Navigating the financial pandemic of non-performing loans

By Sebastian Steger and Julian Gulden

The public and private sectors must act now to manage the threat of NPLs in emerging economies

A major increase in the ratio of non-performing loans could be a serious financial consequence of the Coronavirus pandemic. Developing economies are particularly vulnerable to a vicious circle of financial instability. To combat the threat, public and private players must act now with tailored local solutions.

NPLs and Covid: an avalanche of bad debt?

There’s nothing new about non-performing loans (NPLs) – loans that are in or close to default. Yet they continue to present problems. Left unaddressed, NPLs can be a serious burden on any national financial system: they can impair a bank’s ability to provide financing , causing a growing number of businesses to fail and setting off a downward spiral of instability.

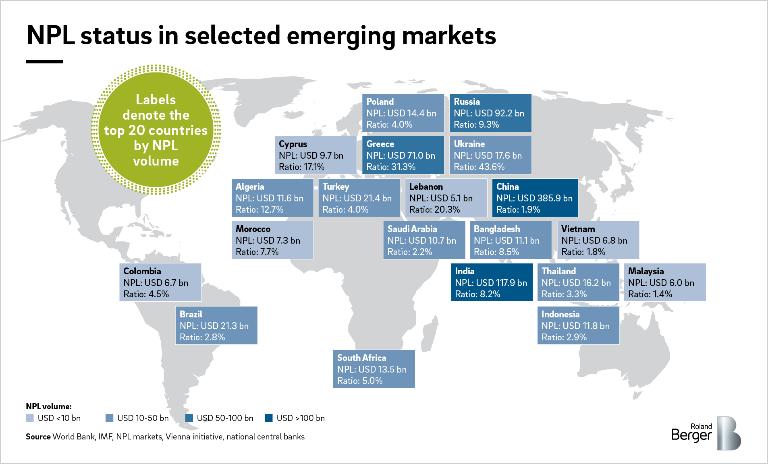

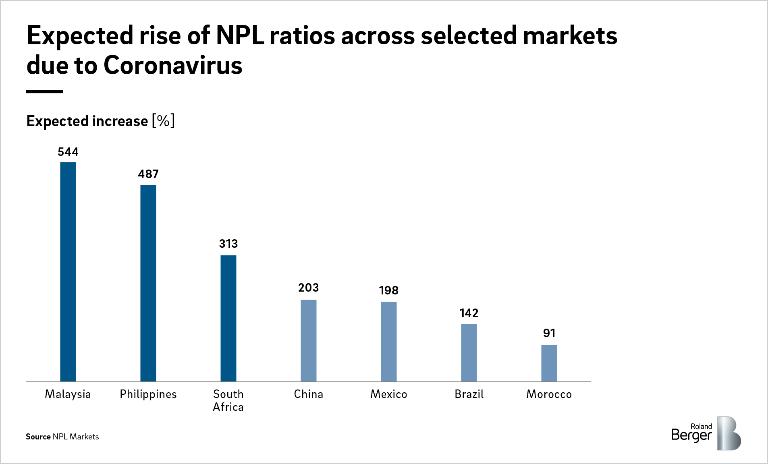

The ongoing Covid-19 pandemic is leading to a significant increase in NPLs at banks around the world. Without the resources and infrastructure to cushion the blow, the impact will be severe, particularly for developing economies. Forecasts vary, but some are particularly alarming: according to specialized analytics company NPL Markets, post-Covid bad debt ratios could increase severalfold in multiple emerging economies.

Five main factors explain why developing nations are more vulnerable to problems with NPLs:

- They often lack the sound legislative and regulatory tools required to resolve NPLs.

- The local banking systems are lacking credit and NPL management standards.

- The markets are also lacking market solutions and investor access to manage and reduce NPLs.

- Developing economies often rely on labor-intensive industries like textiles, foreign consumption of raw materials or tourism, all of which lack remote-working alternatives and heighten the impact of Covid-19.

- Pre-Covid NPL ratios were already high in some countries such as Ukraine (43.6%).

Even as vaccination programs begin, recovery will be a long, tough road. Continued lockdowns could be the tipping point for a large-scale NPL crisis.

A two-step approach to NPL management

NPLs may be a global issue, but they must be dealt with at a local level due to varying legal and business environments. There is no one-size-fits-all solution. Ireland’s National Asset Management Agency, for example, was set up in 2009 to purchase bad bank assets and manage them centrally. This solution required significant capital, transparent governance, clear transfer pricing and a strong legal framework – conditions that are often absent in emerging markets like Bangladesh, where NPLs are on the rise.

Improvement requires a two-pronged approach. Step one is to get the basics right by establishing the necessary legal framework and debt resolution infrastructure. This includes:

- Clear write-off guidelines for NPLs in the banking system with fair tax treatment for loss recognition.

- A sound insolvency regime to settle bankruptcy cases; established debt servicing capacity and enforcement capabilities; and clear protection of both debtor and creditor rights.

- Efficient and sufficient judicial conditions for out-of-court debt restructuring (corporate workouts).

