Read more on how the automotive sector is evolving towards a growing demand for lithium-ion batteries and how European suppliers can challenge the Asian market.

Digging deeper: How to manage supply chain risk for lithium-ion batteries

A secure supply of raw and refined materials for batteries and an optimized supply-chain set-up are vital to the electric vehicle business model

The rapidly growing popularity of electric vehicles will cause demand for lithium-ion batteries to soar over the next decade. This will create new supply chain risks, particularly around raw and refined battery materials. Mitigation will require increased focus on vertical integration and strategic partnerships throughout the supply chain, as well as supply chain localization and closed-loop battery recycling.

Battery electric vehicles (BEVs) are a crucial factor in decarbonizing the transportation sector. After years as a somewhat niche option, adoption rates are now rising quickly, especially in Europe and China. In 2021, BEVs accounted for just 4% of global passenger vehicle sales, but this is expected to grow to more than 30% by the end of the decade based on OEM target announcements.

A key component of electric mobility is the battery pack. In recent years, a combination of rapid technological progress and scaled-up production rates have led to improved performance and – mostly – a fall in production costs for BEV batteries. Mostly, because rising raw material costs and the recent semiconductor shortage have caused prices to temporarily rise again over the last two years.

Based on figures from mid-2021, an average NCM811 battery pack costs around USD130 per KWh. Battery costs are heavily influenced by the cell technology used, the production location and the price of raw materials. Cell costs comprise approximately 75% of the total cost of the battery pack. Materials, such as cathode and anode active materials (CAM and AAM), account for 70% of the cost of each cell, with raw and refined materials like cobalt- and nickel-sulphates and lithium salts accounting for more than 30% of cell costs.

"The battery market is expected to show 30% CAGR to reach a total annual capacity of more than 3,000 GWh by 2030."

How to further reduce battery costs

The battery market is expected to show 30% CAGR to reach a total annual capacity of more than 3,000 GWh by 2030. However, this can only be achieved by further reducing production costs per kWh. So how can OEMs and cell manufacturers continue to lower battery costs over the coming years?

The largest lever is the improvement of the cell chemistries and design. The shift towards CAMs with higher nickel content (beyond NCM811) and AAMs with more silicon is expected to boost cell energy density and reduce overall cost per kWh. This can be supported by larger cell formats and a lower share of non-active materials like cans and current collectors.

Away from cell chemistry and design, there are further ways to reduce costs. These include increasing the size of modules to reduce the number of modules per pack, and improving manufacturing technology for lower CAPEX and OPEX. All in all, we estimate these measures can reduce costs by approximately USD30-40 per KWh.

Battery production goes regional

While EV adoption is on the rise globally, Europe can expect to see the strongest growth. By 2030, more than half of all light vehicle sales (52%) are expected to be BEVs – almost double that of North America (29%). In China, BEVs are predicted to make up 38% of light vehicle sales in 2030.

This is changing the production landscape for EV batteries. With China currently dominating battery cell production, only a handful of manufacturers currently have facilities in Europe. But things will soon change as a variety of global competitors open European factories in the coming years, including established OEMs (often via joint ventures), battery suppliers as well as European start-ups.

Four areas of supply chain risk

However, such is the industry’s dependency on certain raw materials that a sharp rise in production will significantly increase risks along the supply chain. These can affect the availability, price and sustainability of the final product. We have identified four key areas of risks that need to be managed:

- Geopolitical

Some of the resources crucial to battery production are concentrated in a small number of countries. Of these, some are prone to political instability or are subject to diplomatic tensions. Lithium extraction, for example, is dominated by Australia, Chile and China, with China also monopolizing chemical processing and manufacturing. - ESG

While electric vehicles may emit zero tailpipe emissions, battery manufacturing does have a significant environmental and social impact. Lithium extraction uses large amounts of water and some production processes emit a lot of CO2. And for years there have been severe human rights issues in several mines. - Price

Battery raw material prices have been subject to strong fluctuation, reaching an all-time high in 2022 due to supply imbalances during the recovery from Covid-19. What’s more, ramping up battery production to meet increased demand won’t come cheap. We expect a necessary CAPEX of EUR250-300 billion over the next eight years. Around a third of that will likely be in Europe. - Supply/availability

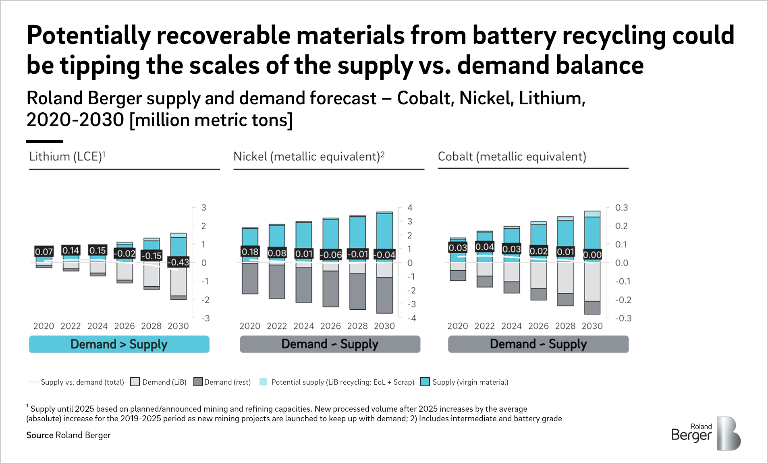

As battery demand grows, maintaining sufficient supply of CAM materials will be challenging. Supply levels will be tight for nickel and cobalt, but for lithium there is a very high risk of a substantial shortfall. And lead times must also be considered: It can take three years at the very least to go from exploration to setting up a full-scale mining plant for lithium. Nickel can take twice as long.

