Energy markets in Europe and around the world are still reacting to the tragic conflict in the Ukraine.

Military conflicts and energy security

Four steps for reducing energy costs and stabilizing supply at a time of war

Could decarbonization and the switch to renewable energy be the key to ensuring supply security and energy independence for Europe and other OECD countries? As European countries scramble to wean themselves off their dependence on Russian oil and gas, we believe that the longer-term goals of diversification of the energy supply and decarbonization are not in fact mutually exclusive.

The Russian invasion of Ukraine has sent shockwaves through energy markets, massively accelerating the increase in fuel prices already triggered by the Covid-19 pandemic. Besides inflationary pressure, the war in Ukraine has also brought to the fore the question of overall supply security and Europe's energy dependence on Russia. In this article, we summarize our analysis of industries most affected by sanctions and conflict. We then suggest four practical steps that corporations can take to reduce energy costs, manage stability of supply – and reconcile immediate energy security concerns with longer-term efforts to achieve decarbonization.

Predicting the unpredictable

Multiple scenarios exist for how the current military conflict in Ukraine will evolve. Coming on the heels of the Covid-19 pandemic, the war – besides its horrendous human cost – has placed businesses in a position of great uncertainty. What is certain, however, is that price and supply turbulence will continue, driven by geopolitical factors. Companies, and particularly energy-intensive players, face serious risks due to the high cost of energy and supply disruptions. Governments and their regulators must also make choices with regard to the impact of the war in Ukraine on the transition to renewable energy and the resilience of the energy system – as we discuss in our recent publication War in Ukraine: Lessons for managing the energy transition .

In a way, however, what is happening today is nothing new. Over the last 50 years, commodity price shocks have largely been driven by military confrontations – the Yom Kippur War, the Iran-Iraq War and the 2003 invasion of Iraq. Similarly, the war in Ukraine has resulted in the largest hike in fuel prices in a single year since the 1970s. Continuation of the conflict and the risks of further sanctions against Russia will drive volatility and add further premiums to the price of fuel.

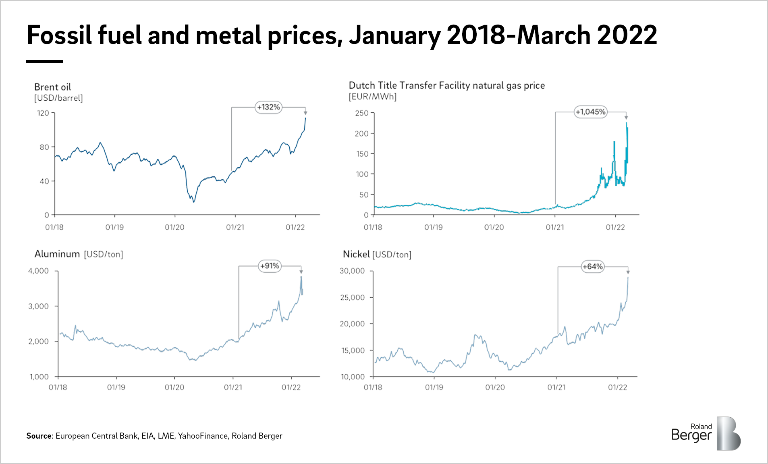

Military conflicts and commodity prices

The current conflict follows the Covid-19 pandemic – a "black swan" event, or outlier event that comes as a surprise to most observers and has a disproportionate impact on the economy and society in general. Between January 2021 and March 2022, the price of crude oil more than doubled, beating all forecasts. Gas prices in Europe saw an even greater hike, increasing tenfold over the same period. The rise in the gas price was driven by economic recovery from the initial Covid-19 crisis, followed by supply constraints for liquified natural gas (LNG) and reduced European production. This led to an inability to restock gas storages in 2021. The outbreak of war in Ukraine triggered a further significant price surge.

Metal prices have also increased sharply, driven by fears of supply shortages due to sanctions. Russia's significant share in the world supply of aluminum and nickel – the latter a major input metal for electric vehicles (EVs) – means that sanctions have provoked a major shock to current prices. Continued geopolitical turbulence is likely to drive further price rises, including for agricultural commodities.

