The automotive world is experiencing unprecedented change. By 2040 the industry will be polarized, automated, connected and electrified – or PACE, for short.

A turning point for automotive SMEs – New paths to growth beyond automotive?

By Felix Mogge, Thomas Schlick and Matthias Nagl

Findings of our new SME study: Automotive suppliers in the DACH region are targeting diversification – especially in the defense sector

This latest edition of Roland Berger’s SME study shows that day-to-day business of SMEs (small and medium-sized enterprises) in the automotive supply industry is still shaped by massive price and competitive pressure. Price pressure, cited by 66% of respondents, remains by far the most serious challenge. At the same time, the question of where players in this industry might turn to find fresh growth is gaining ever greater urgency.

"New areas of growth should and must be seized, if only to make better use of capacity."

For six out of ten respondents, the lack of growth prospects ranks among the top issues on their management agendas. Three out of four suppliers see diversifying their business portfolio outside of the automotive sector as the most promising option. For 46%, this is indeed the best way to penetrate new areas of growth. Nearly a third hope diversification will help them make better use of available capacity.

Similar technologies and capabilities make suppliers attractive partners

The view taken by nearly two thirds of the c. 200 managers surveyed for the study across Germany, Austria and Switzerland is that the defense sector appears to offer the best prospects for tapping new revenue sources.

This clear leaning toward the defense sector can be explained in part by rising defense budgets as a result of geopolitical tensions that have been heating up for years. Since planned investments significantly exceed the capacity currently available to companies in national defense sectors, the obvious course of action seems to be to draw on capacity in civilian branches of industry to fill the gap.

"Going forward, vital capacity seems to be lacking in the defense sector. Thanks to highly industrialized operations, midsized automotive companies can provide optimal support in this area."

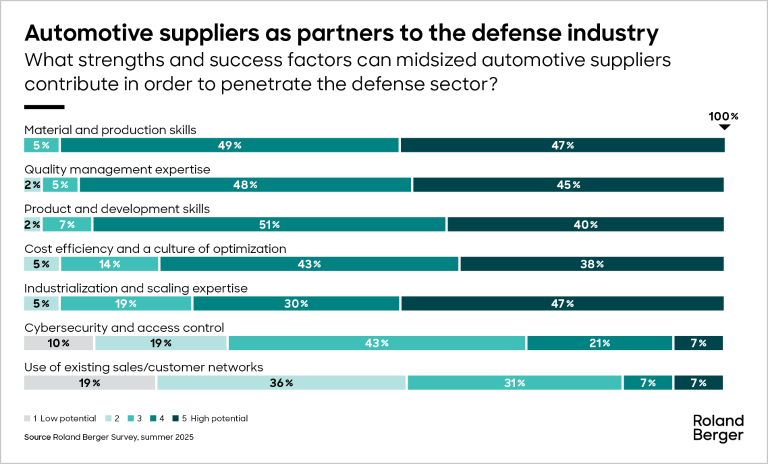

A second reason for the positive expectations in the defense sector is the technological similarities that exist between the two industries. Suppliers already possess compelling capabilities in fields such as sensors, and systems integration, for example. Material and manufacturing skills likewise position midsized automotive firms as attractive partners, as does their quality management expertise.

As far as products are concerned, one focus could be on mass-produceable software-defined defense systems. These are needed at affordable prices, in compliance with the given requirements and in large quantities. The study participants also see viable entry opportunities in electronic and mechanical components as well as modules for drive systems and power supply units.

Turning point: New opportunities for midsized automotive players

To step into the ring successfully, the experts at Roland Berger believe that civilian companies must now make systematic use of the opportunities that present themselves. Depending on their level of ambition and available funds, new suppliers from the automotive industry could conceivably assume a variety of roles: from pure-play production partners to a (co)-leadership role in defense programs.

Sign up now to download the full "SME automotive 2025 study" in German on SME automotive suppliers in the global competitive landscape. You will also receive regular news and updates, delivered straight to your inbox.

_person_320.png?v=770441)