Tracking the 'New Normal' in Automotive

Our New Normal Tracker provides regular updates on key industry trends.

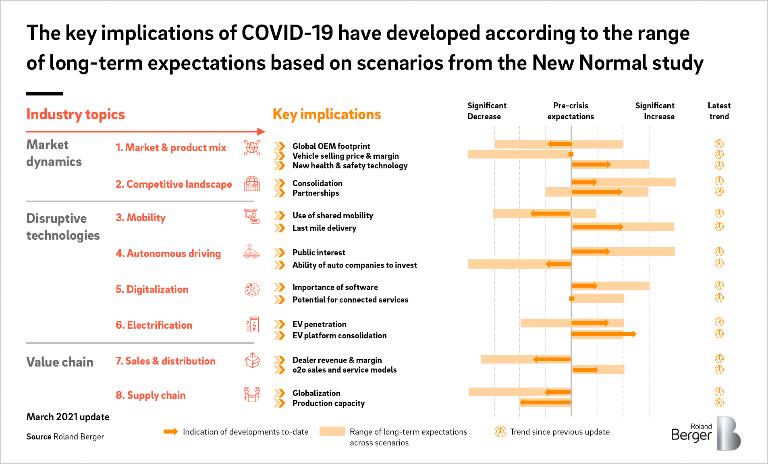

March edition: Business models, supply chains and connected vehicle developments will be optimized and refined

Main article

The post-crisis landscape for the automotive industry has been constantly evolving since our initial publication on the 'new normal' in early May 2020. In this update, we track the course of economic recovery and government policy across the United States, Europe and China, as well key developments within the industry. Furthermore, in parsing out the news from the noise, we identify several emerging trends and core themes of development, which include some of the highlights listed below:

- Light vehicle sales in China remain strong, while the US and Europe continue to struggle with sales down YoY in early 2021

- Widespread vaccine administration and reduced virus transmission bode well for the future of light vehicle sales recovery

- Chip supply crisis forces global plant closures across the automotive value chain

- Biden administration begins to reverse Trump era emissions policy with a series of executive orders directed at the US Environmental Protection Agency (EPA) and the Department of Transportation (DOT)

- European Commission announces new EU trade strategy, expected to put pressure on the US and China

- China foreign minister urges Biden to ease Trump era restrictions

- SPAC frenzy continues to accelerate with several electric vehicle OEMs, electric vehicle suppliers and LiDaR suppliers going public

- OEMs optimize their global footprints as Honda exits Russia and VW establishes a majority position in China joint venture, JAC Volkswagen

- OEMs including GM, Jaguar, Nissan and Ford announce plans to phase out internal combustion engine vehicles for electric vehicles in various markets

- Electric vehicle platform consolidation increases as Geely and Foxconn partner to build electric vehicles for other automakers, and Foxconn plans to build upcoming Fisker electric vehicle in new partnerhsip

- Volvo and Daimler, and separately GM and Navistar each partner to share fuel cell technology for semi trucks

- Consolidation trends solidify as PSA and FCA merger completes to create Stellantis and Goodyear agrees to buy Cooper Tire, though Volvo and Geely scale back their intended merger to focus on powertrain collaboration

- Apple struggles to find a manufacturing partner for upcoming electric vehicles after failed talks with Hyundai and Nissan

Previous editions

Related contents