E-mobility: Automakers in need of battery strategy

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/pub_419_e_mobility_cover_en_download_preview.jpg)

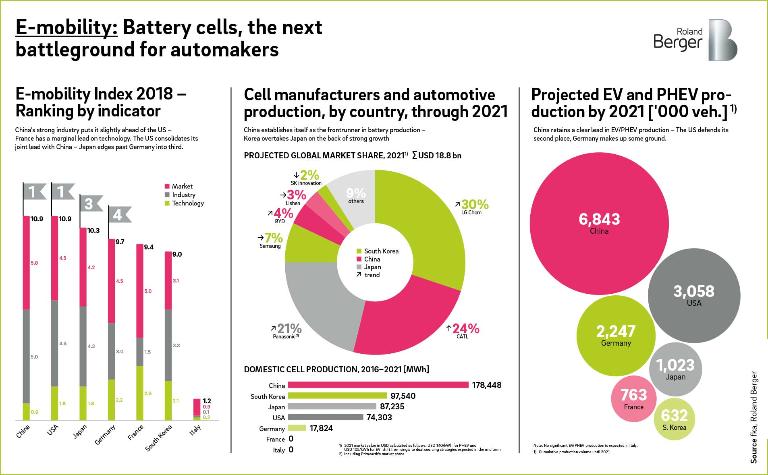

The leading automotive nations are driving e-mobility forward. Rising numbers of new electric cars on the roads will see the demand for battery cells rise and with it the market clout and negotiating power of the leading producers. OEMs need the right strategies.