Mechanical and plant engineering at a crossroads: repositioning instead of continuing

By Urs Neumair, Jörg Schrottke and Gerald Orendi

The coronavirus crisis as a catalyst for more focus on the future, more profitability, more sustainability

"The mechanical engineering industry should use the coronavirus crisis as an opportunity to tackle the problems and challenges it's been facing for some time now."

The coronavirus crisis has laid bare the problems and issues that have been plaguing mechanical engineering firms for many years and causing stagnation across the industry. So it won't be easy for operators to simply carry on as before. That said, the crisis gives companies an opportunity to fundamentally challenge their business models and to rethink productivity. Doing this properly requires an understanding of the long-term drivers and developments that present options for repositioning the business, and any actions taken must be tailored to the specific situation each company faces.

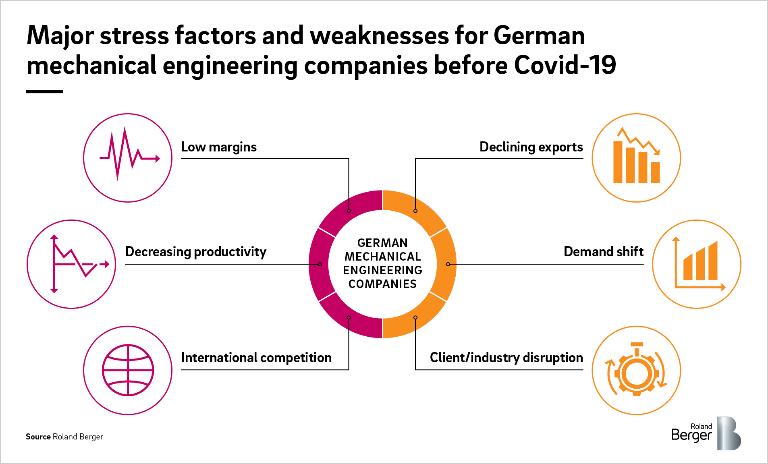

With lost revenues, the immediate shuttering of production and export markets collapsing, the coronavirus crisis has hit the mechanical engineering industries hard. However, the situation was difficult even before the pandemic : Export volumes were already 1.5 percent down in 2019 and EBIT margins have actually been falling for a decade . Added to this is an overall decline in productivity across manufacturing businesses in Germany. So, although the coronavirus crisis did not cause the problems in the engineering sector, it has laid them bare and is exacerbating a gradual effect that has been ongoing for over 30 years, leading the industry to stagnate.

Three trends are the key drivers

The engineering sector across the GSA region (Germany, Switzerland, Austria) is therefore facing challenges on a scale far exceeding the actual post-coronavirus restart. The industry needs to decide how it will position itself going forward and what new opportunities it needs to seize. Three key drivers are pivotal here:

- Digitalization and automation as a differentiating factor: The physical and digital worlds will continue to converge – in the engineering sector as in every other.

- "Green" products and services for sustainable business: In order to avoid increased environmental taxes and bad PR, companies will have to align their value chains strictly towards sustainability in the future, while still needing to integrate stranded fossil-fuel assets.

- Products with the "right" price point and services to make up for the decline in the machinery business: Instead of physical assets, it's now control and data-generating components that are becoming increasingly important for manufacturing companies. Mechanical engineering firms must adapt accordingly. Less expensive capital goods are also becoming more important as companies seek an asset-light constellation.

