Roland Berger's study "Future of health 4" examines tomorrow's patients – their attitudes to innovation, trust in healthcare participants and willingness to pay.

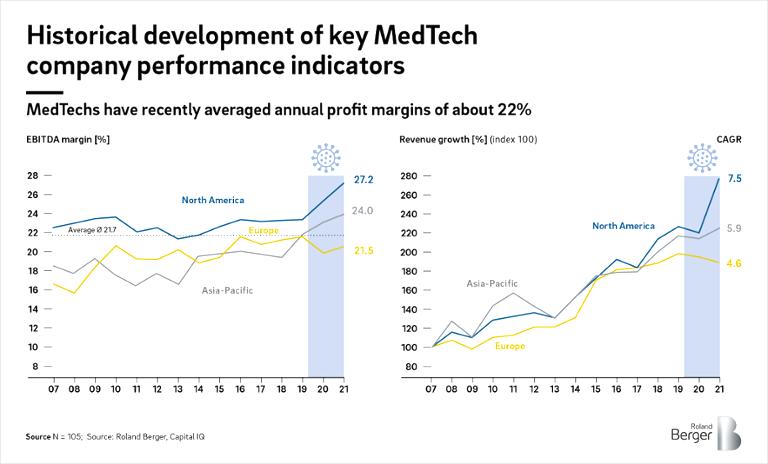

Can the MedTech sector keep outperforming?

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/Roland_Berger_INS_INS_921_Global_MedTech_DT_download_preview.jpg)

The Roland Berger Global MedTech Report 2022 shows that medtech "winners" are highly profitable companies with strong growth and on average invest more in research and development than "underperformers". Winners are significantly more efficient in capital allocation and had on average twice the market capitalisation of underperformers. Medical technology companies from the USA are thus the most profitable, which is mainly due to better access to the lucrative US market.

![Financial performance matrix MedTech [2018-2021]](https://img.rolandberger.com/content_assets/content_images/captions/Roland_Berger_INS_INS_921_Global_MedTech_GT_02_image_caption_none.jpg?v=770441)