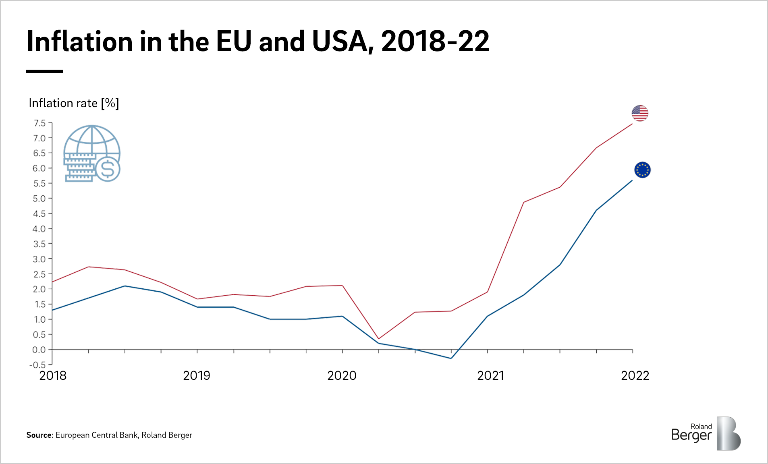

At a national level, rising energy prices are a major factor in inflation and overall increases in the cost of living. For this reason, ensuring price stability for fuel and metals is becoming a top priority for most governments in their attempt to combat the inflationary cycle.

Reducing dependence on Russian fuels

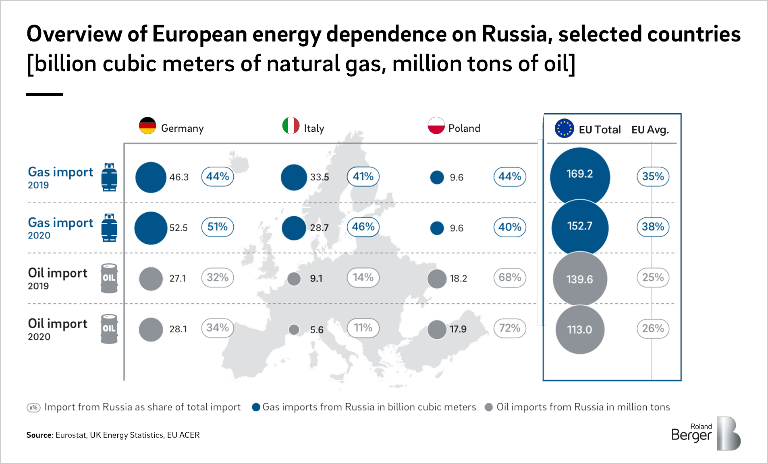

Inflationary pressures and rising costs driven by high commodity prices are not the only thing worrying governments. Another major concern regarding the ongoing war relates to security of supply. Over the last two years, the energy dependence of European nations on Russian oil and gas has actually increased: for gas, Russia's share of total EU imports has grown from around 35 percent to 38 percent, and for oil from around 25 percent to 26 percent. In the case of some major economies, including Germany, Russia's share of imports is even higher.

Following the Russian invasion of Ukraine, Western countries imposed sanctions on Russia. These have impacted both the sales markets and the supply chains of Western companies. Although sanctions targeting Russian fuels are being considered – specifically restricting imports of oil – EU countries in particular still rely on Russian energy products and have not yet joined the US embargo on Russian oil and gas. This may change in the future.

Government response: supply diversification and decarbonization

In response to the severe supply risks associated with dependence on Russia, many Western governments are now prioritizing diversification of the energy supply. This has led to the observation by some analysts that the goal of rapid diversification could to some extent undermine the decarbonization efforts of recent years.

We suggest taking a longer-term view. We believe that while the emergency situation has shifted some priorities in the short term, the longer-term goals of diversification of the energy supply and decarbonization are not in fact mutually exclusive. Indeed, the two goals may actually be synergistic: decarbonization could be the key to ensuring supply security and energy independence for Europe and many other OECD countries. Thus, if the European Union meets its target of 27 percent renewables in final energy consumption by 2030 and fulfills its objective of reducing CO2 emissions by 80-95 percent by 2050 compared to 1990, it will make itself significantly less dependent on Russian oil and gas in the process.

Achieving the dual goal of energy independence and decarbonization is not an easy task. It requires a concerted effort by key stakeholders such as government ministries, the central bank, major energy companies and financial institutions such as banks, insurance companies and so on.