What options are available to engineering firms

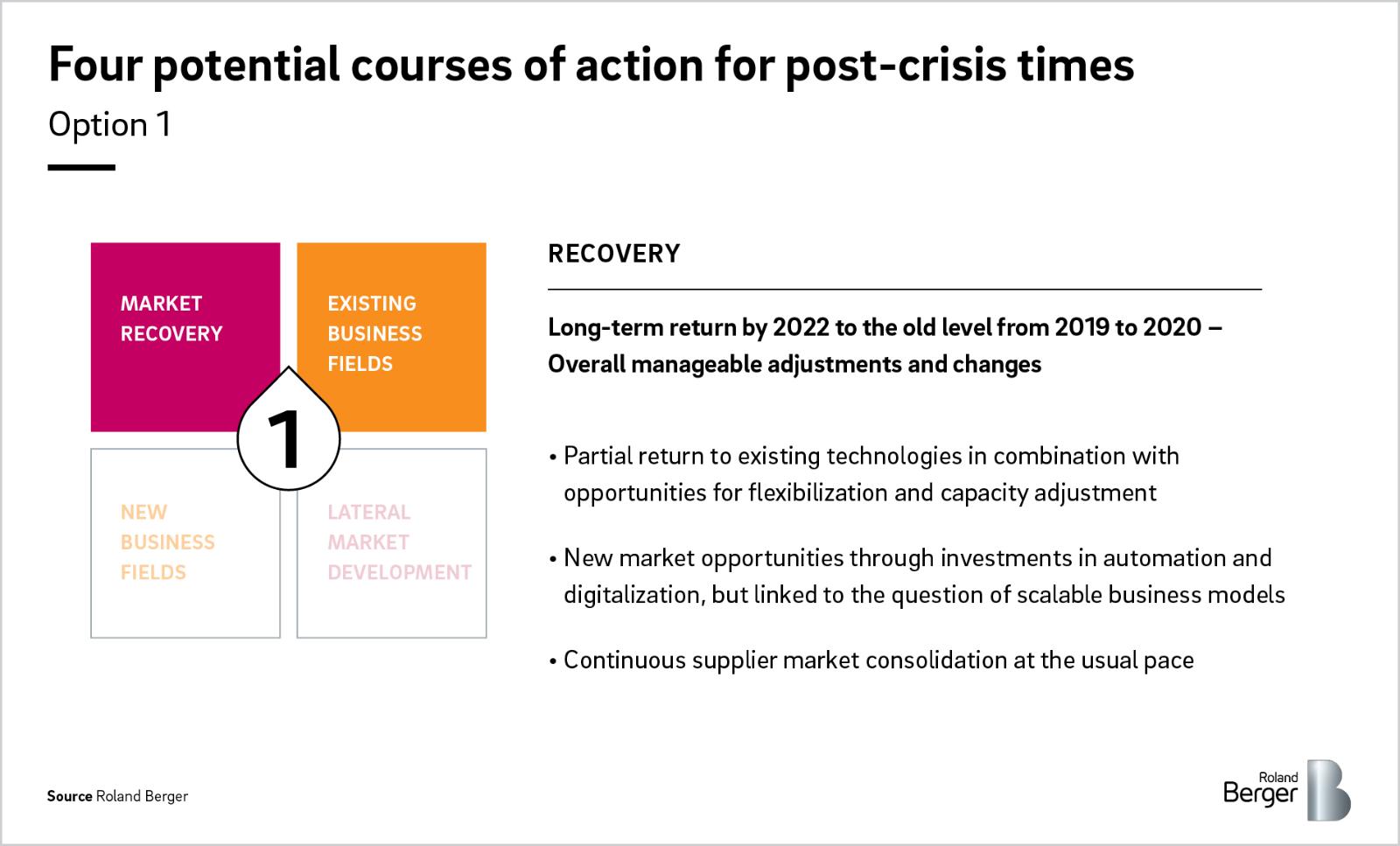

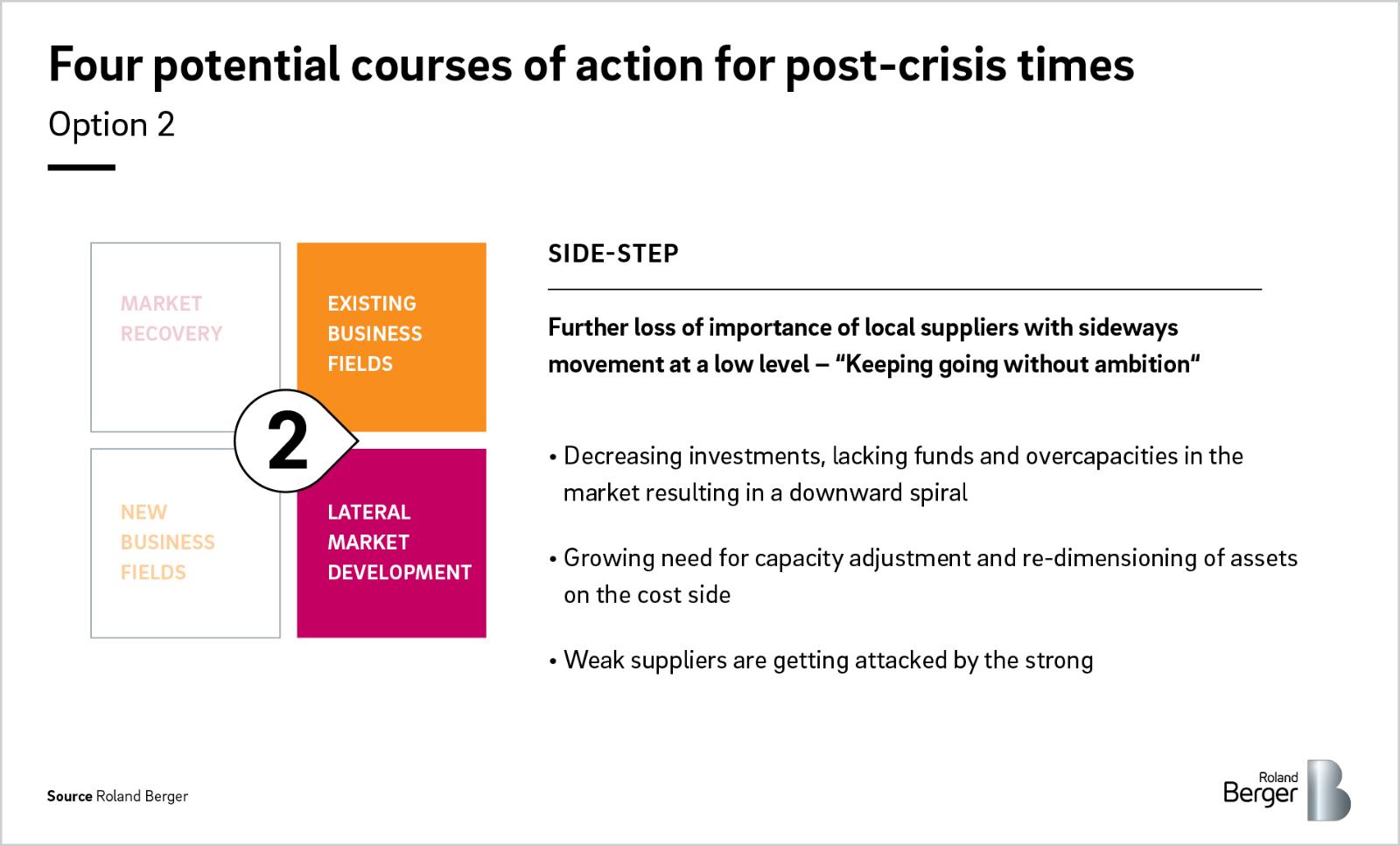

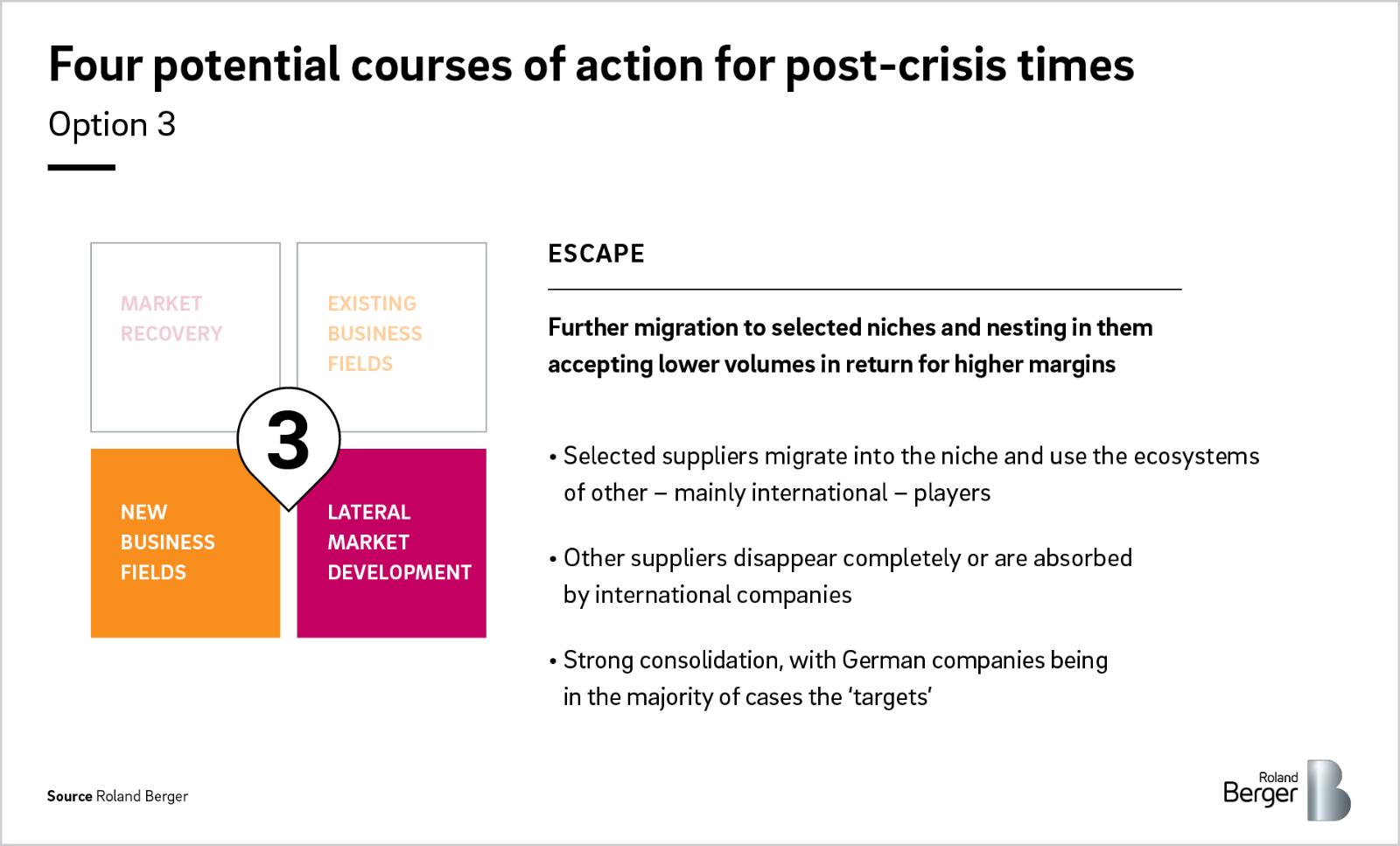

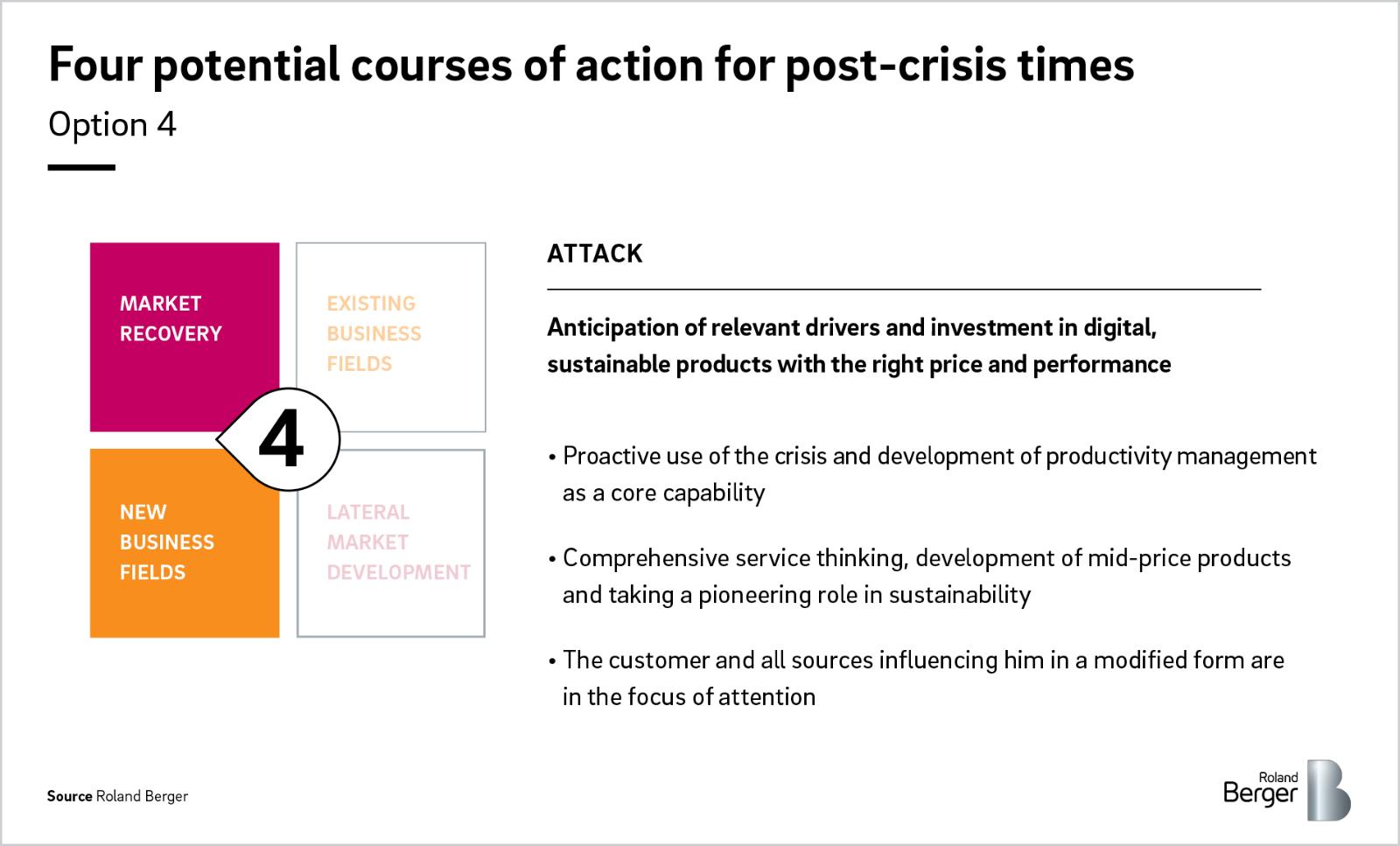

These three drivers had been developing slowly and in isolation before the outbreak of the pandemic. Now, combined with the direct and immediate effects of the crisis, they are unfolding their full impact – being seen, for example, in the rapidly growing acceptance of digitalization across businesses and society at large. In choosing a possible course of action, it thus makes sense to consider the drivers in combination with the direct and immediate effects of the coronavirus crisis. There are four conceivable ways to go:

- Recovery: This approach aims at a return to pre-coronavirus levels in the medium term. It therefore involves sticking to the template that made