New mobility: The radical transformation of an industry

Global mobility trends and emission requirements will bring unknown challenges for the automotive industry – an interview

How will people get around in the future? Will the electric scooter banish cars from city centers and air taxis transport us to our destinations in the future? These are all questions that concern not only cities and transportation providers, but automotive industry players as well. In this rapidly changing world of mobility, it is crucial to identify trends at an early stage to keep the industry itself moving. Alternative drive technologies, digitalization and autonomous driving are some of the developments that herald new challenges, but also bring new market opportunities. Fast movers have a clear advantage here.

Norbert Dressler is a Partner in the Automotive Competence Center at Roland Berger in Stuttgart, where he specializes in the commercial vehicles, construction and agricultural machinery industry. In particular, he is committed to mapping current and future developments in the industry , with his findings appearing regularly in Roland Berger studies.

"If any industry players haven't yet formulated a goal or made a plan for their transformation in the coming years, it may well be too late to do so now."

Mr. Dressler, the automotive sector is in the midst of a radical transformation. Where do you foresee the greatest challenges for the European automotive industry?

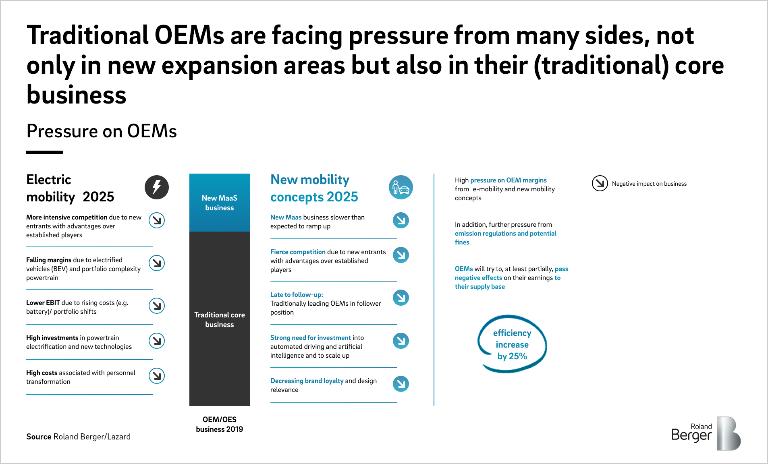

The industry has been battling declining production volumes since 2018. The current situation is not comparable with what happened in 2008/2009 but it does show that suppliers who have relied solely on volumes going up and up can quickly get into trouble. Whether the market will recover in 2020 or later depends to a large extent on developments in China and how quickly political crises can be resolved. The real automotive crisis is the scale of the change brought about by global megatrends , which is only going to gain momentum. This transformation will be very long-lasting and bring challenges never before seen. One example is the move from ICEs to electric powertrains , which forces OEMs to operate parallel production structures, at least for a certain time. That is very costly. And OEMs and suppliers still have to invest in innovative mobility strategies if they don't want new players like Uber coming in and taking their market share. All of these investments are strategic in nature and many won't pay off until after 2025. The new services take longer to get established and start bringing in a profit. Not to mention the fact that the business with electric vehicles – even if you don't consider the cost risks associated with the batteries – is going to be a lower-profit business initially, because the production costs are even higher than they are for conventional vehicles.

You mentioned a number of trends driving the transformation. What are they?

There are four main megatrends: new Mobility , Autonomous driving, Digitalization and Electrification. We call them the MADE trends, partly because you can't necessarily delineate them cleanly from one another and they also mutually reinforce each another. What is for sure is that they are changing the way in which people access mobility, today and even more so in the future. So of course these trend are affecting the automotive industry, its market and its business models. We regularly publish our Automotive Disruption Radar to map the developments that are going on here, zooming in on the relevant figures, data and facts. With every new edition we release, we are struck by just how fast things are changing and how great an impact the transformation is having on the automotive ecosystem! It's not just the "classic" OEMs that are affected – OESs are heavily impacted as well, as our latest Global Automotive Supplier Study shows. In short, if any industry players haven't yet geared up for the automotive transformation, it may well be too late to do so now.

In which of the MADE trends is there still the most work to be done?