Some of the areas of a unified government response are improving preparedness for potential sanctions on fuel imports from Russia, "nearshoring" oil and gas (in other words, increasing domestic and regional supply), increasing oil and gas storage obligations, improving the physical security of strategic reserves, and boosting the resilience of energy systems. In parallel, such a response should include pushing decarbonization as the key to the energy transition, fast-tracking renewable and low carbon projects, and providing regulatory and investor support for the energy transition.

What can corporations do?

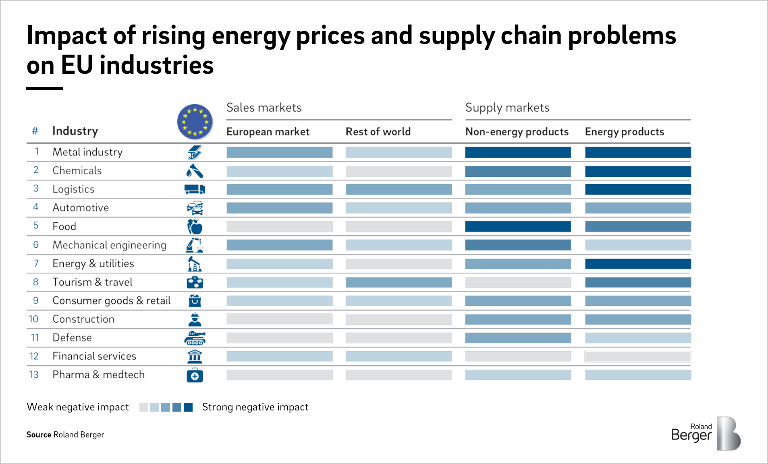

At times of heightened market turbulence, companies with significant exposure to energy markets face an array of difficulties. The Roland Berger Ukraine Taskforce analyzed the potential implications of the war on European industries.

In general, European markets are negatively impacted by decreasing consumer confidence and increasing prices. Problems range from subdued profits due to higher energy costs and difficulties in planning business operations, to commodity price fluctuations and potential production stoppages that can lead to contractual penalties. Businesses must also deal with challenges such as customer and revenue losses , and frequently also disruptions to their supply chain due to logistics bottlenecks or sanctions.

We expect numerous European industries to be strongly impacted by rising energy prices and problems in the supply chain, as shown in the graphic below. Manufacturing, energy-intensive and carbon-intensive industries will be strongly affected by supply issues in both energy and non-energy products.

Exports to the rest of the world remain largely unaffected, as economic growth in the rest of the world is not heavily affected by the conflict, while a weakening euro may boost the competitiveness of European export goods.

Companies can take a number of actions to ensure their own agility, reduce their energy costs and manage their fuel supply security. We suggest implementing the following four steps, in the order presented below. This four-step program can be an add-on to broader optimization and decarbonization projects – an additional "energy security" component – or a standalone project aimed at reducing energy costs and improving supply security.

#1 Energy resilience check-up

Companies should identify any potential energy security risks to their operations resulting from disruptions to the supply chain, assess possible geopolitical risks and identify which of their business units are most vulnerable to energy price hikes in the short to medium term, and commodity price volatility in the longer term.

#2 Supply security radar

The next step for companies is to carry out scenario planning for potential sanctions on Russian fuel imports. Larger corporations should try to build up their own safety stocks, while players of all sizes should look closely at the possibility of future supply chain disruptions and increase their preparedness for unexpected events.

#3 Roadmap for energy fitness

Third, companies should draw up a list of energy-cutting "quick wins" – short-term, easy-to-implement actions that reduce energy consumption within the firm. They should complement this with a longer-term plan for reducing energy costs across the entire business.

#4 Updated decarbonization strategy

Finally, companies should identify key emissions drivers throughout the organization. With the help of the roadmap for energy fitness (Step #3), those parts of the company that are most suitable for a fuel switch to renewable and low-carbon sources should be identified and an optimal path to decarbonization developed, based on industry know-how. The emphasis should be on supply de-risking and energy independence.

Conclusion

Military conflict, geopolitical turmoil and black swan events create massive uncertainty and unpredictability. However, it appears clear that the cost of energy and security of supply will remain high on government and corporate agendas for months and possibly years to come. For companies, the key to building greater preparedness for unexpected events is not trying to predict the unpredictable, but rather drastically increasing energy fitness and agility throughout the organization. For governments, the good news is that the dual objectives of diversifying energy supply and decarbonization may not be as contradictory as they first appear.

Sign up for our newsletter and get regular insights on newest publications related to Energy & Utilities.

_tile_teaser_w425x260.jpg?v=770441)