engineering firms strong in the past. This includes a heightened focus on electromobility as well as a partial return to existing technologies and the selective use of new ones. Automation and digitalization are opening up new market opportunities, but the underlying business models are often not scalable.

- Side-step: This option focuses even more strongly on investments in known technologies, while ignoring new trends. This results in a downward spiral and necessitates cost-cutting measures. Weak suppliers are attacked by the strong, and industry consolidation continues. In the best case there will be a sideways movement at current levels or, in the worst case, an accelerated decline.

- Escape: Under this option, companies migrate or withdraw into niches that promise above-average margins. Some of the local mechanical engineering companies dock onto international players, exploit their ecosystems and develop products and services for specific niches. Other suppliers disappear completely or are absorbed by international companies. Very few take a proactive stance in the consolidation.

- Attack: This option uses the crisis to make a big push forward: It involves anticipating the relevant drivers and investing in digital, sustainable products with the right price point. The key factors here are a close focus on the customer, an integrated approach to value creation, appropriate positioning in the market and constant innovation, particularly on digitalization and automation. This option is uncomfortable by definition and will meet with resistance. However, once the resistance is overcome, a whole new level of productivity can ensue.

The new normal after Covid-19 is probably going to be a mix of all this. So the four options can also be combined to develop different measures to suit different business areas.

Whichever option is for you, it's important to exploit the opportunities arising from the coronavirus crisis. The conditions are good: With its international orientation, willingness to adopt or adapt best practices and a pronounced spirit of invention and innovation, the industry has always been capable of reaching new heights of excellence and has regularly turned transformations into renewed successes in the past. "Attack" as a pathway enables companies to use the crisis as a catalyst and an accelerator for the transition to the new normal.

In a detailed article on this subject, our experts explain the situation facing mechanical engineering firms across the GSA region and describe how the sector can future-proof its business by repositioning after the coronavirus crisis. Request your copy of the article here.

_person_144.png?v=770441)