Packaging and processing industry: Rethinking the service business

Service is the key driver of profits and customer relationships in the new normal

The Covid-19 pandemic has had an unprecedented impact on both the economy and everyday life. In 2020, suppliers of packaging and processing machines and materials faced hitherto unseen challenges to their profitability, value chains and business operations. Providing high-quality service to customers became more difficult than ever. But at the same time, service developed into an area where high-performing companies could stand out from their competitors and build stronger customer relationships than in the past. Service is now the key driver of profits and customer relationships for companies operating in the sector, and is likely to become even more relevant in the future.

Servicing in the new normal

The "new normal" is not just about challenges to global supply chains or the bottom line. Customers are also expecting more from suppliers. The service business is no longer about selling spare parts: It is about offering solutions. Clients increasingly look for solutions from suppliers that will help them shift their focus from CAPEX (capital expenditure) to OPEX (operating expenditure), driving a faster transformation towards risk and gain-sharing models. At the same time, they are increasingly demanding remote technology such as virtual teams, technology based on augmented reality (AR) and virtual reality (VR) and remote-based machine services and operations, enabling predictive maintenance and other innovations.

The problem? Many suppliers in the packaging and processing industry are still overly focused on selling new machinery and materials. To capture the major business opportunities that are emerging, they need to take a broader view stretching across the entire product lifecycle. This is especially true for equipment providers, who would do well to consider a comprehensive transformation of their business model, from selling new machinery and services as and when necessary to selling service solutions across the entire product lifecycle. They could even go as far as implementing an "anything as a service" (XaaS) business model, rather than the traditional CAPEX-driven model they employ at present. The XaaS approach is still in its infancy in this industry, but we are already seeing the emergence of related phenomena, such as output guarantees.

"Without a service-oriented business model, suppliers in the packaging and processing industry will fail to acquire repeated or long-term service agreements."

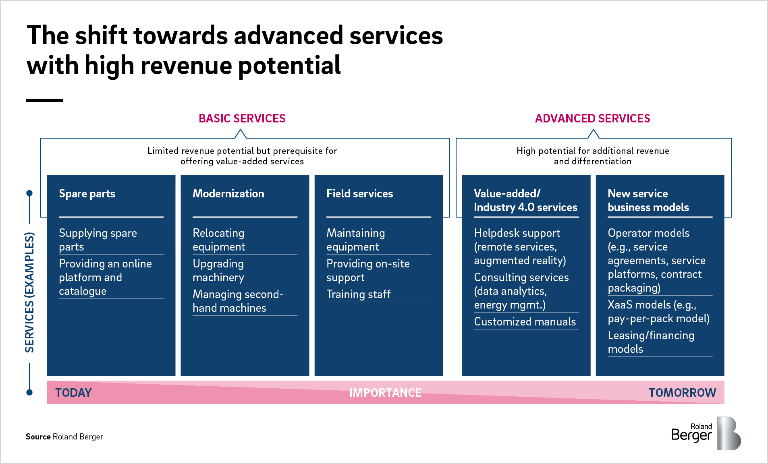

In today's new normal, basic services offer only limited revenue potential. The true potential for additional profits – and, critically, for differentiation in the marketplace – lies in advanced services. Companies finally need to take the service business seriously. That means achieving greater efficiency through methods such as "glocalized" service operations, or local delivery with global coordination, an approach that allows them to capture anticyclical service revenues and scale effects, while ensuring proximity to customers and markets. Setting up a central service desk with 24/7 availability means that they can offer direct, immediate support through remote maintenance and AR applications. They Firms should also provide their local service delivery teams with greater support and optimize response times where clients require field service. Companies can also secure recurring revenue streams by shifting further away from contractual business towards long-term service agreements.