Some countries are already taking the right action. India, for example, has introduced the Insolvency and Bankruptcy Code, which significantly reduces the resolution period in bankruptcy courts and improves creditor rights.

The second main step is to unclog the market by involving the private sector and forming primary and secondary NPL trading markets. Steps include:

- Setting up a public credit registry, adjusting data protection rules and pushing digitization of records to improve information transparency and lower costs for due diligence.

- Removing banking license requirements for NPL investment and deregulating foreign special purpose vehicle (SPV) investment structures to lower investment barriers.

- Discarding requirements such as borrower notification or consent to facilitate asset transfer.

- Provide financial incentives, e.g. guarantees or co-investment by financial agencies or development institutions.

For the private sector, the time to act is now. Companies in insolvency or distress should engage in restructuring discussions early on. Distressed asset investors can help by stocking up their portfolios with NPLs in viable emerging markets. Multilateral development banks must align with regulators on how to provide support to government, banks and borrowers.

Rapid response: Roland Berger’s NPL Safeguard solution

Emerging markets are at the center of the current NPL storm, which is exposing past negligence. Any sense of security from short-term gains like increased trade volumes is likely to be a false one: many small companies are already on the verge of insolvency. Emergency government measures such as Covid loans will leave behind companies with higher indebtedness and zombie companies that will run into trouble once the measures end. The same holds true for loan moratoriums which could bring a major default shock once they expire. Quite simply, it has never been more important for banks to proactively prepare.

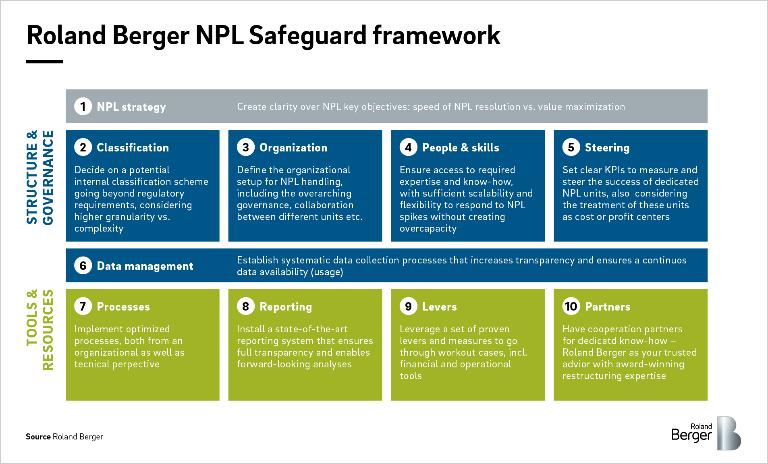

This must be done with a clear NPL strategy which combines solutions on bank level, market level and government level. The strategy should provide clear guidance on the speed of NPL resolution vs. value maximization. From here, banks, investors and regulators can carry out further in-depth analysis to better understand gaps and levers for improvement in structure, governance, tools and resources.

An adequate NPL classification scheme and specialized skills will help quickly addressing these extraordinary challenges. New market information must be incorporated into an intelligent credit policy to detect balance sheet risks and minimize potential losses.

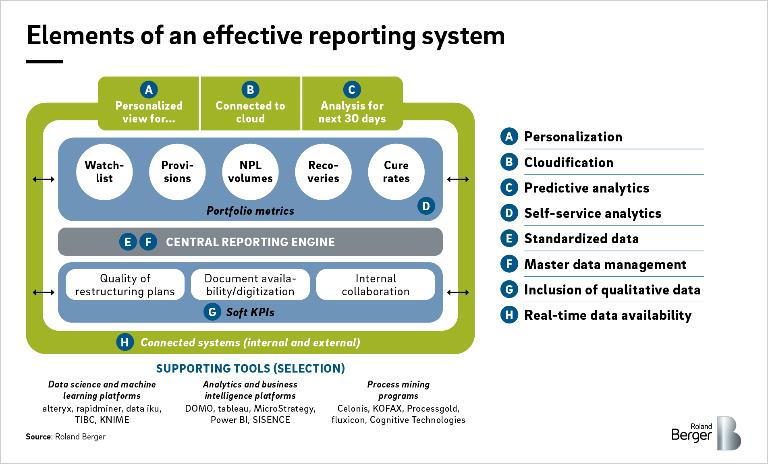

All parties involved must also ask themselves if current reporting cycles and procedures are capable of handling exceptional crises like Covid-19. Those without an individualized and forward-looking reporting system must act as soon as possible.

Roland Berger can support with the NPL Safeguard framework which is applicable in principle on the individual bank level as well as on the market level.

Act now – every little helps

For public and private stakeholders, it is becoming increasingly apparent that NPLs are likely to become one of the most serious consequences of the pandemic. Managing the threat will require significant work from businesses, governments and multilateral development banks, both individually and together. Even small steps in the right direction could bring significant relief to financial systems around the world.

Sign up for updates on financial services.

_person_144.png?v=770441)