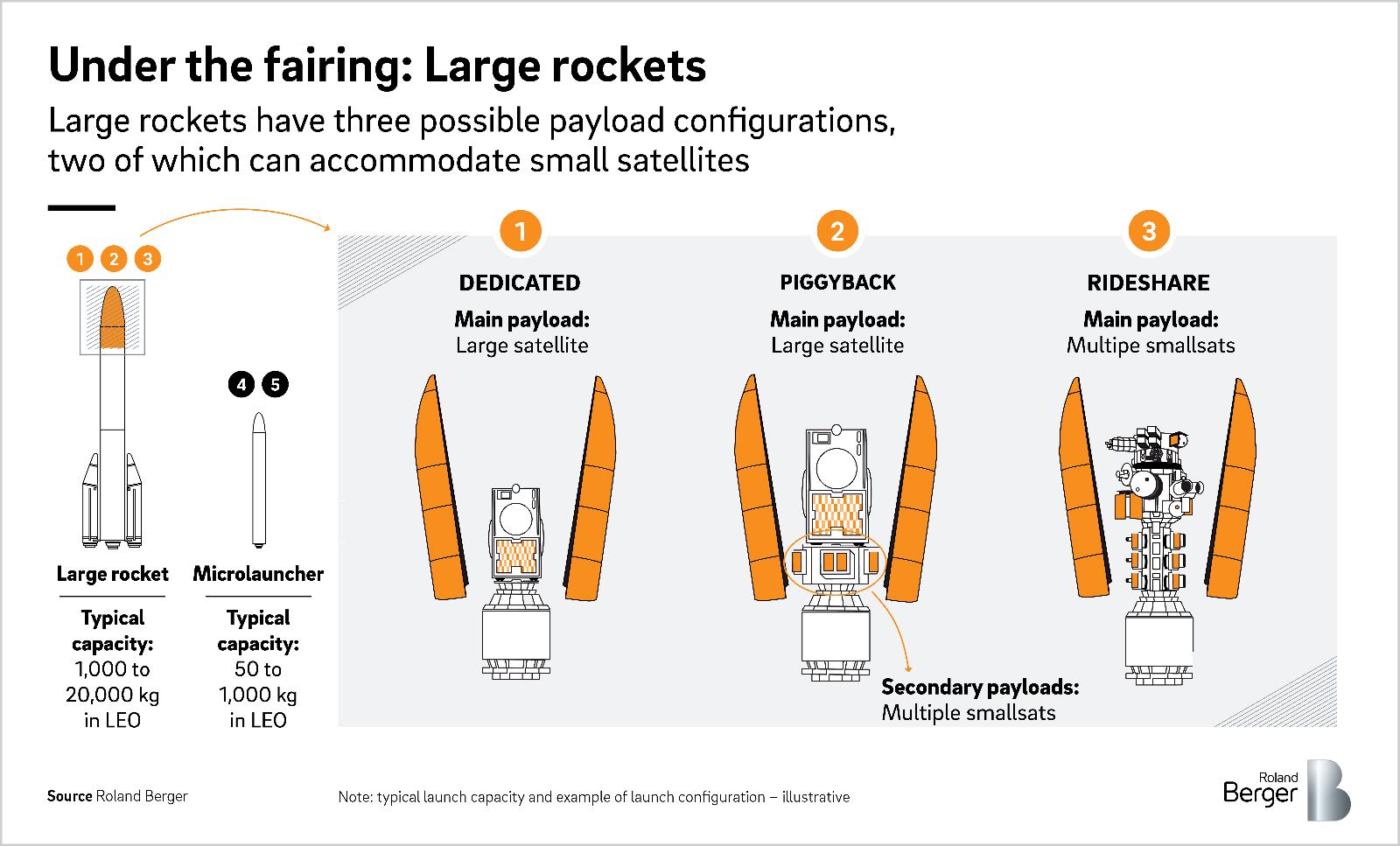

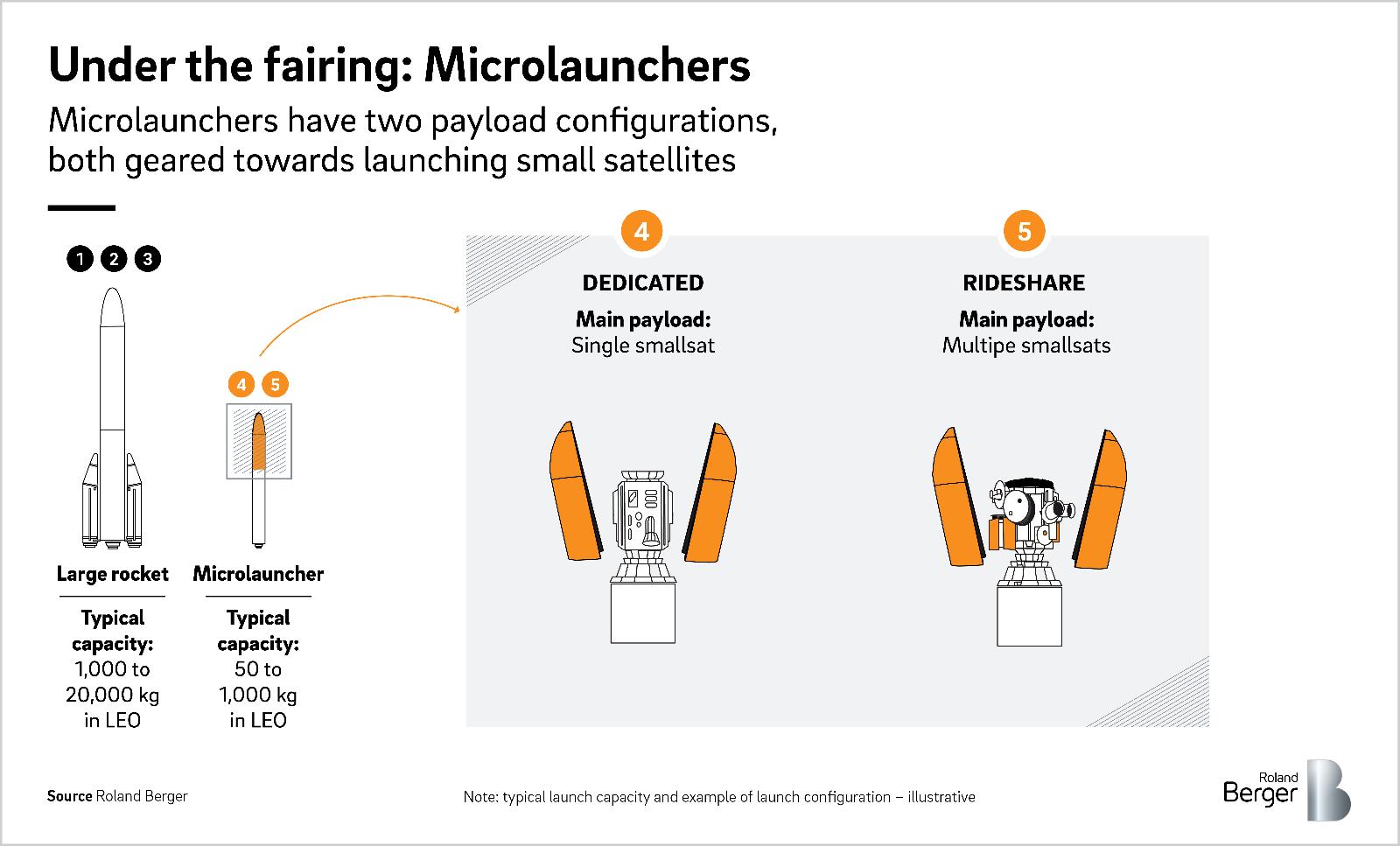

Available launch slots are rare, especially for small satellites. Risks and benefits of ridesharing and dedicated microlauncher solutions need to be considered.

Supporting Europe's microlauncher lift-off

How Europe can develop and secure a small-satellite launcher solution

The small-satellite market is booming, with huge numbers of shoebox-sized spacecraft set to swarm near-Earth orbit and offer the next generation of communications and Earth observation technology. There’s just one problem – getting them into orbit. So-called microlaunchers offer a solution, but Europe needs to act fast to get in on the act.

"It is a challenge for launcher companies to be commercially viable. They must all rely on direct or indirect public support."

Despite popular imagination, the vast majority of satellites orbiting Earth are not large, car-sized spacecraft with wing-like solar panels. Rather they are shoebox-sized devices, often carrying little more than a camera and transmitter. So-called small satellites, or smallsats, weigh less than 600kg and typically operate between 200 and 2,000km above Earth. This proximity enables them to supply very fast communications links (for internet connections in remote places, for example) or capture very detailed images (for mapping etc).

They often have to cooperate in large networks (for example, planned mega constellations for global communication involve up to 41,000 satellites) to ensure sufficient coverage of the Earth. But their small size, low weight and low Earth orbit makes them easier and cheaper to launch than traditional, larger spacecraft. These advantages, along with the ever-increasing demand for global connectivity and Earth observation data have resulted in a booming market. Several big players are involved, and their mega constellation projects are driving the boom. In 2020, 87% of the 1,190 smallsats launched were for constellations. The total number launched is almost three times what it was in 2019, and is projected to almost double in 2024.

But the small-satellite sector is still developing and faces several barriers. These include a lack of a robust busines s case for a majority of companies involved in the field, and a dependence on a small number of mega constellation projects. One of its biggest challenge, however, is a launch bottleneck. the number and schedule of current launch systems, mostly large conventional rockets, is severely limited. This is hindering smallsat projects and putting pressure on launch services.

