The white goods market

Despite years of robust profits, the white goods market is undergoing dramatic change. As a result, players in the industry, particularly mid-sized companies, are facing massive challenges. Many manufacturers were long successful with their strategy of "engineer for eternity, build production scale and leave selling to retail". But those times are over.

Instead, the wave of competition is growing, especially for smaller brand European manufacturers. While these firms are struggling with falling margins in saturated markets, their R&D budgets might not be sufficient to withstand the growing presence of large Asian players that have been able to significantly expand their position through strong growth in their home markets and strategic acquisitions. The ten largest suppliers - the majority of them Chinese and Korean – already dominate 63 percent of the global market.

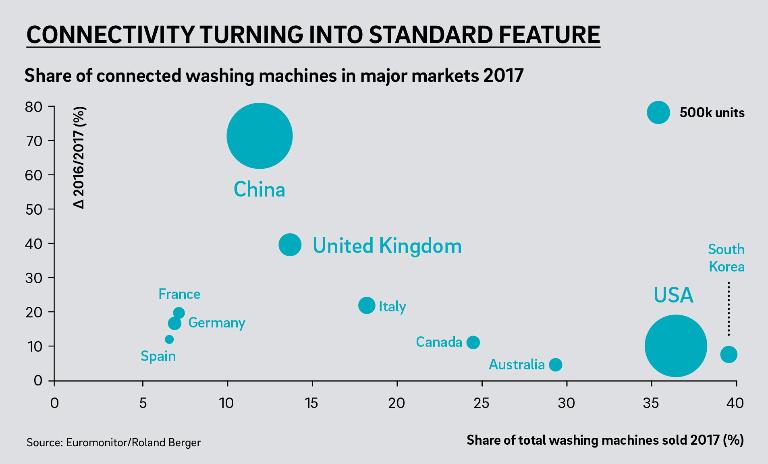

How do Western brand suppliers get back on the offensive? A successful future has two key requirements: connectivity and consumer marketing.

Of course, controlling domestic appliances from a smartphone, tablet or computer is simple, fun and convenient. But connectivity is much more than another feature for the customer – it's also an important new source of information for manufacturers. The data they receive can foster a deeper understanding of and closer interaction with customers. The result is attractive opportunities for new business models and sources of revenue. Take washing machines: manufacturers can now provide these on a pay-per-cycle basis, where customers pay only for the actual use of a machine instead of owning one. And customers don't need to buy their detergent at supermarkets anymore but get it delivered automatically by the maker whenever the machine signals a lack.

Connectivity also offers greater opportunities for customer acquisition and retention. The appliance itself provides information about its correct installation or efficient usage. In addition, even difficult maintenance becomes much easier; required replacement parts can be delivered much faster. This not only benefits the customer, but also manufacturers. Each purchase, use or repair of a household appliance generates important data, helping manufacturers better understand their customers, provide higher quality services and more targeted products. This is a key advantage, especially in today's highly competitive market.

Download the full infographic here .

At the same time, this data provides the basis for a new marketing and sales model, which brings us to the second keyword, consumer marketing. Anyone who relies mainly on retailers as a central sales channel, will likely lose out in the future. Even large household appliance manufacturers need professional consumer marketing. The automotive industry and the multimedia equipment sector are leading the way in this regard.

Many manufacturers already have data on customer behavior and preferences through after-sales contacts. However, accurately using this type of data for more reliable sales forecasts, better customer segmentation or for more targeted campaign planning is new territory, at least for most mid-sized manufacturers.

Who doesn't want to lose out to the competition, needs to take action now. The future has long since begun. By 2022, connected white goods will be standard. For innovation leaders, however, the cash register is ringing: connected appliances are still around 15 percent more expensive.