Understanding customer segments and needs

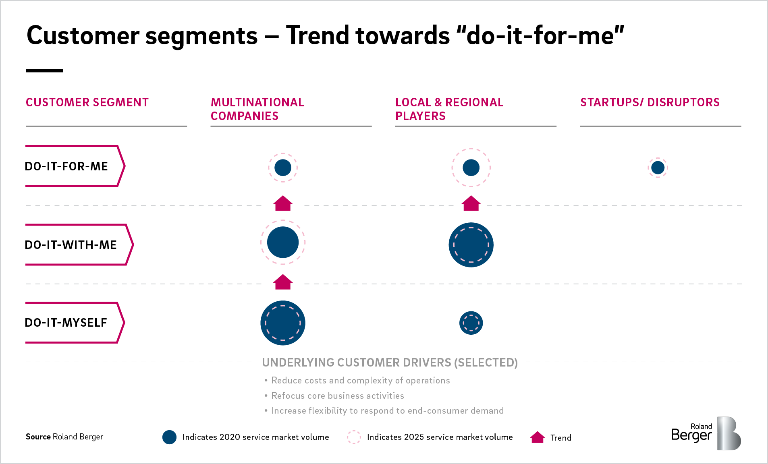

To maximize the opportunities offered by the new normal, packaging and processing providers first need to understand the dynamics within their customer landscape and the needs of their customers. Recent years have seen a trend towards co-servicing and service outsourcing, both of which provide attractive revenue pools. However, these opportunities also come with challenges, as players need to develop the internal capacities to serve these needs effectively.

We divide the customer landscape into three different customer segments or profiles: "do-it-myself", "do-it-with-me" and "do-it-for-me" customers. "Do-it-myself" customers are highly price sensitive and have only basic service requirements, essentially limited to the spare parts and machine maintenance they require in order to function. "Do-it-with-me" customers are looking for co-servicing solutions, with a focus on price-performance offerings (such as bundled service packages for maintenance, repair and operations) and strategic partnerships (due to their leaner company structures). Finally, "do-it-for-me" customers outsource their service arrangements completely. They require high flexibility and performance as part of a comprehensive, competitive service offering, such as embedded engineers. This customer segment actively seeks out value-added services such as predictive maintenance.

At the moment, the "do-it-with-me" segment is dominating the market. However, an increasing number of large multinational corporations and regional companies are moving into the "do-it-for-me" space, as they shift resources to their core business activities. In an environment of ever-faster changes, this trend is likely to continue.

Untapped potential

The classical service business in the packaging and processing industry – namely spare parts, upgrades, modernization and field service – is today under severe pressure. As competition increases and customer demand for cost savings rises, the profitability of these traditional service activities is declining. In response, even large equipment suppliers have started to expand beyond their installed base in order to capture more service revenues, fueling competition. At the same time, third-party providers are muscling in on the market, particularly in the area of simpler spare parts and field service.

One possible remedy for players is to extend their service offering, for example by adding value-added services or XaaS. This is best done on the basis of a thorough review of the company's service market potential. In recent years, for example, advances in technology such as predictive maintenance and data analytics, combined with increasing customer demand, mean that most companies now have a larger potential service business than would have been the case just a few years ago. But in many cases, they are not yet fully unaware of this opportunity.

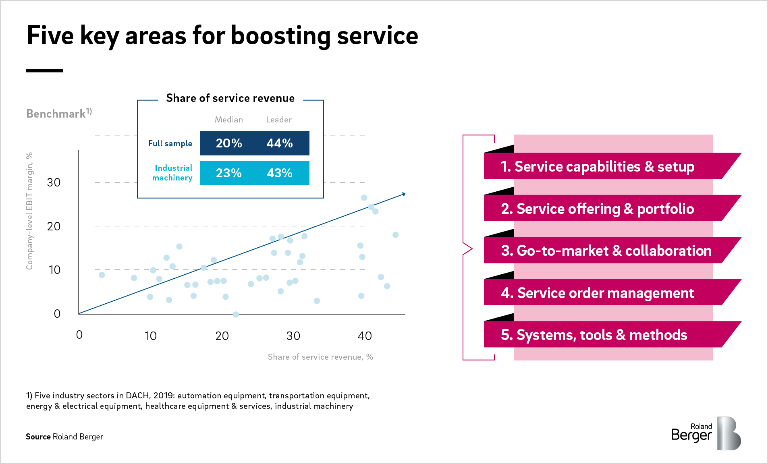

To determine the extent of the potential, we analyzed five sectors in the DACH region (Germany, Austria and Switzerland) as a benchmark for processing and packaging equipment providers: automation equipment, transportation equipment, energy and electrical equipment, healthcare equipment and services, and industrial machinery. We found that the best-performing companies in these five sectors generate up to 45 percent of their revenues from services. Moreover, the revenue from their service business is both profitable and sustainable . By comparison, a typical processing and packaging equipment provider offering basic services to its installed based generates around 25-30 percent of its annual revenues from service business. With a service-oriented business model setup, we believe that such companies could increase that figure to more than 40 percent.

