Is this the last chance for a European payment scheme?

Europe will only achieve relevance in the payment sector with a joint approach that supersedes individual interests

Few areas within

financial services

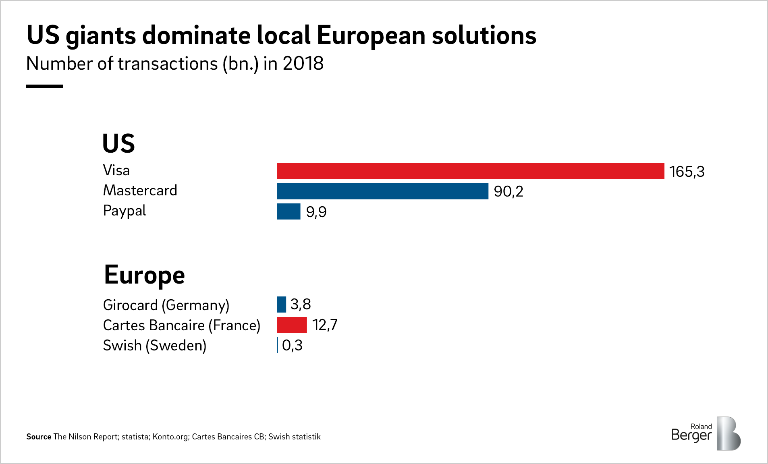

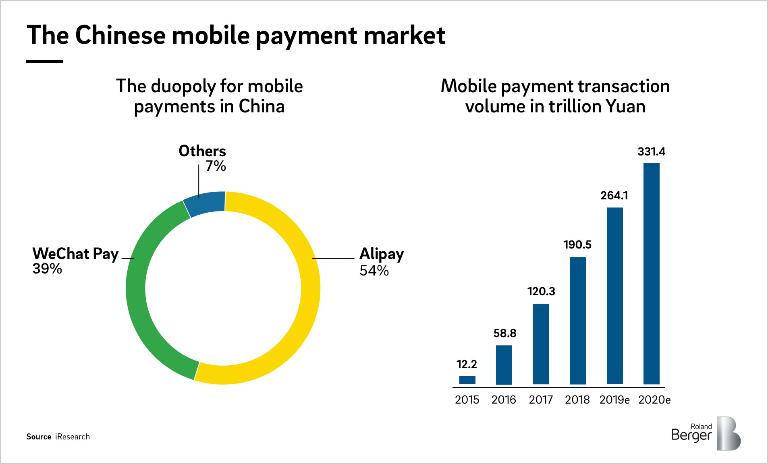

have seen such disruption as the payments sector: Within just a decade, the likes of Alipay and WeChat Pay were not just able to build a duopoly for mobile payments in China, but managed to create entire ecosystems around their payment solutions. In the meantime, US tech giants have made a similar push and successfully established their offering beyond US borders, with PayPal and ApplePay being key examples. And Europe? Here, the focus has so far been mostly limited to local solutions such as Swish, iDeal and the German Girocard, now coming of age – and time is fast running out before the Europeans' literal share of wallet is captured by global players. If Europe wants to stay relevant in the payment sector, a joint approach across national borders is required that supersedes individual interests.

In the end, the most important question payment players as well as governing bodies must ask themselves is: are we willing to fight and compromise to create a powerful pan-European payment solution, or do we yield to the non-European competition? In our view, there is no in-between – and given the obvious importance of payments, the answer to this question should be very straightforward.

The focus of European payment innovation has historically been strongly tilted towards national solutions, or towards solutions covering certain regions such as the Nordics or Benelux at most. And some of these solutions were actually very successful: take Swish or iDeal for example, innovations which have been game changers in recent years and have been able to keep US-based competition out of the market. Despite being around for some time now, the Girocard in Germany adds to the list of successful national solutions, where banks were able to agree on a common objective and successfully executed the rollout of the product.

The lack of serious European competition in the global payments market could be seen as a normal consequence of market forces at play. On the other hand, payments are much more than just the technicality of transferring money from one account to another: payments are the daily interactions of a client with its bank, a treasure trove of personal data – a sensitive subject in Europe in particular – and ultimately a key client interface for banks. They are also an extremely effective glue to keep an ecosystem together, even if the system consists mainly of non-financial services products, as demonstrated convincingly by WeChat Pay and Alipay.

Time-to-market is key as customers will be locked into ecosystems

Europeans should think twice about giving the payment market up to US or China based offerings without providing an alternative. The stakes seem too high. Hence, it is no coincidence that the subject of a European payment scheme has been at the heart of industry discussions lately. From the European Central Bank to the national equivalents as well as leading banks across Europe, serious conversations and activities have been initiated to evaluate the possibilities for a European payment solution. Be it the German "#DK" or X-Pay initiative, which aims at standardizing and bundling payment methods at least on a national level, or the exchange between French and German banks, it is apparent that an increasing number of industry leaders are sensing that this might well be the last chance to establish a European alternative. But it will have to be a true and viable alternative, stemming primarily from two main pillars: acceptance across national borders and a value-added solution for consumers. Furthermore, fast time-to-market will be crucial as the market is already being carved up.

Time-to-market is of utmost importance because the more strongly customers are locked into an ecosystem, the more difficult it is to convince them to use an alternative. And with ApplePay and Google Pay rapidly gaining popularity in Europe, time is running out fast. Cross-border standardization will be necessary to achieve meaningful economies of scale. Only a pan-European solution that is accepted in the largest European countries will achieve the kind of scale that can eventually build up a convincing alternative ecosystem. And of course, competing with the investment power of big tech companies is only feasible by joining forces – single banks will simply lack the necessary resources.

Individual strengths of institutes and nations must be combined

To achieve a truly pan-European solution, individual interests, both on a company and a country level, have to be subordinated – even if that means partly cannibalizing today's profits. The strengths of institutes and of nations must be pooled – for instance combining the innovation power of Scandinavians with the sheer size of the market in Germany or France. Emphatically pursuing such a project will depend on the right governance: rather than having to operate within complex governance structures, the European scheme needs to be able to act on the same playing field as its international competitors. While this comes at the cost of not being able to discuss and compromise on each and every detail of a solution, it represents, in our opinion, the only way to successfully launch a payment solution under the given time pressure. And as the largest countries, it is vital that Germany and France become the driving forces of a European payment scheme.

In the end, the most important question payment players as well as governing bodies must ask themselves is: are we willing to fight and compromise to create a powerful pan-European payment solution, or do we yield to the non-European competition? In our view, there is no in-between – and given the obvious importance of payments, the answer to this question should be very straightforward.