Automotive procurement has reached an endgame

Moving beyond digitalization: How the function can position itself for a more strategic role

More so than other industries, procurement in automotive has an unprecedented opportunity to reposition itself in the organization as a provider of business insight and foresight.

Procurement as we know it today will cease to exist. That is the extent of the forces that have unleashed fundamental changes in both the function and the automotive industry.

We believe procurement has reached an endgame. It is in a stage of transformation that will change procurement fundamentally, therefore we say “endgame”. That endgame is the culmination of many simultaneous developments.

As a result, procurement has a unique window of opportunity to reposition itself and redefine the value it adds for the business, e.g. by taking on an increasingly entrepreneurial role, acting as a network facilitator and playing a fundamentally new and important part in innovation management.

"By embracing new requirements and technologies, procurement can reposition itself, assume different tasks and provide unprecedented value to the company."

A singular opportunity for automotive procurement

Today, across many industries, companies are facing global megatrends that are changing their businesses forever. Trends include demographic changes, scarcity of resources, and the development of dynamic technology and innovation, to name a few.

In automotive, disruption is particularly fierce due to four key industry trends: new types of mobility, autonomous driving, digitalization and electrification. We call these the MADE trends.

Already, automotive OEMs are working in completely new ways, and this means new methodologies and tasks for procurement as well. On one day, procurement may use agile techniques and sprints to work alongside engineering in product development; on the next, it may be tasked to source embedded software requiring an entirely new set of expertise.

In the future, procurement has the chance to move outside its comfort zone even further to take on whole new tasks as part of its new role. For example, it might find itself negotiating with film studios for content for in-vehicle theaters or with suppliers of virtual reality glasses.

Besides trends, a second reason for the current window of opportunity is new technologies that can be used to gain levels of efficiency not known before and to add new value to the business. Examples include bots to improve the efficiency of purchasing negotiations and advanced analytics for better and more effective demand forecasts.

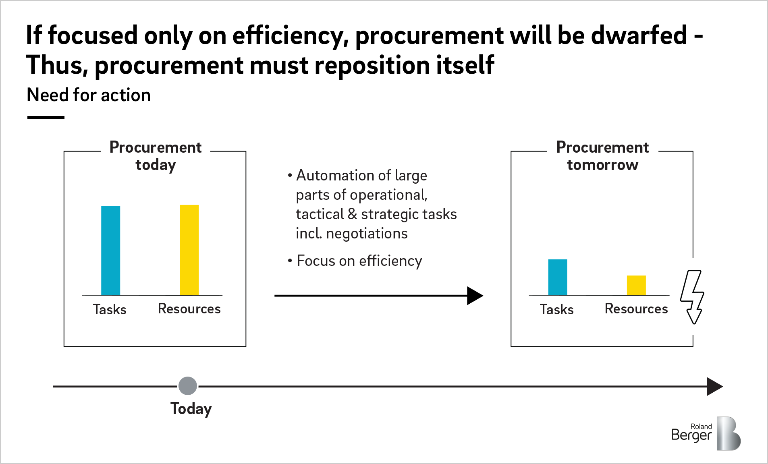

Here it is important to caution that digitalization should not be misunderstood as automation with a focus on efficiency. As Klaus Staubitzer, the Chief Procurement Officer at Siemens AG, has said, "In most companies, digitalization is understood as automation and that is completely wrong". If procurement only focuses on automating its processes to become more efficient, the function will be dwarfed by many others in the organization. Without a repositioning, procurement will wind up drained of resources and responsibilities.

By embracing new requirements and technologies, procurement can reposition itself, assume different tasks and provide unprecedented value to the company. With every bit of sophistication that procurement adds to its processes, it will gain recognition in the organization for all that it can and does contribute.

Here’s an example: Procurement in some industries is using satellite imagery to monitor activities in mines or on fields and draw conclusions about future commodity prices or the upcoming harvest. Companies are doing this to secure better prices, determine an optimal contract duration or manage working capital. (Of course, using alternative sources of data, such as satellite images, has some risks, but some companies may conclude it is worth the try.) This example shows the power procurement has to provide business insights and business foresights.

Given the convergence of megatrends and industry trends, as well as the opportunities to boost efficiency and effectiveness with digitalization, we believe procurement must act now – before the window of opportunity closes and others in the organization take on procurement’s more strategic roles.

