How carmakers will profit from China's relaxed ownership rules

A changed playing field for foreign OEMs

China is gradually opening up the world's biggest car market. We analyze how the recent move to scrap limits on foreign ownership of automotive JVs will affect OEMs.

China surprised the global automotive industry recently by announcing it will scrap limits on foreign ownership of automotive ventures, in a major policy shift designed to open up the world’s biggest car market. So far there's been only a muted response from OEMs, indicating major producers are in no rush to change the status quo, but there are several key areas in which we expect a reaction.

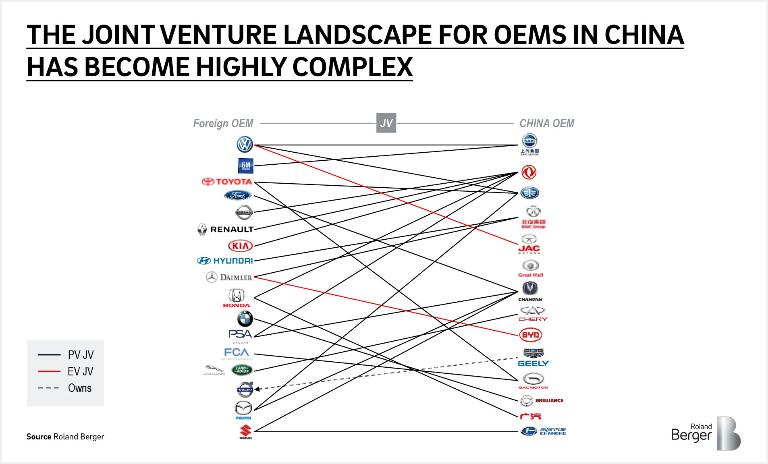

China imposed ownership restrictions in 1994, limiting foreign OEMs to a 50 percent share of any local car producing venture. The protective policy was intended to help domestic carmakers compete, and has resulted in a complex web of partnerships between foreign and local producers. In a possible reaction to simmering trade tensions, Beijing in April flagged it will remove foreign ownership caps for companies producing fully electric and plug-in hybrid vehicles in 2018, for makers of commercial vehicles in 2020, and for passenger vehicles by 2022.

Many of the world's biggest car manufacturers have flourished under the joint venture requirements. Volkswagen and GM, for example, each build around 4 million vehicles in China together with their respective local partners, with both sides profiting handsomely from the arrangement. These and other multinational OEMs who are satisfied with the performance of their Chinese JVs will take their time with any changes to ownership structures.

Window of opportunity for suppliers

However, gaining independent access to domestic suppliers' parts can remain challenging for foreign OEMs. Over time, falling import tariffs should even the playing field, with imports being a realistic alternative for some parts categories. If nothing else, pricing discussions between JV partners are likely to become much more complicated over the near term.

Furthermore, suppliers – or OES's – with strong battery electric vehicle powertrain offerings now have a window of opportunity to move from tier1 to actual OEM status. Of course, this is not easily done across the traditional range of passenger vehicles, considering the steep challenge of building a consumer brand and retail outlets with sufficient density, and service points.

Another area earmarked for change is car dealerships. Over the past years, the dealer networks have quickly grown across China in terms of sales volume. However, in many cases the profitability of dealers has suffered from the initial investments required to build these networks. The result has been decreasing willingness to invest in car retail. That said, investors remain keen to pour money into dealerships for premium brands rather than domestic ones. This could lead to foreign OEMs reconfiguring retail networks, should they opt to look at working outside traditional OEM JVs.

That takes us to the opportunities lying in e-commerce, where major mobile payments providers are moving into lending and financing. Foreign OEMs could benefit from the trends by offering direct car sales with online financing options. An additional advantage of this approach would be that it gives foreign OEMs the ability to take more ownership over brand management and positioning.

Next steps in opening the market

In another important step towards opening up the world's largest car market, China announced in May that it will cut import tariffs for most vehicles to 15 percent from 25 per cent, effective July 1. Import tariffs for auto parts will also be reduced, to 6 percent from mostly around 10 percent. The move is seen as beneficial to overseas OEMs as it should help them close a price gap on locally made vehicles.

So what are the likely next steps in China's opening up of the car market? Considering the relevance of the sector in Beijing's industrialization plans, we can expect both ongoing liberalization as well as continued control and guidance of domestic OEMs, in particular in areas of long-term strategic relevance (eg EVs and autonomous driving).