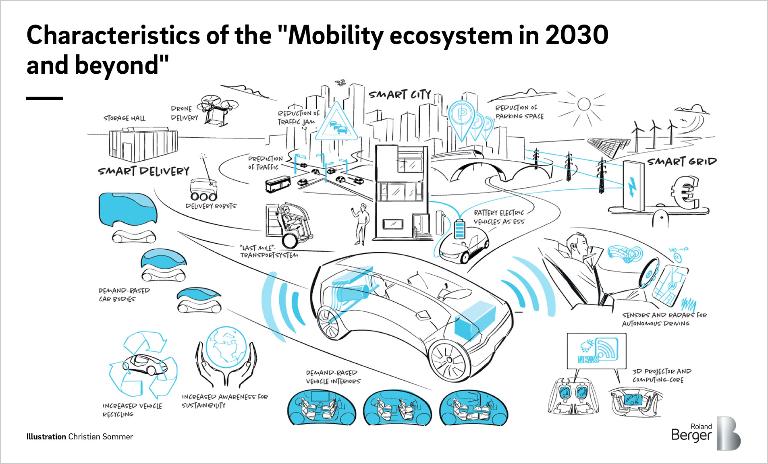

It's not the same for all companies. Some automakers are pretty far advanced on digitalization, many could even be called pioneers – and not only in their own industry. That said, the automotive sector still has many a development to come that others have already gone through, like the retail sector with e-commerce, or the media industry. But there's no doubt that it's not just the car industry that will need to address the new mobility situation. Cities, transportation providers and other players are all affected – just look at the number of alternative mobility offerings like car sharing, ride sharing, ride pooling as well as micro-mobility services like bike or electric scooter sharing that are already established in many of the world's metropolises. Other offerings are almost ready to take off, too, such as air taxis, where there's a real battle going on to be the first to market . In order to develop a working system of urban mobility for the future, we need integrated strategies that combine all of these mobility offerings with each other and with the public transportation network. If Germany doesn't want to get left behind, carmakers, city authorities, power utilities and a lot of other companies will need to massively up their level of commitment.

What does that mean for business models in the automotive sector? Should firms be looking at strategic partnerships, say with new mobility providers?

If the transition to a new mobility is successful, we will see fewer cars, especially privately owned cars, in our cities of the future. That will naturally have a direct impact on the OEM and OES business model, which is of course centered on the sale of cars. So some OEMs are already working on new business models in the mobility space in an effort to develop new markets. But they often find themselves in a sort of unfair competition with startups, which are often faster and more agile because their financial backers are happy to invest huge amounts of money, confident in the belief that they will be one of the few providers to make it onto the market in the end. A carmaker is not always going to be able to survive such cut-throat competition. That is why it absolutely makes sense – and is indeed imperative – for OEMs to engage in strategic partnerships if they want to have a role in future mobility strategies long term.

On the other hand, new mobility also heralds new opportunities for the car industry. There is, for example, growing demand for vehicles that are specially designed and laid out for mobility services, with a particular focus on the needs of the passengers instead of just the driver. In our study on purpose-built vehicles we calculated that the global market volume for these vehicles is set to grow to five million a year by 2030.

So what must companies do to be a winner in this transformation?

Even though the mobility transformation certainly does not spell the end of Europe's most important sector of industry, it may well hit companies hard. So they need to take fast and decisive action. There is no one-size-fits-all solution, because every company is coming at it from a different starting point. But there are certain approaches that we recommend for all. These include performance programs specially focused on the transformation – the radical change that will be required calls for deliberate steps to navigate the challenge, and these need to be backed by all of the company's stakeholders. Without a radical rethink of current structures, core competencies, product portfolios, complex decision-making structures and production capacities, and without intensifying efforts to digitalize their business, OEMs and OESs will find it hard to survive the growing pressure on margins in the coming years. Industry players also need to be building up targeted expertise in areas that promise success in the future, such as the digitalization space. To do that they will need people with the right skill set – and this is a factor that will become ever more important going forward, so it needs to be incorporated in companies' strategic plans. That said, it's not always necessary for every company to have every skill in-house: when it comes to developing new and profitable business models, it often makes more sense to engage in partnerships or risk capital investments, partly for the opportunity to exploit the innovative power of startups. And finally, clear communication is important in getting the workforce on board and feeling good about the transformation. As is so often the case, the right leadership is the key to success, as it's management that creates the right culture within the company to support future-oriented ways of thinking and acting within the organization.