"In the automotive industry, procurement needs to find solutions to help it handle new and evolving value chains that may still remain elusive."

How procurement can be a true partner to the business

Procurement has come a long way since the days of faxed purchase orders, but it still has some steep learning curves in front of it as it moves into a more strategic role.

That’s because procurement is in new territory. In the automotive industry, procurement needs to find solutions to help it handle new and evolving value chains that may still remain elusive. For instance, many procurement professionals may not be fully accustomed to purchasing embedded software, payment solutions or entertainment content. Then there’s the matter of securing long-term access to raw materials under different contracting conditions than in the past, such as those needed for cobalt. These are just two examples.

To get a handle on such challenges, and to understand how to use the endgame to your own advantage, automotive procurement can examine the situation through four lenses: the future required performance of procurement; how to create value with procurement technologies; what others in the industry are already doing; and current company-specific pain points and priorities.

Lens 1: What is the future required performance of procurement in automotive?

For the first lens, consider what will be needed from automotive procurement in the years to come. For instance, how will companies buy commodities and services, and what are the new expectations regarding cost and efficiency?

As the industry moves to electric vehicles, the way commodities and services are bought, and which ones are needed, is becoming far more complex than in the past. Companies need to understand the new, evolving value chains, cost structures and pricing models, for instance for sophisticated software solutions for autonomous driving, for embedded software, or for high-tech parts, such as sensors and radar.

They also face complex systems decisions, for instance those about batteries or alternative drives. This is whole new terrain with high uncertainty. It also brings with it higher risks, since some of these items must be bought with very different, and sometimes very long-term, contracts.

Another area of change is the sourcing of content and solutions, e.g. payment solutions, which requires different sourcing strategies and new collaboration models with suppliers. It may even impact the company's revenue models and pricing strategies.

As if that’s not enough, procurement is also expected to deliver cost reductions and efficiency improvements, given the profit pressure in the industry. The pressure has been brought on in part by companies’ need to finance the transition to electric vehicles and digitalization, as well as pressures from large-scale efficiency improvement projects and company-wide mandates to reduce headcount.

All in all, it comes down to this for the required performance of procurement: Procurement must not only do more with less, but it must do a whole lot more with much, much less. Sometimes we call it the “do more with less² imperative.” Emphasis here is on the “squared.”

There’s more. Supply base disruption is right around the corner for automotive OEMs, as production moves to electric vehicles. It is just a matter of time until some components for gasoline-based vehicles are simply no longer available or become too expensive, as automotive suppliers adapt their own product mix for electric vehicles, or some go out of business for not having done so.

The big problem for OEMs is the pain that comes in the transition to electric vehicles as some “older” parts are simply not available anymore, or suppliers go out of business. This is a particularly destabilizing problem for the automotive industry that others are not necessarily facing to such a degree. Procurement will need to manage this transition with all its uncertainty and complexity. That will require new approaches for procurement, which may even involve some M&A.

Finally, another important thing to consider about the required performance of procurement going forward is the need for transparency and new ways of working.

As data volumes increase and networks become more complex, it falls on procurement to ensure transparency along the entire supply chain across the different supplier tiers. In addition, as internal and external business partners adopt new ways of working, like sprints or scrum, procurement will need to follow suit and adopt those ways of working as well. Otherwise, business partners will begin to shun procurement and label it slow and old-fashioned.

"We see a complete re-shaping of value-creation models, real-time transparency across the entire supply chain, a majority of strategic and tactical tasks automated, and full outsourcing of tail-end, non-critical commodity procurement."

Lens 2: How do you create value with new technologies – in procurement and for your business partners?

Next let’s look at the second lens for evaluating how to make the most out of the procurement endgame scenario: the radical technology-based changes we expect to see in procurement across the board, not just in the automotive industry.

Among our many hypotheses, we see a complete reshaping of value-creation models; real-time transparency across the entire supply chain; a majority of strategic and tactical tasks automated; a full outsourcing of tail-end, non-critical commodity procurement (to companies like amazon business); and a smaller procurement team that manages and oversees the system and spends the rest of its time working with core suppliers and focusing on value, availability, innovation and risks.

Of course, no one knows when the scenarios may manifest as usable, doable and affordable solutions (e.g. be mass-market ready). That is unclear. It could be five years. Maybe 10. Or maybe 15.

