Covid-19 highlights automotive industry's structural deficits

By Felix Mogge

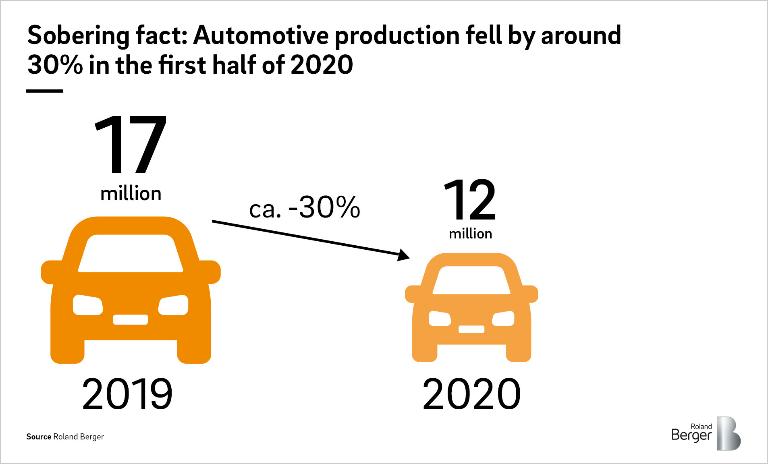

Historic slump forces OEMs and suppliers to rethink strategy

"We're talking about the most dramatic decline the industry has seen in decades"

Covid-19 has caused the global economy to nosedive to unprecedented levels. The automotive industry finds itself no less hard hit – with all segments affected, from OEMs to dealerships to the automotive supply trade. Indeed, suppliers can expect EBIT margins of 0 to 1 percent at most this year. And still there is no let-up in the transformation pressure facing the sector. The Covid-19 situation is putting the industry under a magnifying glass, making so many of its shortcomings and structural deficits all the clearer. But suppliers should also take the crisis as an opportunity to address issues that would otherwise have been kicked into the long grass.

Results for the first half of 2020 make sobering reading for automotive bosses. While Europe's automakers built 17 million vehicles in 2019, the total for 2020 is set to come in some 30 percent lower, at 12 to 13 million. As things stand, we can expect just 70 million vehicles to roll off the production lines worldwide this year. And that means a massive drop in business for automotive supply firms. Whereas these industry players saw EBIT margins peak at over 7 percent in 2018, this year's margins are unlikely to exceed 0 to 1 percent. Even during the financial crisis of 2008/2009, supply firms were averaging 2 percent in their EBIT margin. In 2020 that's unlikely to be bettered.

"Covid-19 is having the effect of accelerating many of the changes the industry is already living through."

Cost cutting all round

A fast recovery for the automotive industry in the form of a V-shaped curve is relatively unlikely on a global level, in our view. Whether it ends up being a U-shaped or an L-shaped recovery is hard to say at this point in time. But the crisis is eating into the big suppliers' balance sheets. Mid-sized firms face even greater danger and for them it makes sense to avail themselves of short-term loans, perhaps also turning to some of the government aid that's on offer. But any loans taken out now will need to be paid back in two or three years' time. To be able to shoulder this burden, firms need to reduce costs all round. And make decisions about their future business model: Should we redefine our strategy and invest in new technology trends – with all the associated risks? Or should we go on doing what we've always done in a business model where we have a solid competitive edge? In this current crisis, companies can no longer afford to put off these fundamental decisions. They must set themselves on the right path and align their organization to suit the decisions they make.

The industry will look very different three years from now

Covid-19 is having the effect of accelerating many of the changes the industry is already living through. As well as being shaped by the state of the economy as a whole, the type of transformation the sector will experience and the speed of the changes depend very much on the prevailing politics. We therefore believe that a greater degree of regional focus will find its way into the supply chains. But we don't foresee manufacturers reshoring everything on a grand scale. At the end of the day, globalization is also a matter of economics. So supply chains might get a bit shorter here and there, becoming consolidated in one or more geographic areas, but that will be because firms feel a strategic need for more flexibility – so that they can act fast in a crisis.

Where we might see some growth impetus is in electric mobility, driven by initiatives at EU level and also national subsidization programs like Germany's. Given that some countries like the United States are making decisions that go in precisely the opposite direction, it's hard to predict how these trends might ultimately evolve.