Microlaunchers, dedicated smallsat launch vehicles, offer a solution. Several types are already in use, typically carrying between 1 and 20 satellites. Solutions include dedicated smallsat rockets launched from mobile or static platforms and airborne-launched vehicles. Microlaunchers also face the competition of large rockets using smallsat deployers fitted under their fairings (so-called rideshare or piggyback solutions). Overall, more than 100 microlauncher projects have been announced worldwide since the early 2000s. The US dominates the market, with 44% of projects based there, while 33% are in Asia and 23% in Europe.

Public and private investors are pouring into the technology, although current investments in Europe are dwarfed by those in the US. Startups, such as Rocket Lab and Virgin Orbit, abound in the industry , but big names are also getting in on the action, with Europe’s Arianespace and SpaceX (with their respective rideshare solutions) among those involved.

Despite this investment and activity, Roland Berger predicts that most microlauncher projects will be abandoned due to a limited addressable market demand. We expect five to seven microlauncher players to reach commercial scale in the next 10 years, and we are confident at least one will be European.

In this report, we fully assess both the smallsat and microlauncher markets, provide microlauncher use cases and offer six detailed recommendations to European stakeholders (EU Commission, European Space Agency, civil and military public space entities, launcher companies, commercial satellite operators etc.) to help facilitate a European microlauncher solution. These form the basis of a tailored strategic roadmap towards a European solution.

We conclude that if Europe wants to have a sovereign microlauncher capability, stakeholders from the public and private sector must align to create the necessary environment.

Register now to download the full report, including all insights into the small-satellite and microlaunchers market, and get regular insights into aerospace & defense topics.

_tile_teaser_w425x260.jpg?v=770441)