For some scenarios, companies will need to make an active choice to participate or not. For instance, it is an active choice to say that your company’s tail end spend will be automated by bots. In other cases, the scenarios are set to become reality due to forces outside the control of companies.

One example is the fight for talent. Procurement will need many more data scientists and people with digital skills. It’s simply a fact that this cohort wants flexible work time, workplace mobility, and an aesthetic office environment. Companies only need to determine when the scenario will set in; that it will happen is a given. If they choose to ignore the trend, their recruiting efforts for the best data scientists will get harder.

We have developed more than 25 future-oriented scenarios that companies can use to consider the impact of new technologies on their business and begin adapting as needed.

The scenarios can be put into four categories: disruption of the procurement function, disruption of buyers, disruption of the supply base, and scenarios for disruption of data and systems. Some examples are: procurement as the gatekeeper to the external world; procurement enabled by artificial intelligence; procurement as a generator of value off site; and procurement as an enabler of smart contracts.

By evaluating each scenario and how it does or does not fit into a company’s strategy, companies can get a head start in positioning themselves for the endgame.

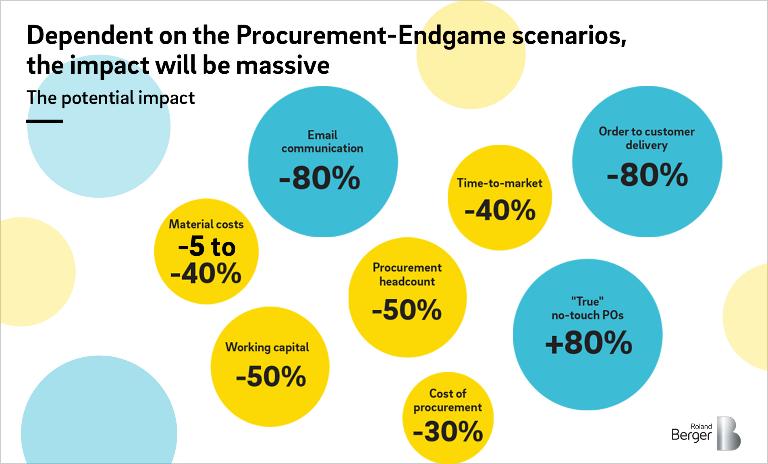

Those companies that manage the procurement endgame in a strategic way have much to gain: Our estimates show the potential of 40 percent quicker time to market, 50 percent less working capital needed, and 30 percent cost savings for procurement.

Lens 3: What are other OEMs doing in digital procurement today?

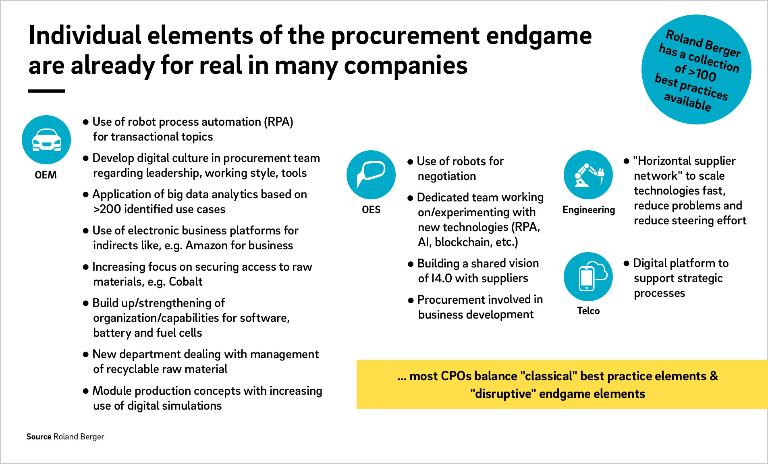

To create the third lens to look through, we worked with clients, conducted research and observed various aspects of the future-oriented scenarios for procurement that are already being tested by automotive OEMs and suppliers.