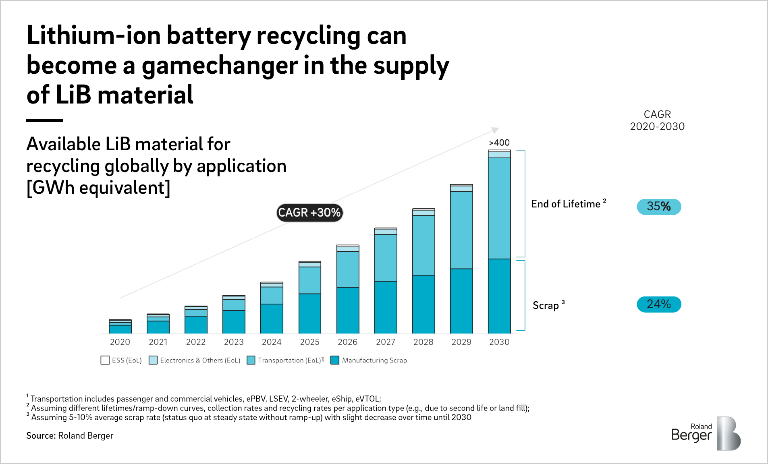

Time to embrace recycling

There are numerous reasons to expand and improve the recycling infrastructure for EV batteries. Before we get to sustainability, there is the straightforward factor of supply and demand. The potentially recoverable materials from EV batteries may only play a minor role compared to the overall supply, but they could be vital in ensuring supply is able to meet demand. This will be particularly true for lithium and cobalt toward the end of the decade.

As regulatory requirements evolve, companies throughout the value chain will find themselves increasingly obligated to prioritize recycling and implement a circular battery economy.

In Europe, Article 8 of a draft EU battery directive proposes an increasing amount of mandatory recycled content in EV batteries from 2030. Article 47, meanwhile, covers the ‘extended producer responsibility,’ which outlines obligations for producers to organize and finance the collection, treatment and recycling of waste batteries.

Three different fates typically await EV batteries that can no longer be used in vehicles. Some will still have sufficient capacity to be repurposed for uses such as stationary energy storage; some can be ‘re-manufactured’ by replacing or repairing certain components to extend their lifecycle; and others can be stripped to enable certain materials to be recycled.

Battery recycling technology can vary. The dominant approach in North America and Europe uses pyro- and hydrometallurgy, in which batteries are smelted and the resulting alloys further refined to recover the metals. On the plus side, it is a proven process with high recovery rates for nickel and cobalt, however lithium recovery is much more difficult, and the process is energy- and emissions-intensive.

The mechanical and hydrometallurgy technique favored in China and by some US and EU startups sees batteries shredded before hydrometallurgy is used to extract the battery materials. This has a high recovery rate for all metals including lithium and requires less energy and CAPEX, but does use a lot of water and harmful chemicals.

The direct or "Cathode-to-cathode" recycling method is very promising especially for handling of manufacturing scrap but currently still under development and yet to be proven at scale.

"Greater regionalization and co-location can improve sustainability and reduce geopolitical and ESG risk, as well as lower costs."

How to reduce supply chain risk

If battery producers are to successfully meet the massive jump in demand for electric vehicles, the supply chain must evolve. The processes used today largely date back more than 10 years, when batteries were much smaller and mostly used for consumer electronics, rather than large electric vehicles.

On a production level, a more integrated approach between metallurgy and chemistry will help secure supply and reduce costs. Greater regionalization and co-location for multiple steps in battery manufacturing can also improve sustainability and reduce geopolitical and ESG risk, as well as lower costs. Political decisions also push for a more regionalized supply chain, as shown again in President Biden's invocation of the Defense Production Act to kick-start domestic battery materials production on March 31, 2022

Strategically, OEMs and cell manufacturers must increase their involvement in the upstream supply chain to mitigate risks. This can range from long-term supply agreements to partnerships or even investments. Leading EV OEMs and cell makers, as well as CAM producers, are already aiming at high levels of vertical integration and becoming increasingly involved up to the mining stage. Occupying critical control points along the supply chain can provide a strong competitive advantage but does require a high degree of commitment. The ability to simulate alternative upstream LiB-supply-networks becomes crucial in developing winning battery strategies.

Sign up for our Roland Berger newsletter. You will get regular updates on newest publications across all our expertises.

![Market demand for LiB by application [in GWh]](https://img.rolandberger.com/content_assets/content_images/captions/_Roland_Berger_783_Lithium-Ion_Battery_Market_GT_image_caption_none.png?v=770441)

![Virgin raw materials supply, 2020 [% share of global]](https://img.rolandberger.com/content_assets/content_images/captions/_Roland_Berger_783_Lithium-Ion_Battery_Market_GT_2-(1)_image_caption_none.png?v=770441)