Philippines have also pledged to accelerate adoption of xEVs by 2030. Thailand is particularly ambitious, aiming to produce 50% of electric vehicles locally by 2030 and to achieve full electrification by 2035.

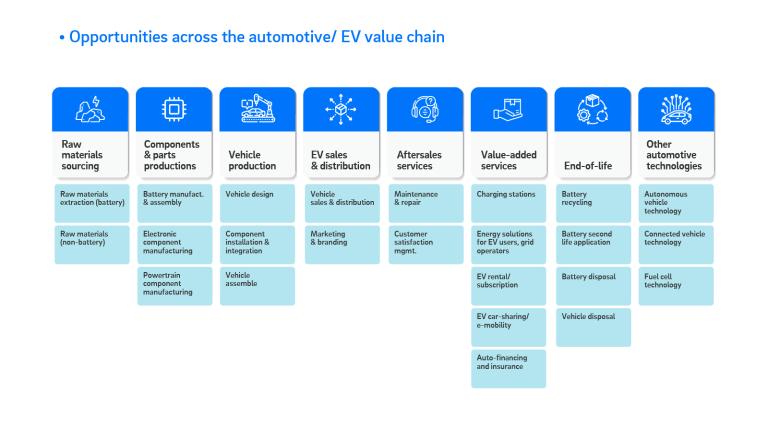

The development of electric vehicles (EVs) has led to the creation of a new industry value chain and numerous opportunities for growth.

In Southeast Asia, for example, the Thai government has set ambitious EV development goals, which could result in a revenue pool of more than US$100 billion. However, there are still many challenges that need to be addressed to fully realize the potential of this new market. These challenges may include issues related to infrastructure, technology, regulation, and consumer adoption.

According to Roland Berger’s biannual Automotive Disruptive Radar (ADR), there is a growing desire among consumers to switch to electric vehicles (EVs), but accessibility, convenience, and price remain key concerns.

The availability of charging infrastructure, access to maintenance and repair services, and the price gap between internal combustion engine (ICE) and EV vehicles are signifcant hurdles that need to be addressed.

Industry players are also facing challenges in the nascent EV market, including the need to develop stronger EV-related knowledge and attract investments to scale up. There is a conundrum about whether to wait for the EV market to mature or to invest now and potentially reap the rewards sooner.

To overcome these challenges, both public and private sectors have important roles to play, with different strategic imperatives and considerations. This abstract provides an overview of the obstacles faced by the nascent EV market in Southeast Asia and highlights the need for collaboration and innovative solutions to address them.

I. Define strategic roles of EV

The electric vehicle (EV) ecosystem comprises a diverse group of private sector stakeholders, including EV manufacturers, parts and component suppliers, fleet operators, large corporations, new players entering the EV market, and investors, among others. Each player has its own agenda and objectives, making it clear that a “one-size-fits-all” approach will not be effective.

The private sector could potentially leverage Electric Vehicles (EVs) in three strategic roles, which include:

- An enabler to achieve environmental, social and governance goals:

- EV as opportunistic investment:

- EV as a new growth engine:

II. Adopt “ecosystem” mindset and approach

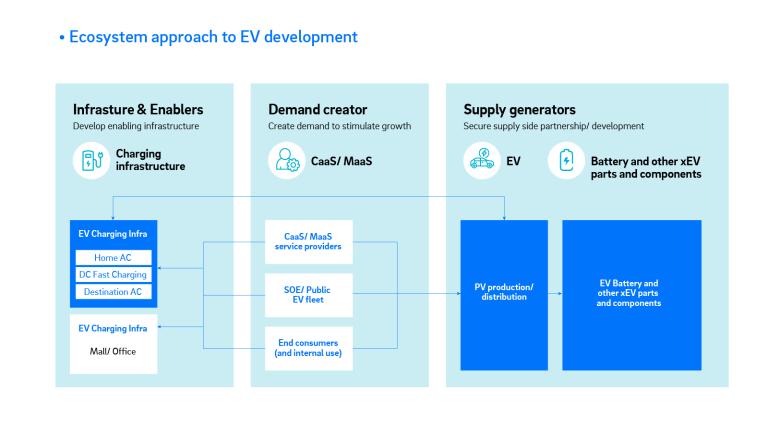

Three building blocks are essential for EV to work in the nascent market environment. These are demand creator, supply securer and enabling infrastructure.

- Demand creator:

- Supply securer:

- Enabling infrastructure:

III. Leverage collaboration and partnership to boost EV market

Partnerships and strategic alliances have emerged as a common and important go-to-market approach for mutual growth and benefits. For example, in the battery sector, LG Chemical formed a strategic partnership with Hyundai to construct an EV battery cell plant in Indonesia, with an annual capacity of 10GWh, to meet the needs of 150,000 electric vehicles.

In the EV production segment, Toyota collaborated with Chinese EV Original Equipment Manufacturer (OEM), BYD, to develop and produce an affordable, all-electric sedan in China. Other entrants to the market, such as Foxconn, are establishing joint ventures with PTT in Thailand to produce EVs, leveraging the latter’s MIH platform.

Such partnerships can potentially shorten product development lead times and reduce associated costs. This approach is expected to expedite the establishment of EV ecosystems in the emerging Southeast Asia market.

EV development will create unprecedented opportunities for various stakeholders in public and private sectors. This “playbook” approach can provide for policy makers and business decision makers to better defne their objectives, hence strategy and approach to capturing EV growth potential. Investors can leverage arising opportunities in specifc segments along the value as entry point or growth option into the EV strategy. One angle to leverage EV growth can be via component manufacturers (e.g., cables, connectors, and battery components) which are well positioned to beneft from EV growth. The ASEAN region has a strong footprint in this part of the value chain and is expected to show further investment opportunities. Investors should thoroughly analyze these assets regarding the impact of EV vs. ICE on the core business model to identify attractive opportunities.

Overall key considerations for investors can be summarized as follows:

- Ecosystem portfolio development approach:

Building a portfolio (either investment or through strategic partnership) covering the three building blocks, demand creator, supply securer and enabling infrastructure.

- Ability to scale:

Given the nascent stage of the market, the ability of the investment to scale not only within a country but beyond to the regional would be an important factor to consider.

- Regulatory constraints:

In some parts of the value chain, e.g., energy distribution and charging infrastructure, regulatory constraints or current market structure may pose restrictions on what could be invested and future synergetic value with other investments.

Register now to download the full Special Edition of the Private Equity Asean Newsletter. Additionally, you will receive this quarterly newsletter on a regular basis.