automotive-disruption-radar.com

Automotive Disruption Radar #8

By Wolfgang Bernhart and Stefan Riederle

Autonomous mobility is coming, and not even the coronavirus can stop it

"The continued push towards autonomous driving is a concern for traditional OEMs as they still lack technological knowledge and competencies."

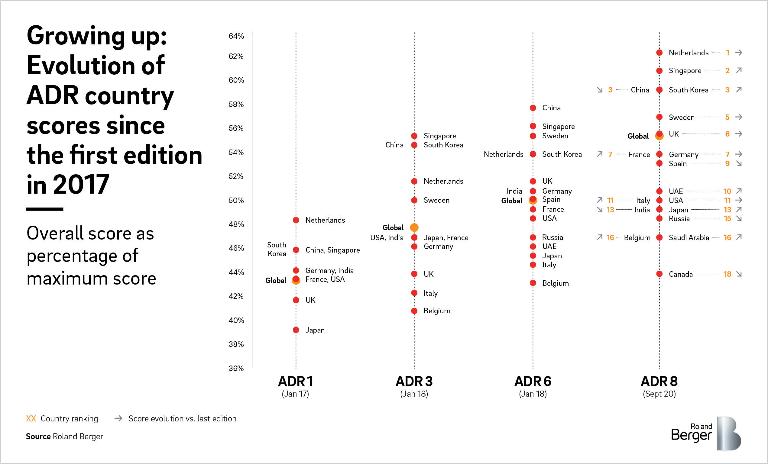

Results from the latest edition of the Automotive Disruption Radar show that the coronavirus crisis accelerated the transition to autonomous driving. Overall scores were the highest ever recorded, with several standout trends from increased electric vehicle sales to continued growth in willingness to use robotaxis. Here we look at the results in detail and four real-life developments that underscore the shift to autonomous mobility.

The coronavirus crisis hit the automotive industry hard but also accelerated the shift towards autonomous mobility, the latest edition of the Automotive Disruption Radar has found. All indicators in the twice-yearly report and survey suggest disruption is still coming to the sector, despite the pandemic-induced downturn and changes in mobility habits.

The eighth edition of the ADR, which tracks 18 global markets, found that Covid-19 stimulated technology players while hitting traditional OEMs hard. Overall, country scores were the highest on record, with smaller countries closing the gap on bigger markets. The Netherlands ranked number one, as it did in ADR7 , followed by Singapore, leaving former frontrunner China in joint third with South Korea. Other countries scored and ranked range from the US and Germany to India, Russia and Saudi Arabia.

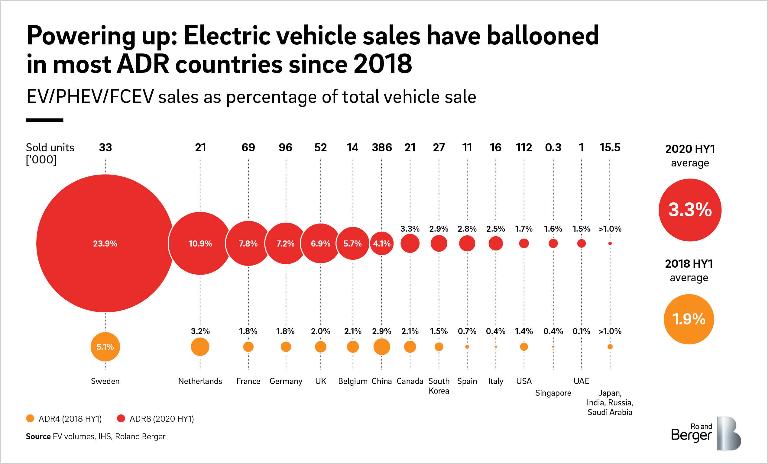

The survey results highlighted a growing interest in electric vehicles and soaring EV sales. For example, 50% of all potential car buyers say they are now considering a battery EV – compared with 35% in ADR1 (Jan 2017). And an average of 3.3% of all cars sold are now EVs, compared to 1.9% in the first half of 2018.

Interest in private vehicle ownership also rose, with the importance of having access to a private vehicle rising from 69% before the pandemic to 76% in August, when the survey was conducted. But interest in robotaxis did not seem to be affected by this, with willingness to use autonomous robocabs rising to 56% overall from 52% in ADR6 (July 2019). R&D activity hit a record high, too. For example, the number of registered patents related to autonomous vehicles/functions as a percentage of all registered driving technology patents reached 5.4%, compared to 4.2% in 2019.

In this booklet, we take a closer look at the ADR8 survey results in text and graphics, and analyze four real-life developments that underscore the shift to autonomous mobility. First, the commercialization of autonomous mobility services, where we examine the world’s first fully driverless robotaxi service, offered by Alphabet-owned Waymo, which began operating this year. Second, we outline the growing competition in the EV market, with a particular focus on an attempt by Taiwan’s Foptconn to develop an open-source EV platform described as the “Android of EVs”.

Third, we look at how OEMs are falling behind as new players enter the autonomous driving software market. The recent announcement of a tie-up between a big German OEM and a US chipmaker – Daimler and Nvidia – highlights how manufacturers lack the in-house expertise to develop software themselves. Lastly, we cover the rise of US EV pioneer Tesla, detailing the factors behind its success and the boost it is giving to the EV market in general.

We conclude that the continued push towards autonomous driving is a concern for traditional OEMs as they still lack technological knowledge and competencies.

Automotive Disruption Radar #8

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/702_roland_berger_adr_8_cover_download_preview.png)

The September 2020 edition of the Automotive Disruption Radar shows that the coronavirus hit the automotive industry hard but had little effect on the sector’s shift to autonomous mobility.