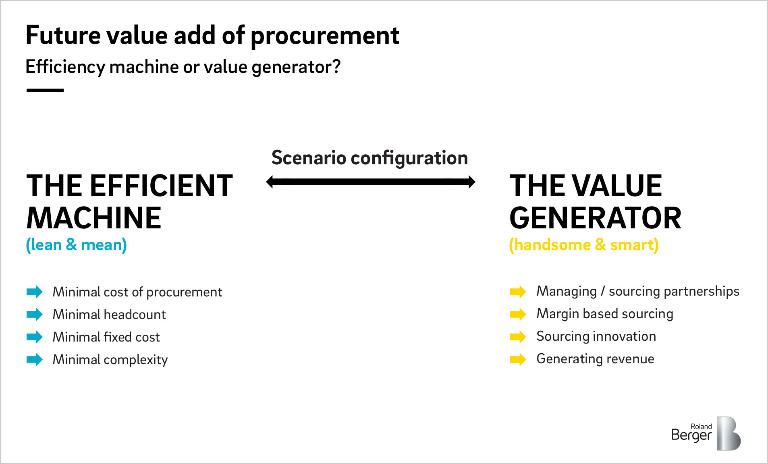

To consider how your company might embrace some of the scenarios, one main point must be clarified in advance: Should your company’s procurement function be positioned as an efficiency machine or a value generator?

Your conclusion should be based on the current requirements of the business. If a company chooses for procurement to be a value generator, then the focus turns to managing and sourcing partnerships, generating revenue, margin-based sourcing and sourcing innovation, for example. One caution here, however. When procurement is a value generator, it must also simultaneously pursue efficiency.

If a company takes the efficiency road, then procurement becomes about being low-cost, with low headcount and minimal risks. In this case, aspects of the future scenarios that support this intention are the best ones to pursue.

The scenarios that are already being tested by OEMs or suppliers fall into three broad categories:

- Governance, business models, processes and roles

- Organization, resources, and skills

- Methods/levers, systems, and tools

One example is procurement adjusting lead time for suppliers to adapt to modular production concepts. This is now possible with the increasing use of digital simulations that enable shorter production-lead and ramp-up times.

Other things OEMs and suppliers are trying: building-up/strengthening of the organization and its capabilities for buying software, batteries and fuel cells, or using apps and advanced analytics to manage supplier risk in partnership with insurance companies. Such apps and analytics allow internal and external information to be used and shared more effectively.

Still others are setting up dedicated teams in digital labs that are charged with working on and experimenting with new technologies such as robotic process automation, artificial intelligence and blockchain. The goal is to test automated supplier negotiations and search for savings opportunities through pattern recognition.

As companies take a closer look at what their competitors are doing, the focus will eventually return to the question of which model for procurement they prefer. If a company knows procurement should be a value generator, then the search can begin in earnest for those examples and models that are a fit with the current maturity of the procurement function, as well as corporate culture and budget.

Lens 4: Where are your current pain points and priorities in automotive procurement?

The fourth and final lens to look through is company-specific, current pain points and priorities. This lens is particularly important for putting into perspective the findings from analyses with Lenses 1, 2 & 3.

In those first three steps of analysis, procurement strategists can paint on a blank canvas and design systems in a best-case scenario, as if technological, organizational and mindset challenges did not exist.

The exercise can even be a lot of fun – e.g. thinking about which mundane tasks can be outsourced to a bot-butler and which processes require technology that is more challenging to set up and operate.

But at some point, reality sets in, and it’s time to consider the particular pain points and priorities that exist today. It’s time to look through Lens 4.

We often say that it’s important to find a balance between the new tools, technologies and trends that will shape procurement (Lenses 1, 2 & 3) and today’s requirements (Lens 4).

Assuming that companies choose the path of becoming a value generator, the roadmap that companies create after going through the four analyses will likely include a large number of steps and measures, perhaps up to 80 percent, that are actually rooted in the evolutionary development of procurement. The remainder will be the crazy fun stuff that might make procurement look like a command central.

In some companies, the ratio may be 70/30 or 60/40, but the point is that companies need to bring Lenses 1-3 down to earth by considering today’s evolutionary reality via Lens 4. In other words, you need to push the boundaries with creative applications in procurement, but companies also need to anchor that in what’s possible today and recognize that a large part of being a value generator is also improving efficiency and effectiveness.

Conclusion

As stated, we believe that procurement in general, not just in the automotive industry, is in an endgame phase in which it must transform itself into a more strategic partner for the business. If it does not, it will be dwarfed and drained of resources as automation takes over.

In automotive procurement, the MADE industry trends (mobility, autonomous driving, digitalization and electrification) are making the whole transformation process more difficult and more urgent.

That’s why we say now is the time for automotive procurement to act and claim a new role as a strategic partner for the business.

The window of opportunity is still open for those who act now.