Explore a comprehensive risk management framework for Bitcoin mining success. Dive into key dimensions: Market, Hardware, Operations, Financial & Treasury, and Energy. Navigate volatility with expert insights.

The future of payments

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/Roland_Berger-23-0193-Blockchain_Payments-DT_download_preview.jpg)

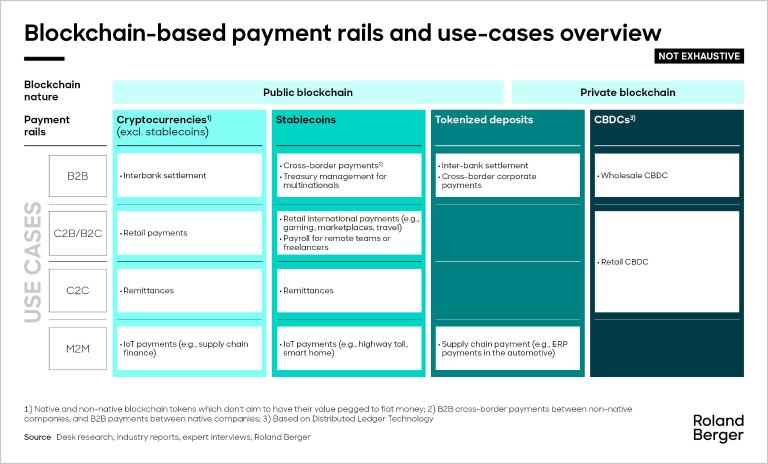

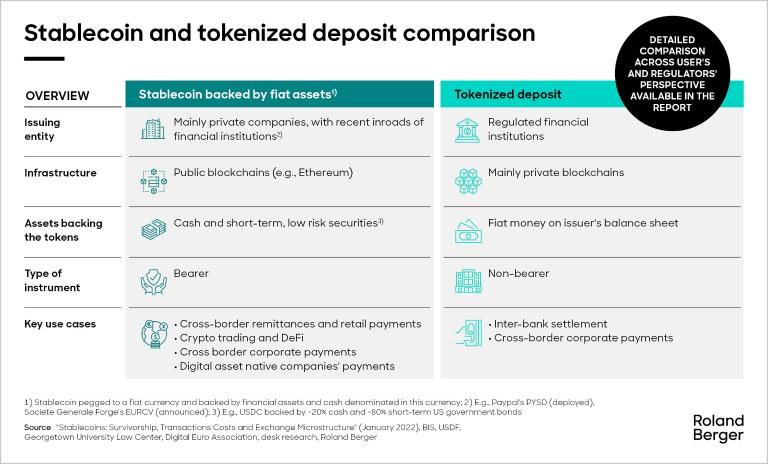

This study explores the evolving landscape of blockchain-based payment rails and their growing prominence within the payment ecosystem.