Key areas for boosting services

We identify five key areas in which players can boost their services and in so doing turbocharge their revenues: service capabilities and setup, service offering and portfolio, go-to-market and collaboration, service order management, and systems, tools and methods. In the area of service capability and setup, to take one example, they can consolidate their service activities and competences by setting up hubs for their operations, thereby reducing organizational complexity and avoiding redundancy in capabilities. As part of this, they should consider implementing strict first, second and third-level support structures, customer interfaces and helplines, while aligning their procedures and best practices by introducing standard processes.

In the area of go-to-market and collaboration, companies can streamline their service sales channels and improve collaboration with and across company functions. They should also consider coordinating their sales approach for services across all channels. This can include defining clear rules with regard to "service giveaways", say, or goodwill evaluation between new sales and service.

Companies operating in different markets or parts of the value chain are employing different service models in order to maximize their profitability. For example, providers of large equipment, such as PET filling machines, traditionally already use their service business to generate profits, as the sales of the machines themselves are often barely profitable. Here, some providers have built a comprehensive lifecycle service business model ranging from spare parts and embedded engineers to digital services.

Large beverage carton and equipment providers have started to shift their focus towards the service business. Major suppliers employ a "razorblade" business model, in which their largest revenue share stems from sales of packaging materials – in other words, they sell their machines at a low price while pushing up overall revenues through the sale of complementary goods. This part of their business is increasingly exposed to competition from non-system suppliers. Overall, the share of revenue deriving from services is comparatively low, at around ten percent. However, system suppliers see services as a key revenue pool for the future and a way to enhance customer loyalty through digital services and customized service contracts.

Converter companies (companies that produce or modify packaging materials) are also increasingly shifting towards advanced service offerings. For example, packaging material suppliers in the food and beverage industry are offering smart packaging solutions in the form of digital prints and QR codes that consumers can scan into their phone to access promotions. They support their offering with consulting and data analytics services, which then form the basis of their clients' marketing campaigns.

In the waste and recycling business, paper-based packaging companies are working more and more directly with supermarkets, providing a free waste pick-up service. That means they can collect paper material for their recycling operations, while at the same time strengthening the relationship with their customers. It's a strategy that also creates a clear incentive for customers to use their services, as those customers enjoy both cost savings and free service provision. In some cases, this service is also extended to secondary packaging.

"To truly provide added value, firms must understand the needs of the customer segment at hand and tailor their service approach accordingly."

Transforming towards service excellence

The service business provides many opportunities for companies in the packaging and processing industry, especially equipment suppliers. And there is much to play for: Companies that achieve service excellence can introduce innovative business models, capture new revenue pools and at the same time build stronger customer relationships.

Boosting the service business involves three key steps. First, companies need to create transparency and build internal knowledge about their installed base, including both serviced and non-serviced customers, and potential new customers. Second, they should segment their customer base, identifying different segments' needs and developing an appropriate service offering. And third, they should review the areas outlined in the previous section, from service capabilities and setup to systems, tools and methods. A good way to do this is by setting up a dedicated service and sales organization with the necessary resources to actively support and drive the business.

Different customer segments require different approaches. With "do-it-for-me" customers – the key customer group for value-added services and new business activities – suppliers will need to establish a trust base first and then actively promote more advanced services. Potential services for this segment include condition monitoring, data analytics and embedded engineers. With the "do-it-with-me" segment – typically the largest group of customers – companies should aim at promoting value-added services that are performance-oriented, while fostering closer collaboration through trust and frequent interaction. Potential services for this group include MES/Software, 3D printing and remote services, including maintenance. With the "do-it-myself" segment – a large group that is part of the installed base but has little interest in purchasing anything other than basic services – firms should actively communicate the added value of the services provided. Potential services range from condition monitoring to on-site and remote support, for instance.

An investment that pays dividends

The current business environment contains many uncertainties, but one thing is clear for players in the packaging and processing industry: Service excellence will be a key determinant of future success and profitability. The Covid-19 crisis and growing focus on sustainability have, if anything, placed an additional spotlight on service. Industry players need to start tackling the challenges in terms of local support, delivery speed and digitization. Rethinking and boosting the service business in the new normal will require an investment of time and resources, of course. But it is an investment that will pay off, making the business more resilient and more competitive in the long term.

_ST_image_caption_none_tile_teaser_h260-2.jpg?v=770441)