The new normal in banking: Covid-19 as a catalyst for existing trends

By Hanno Dachwitz and Klaus Juchem

The new normal for banks after the coronavirus – ten recommendations

The coronavirus pandemic has changed our lives fundamentally and irreversibly. Very quickly, an unprepared economy and society at large had to come to terms with a new reality that had never been seen before. Industries such as the automotive and tourism sectors were left reeling. The few winners were those that had a digital business model in place before the coronavirus hit, such as firms that were already doing a lot of their business through e-commerce.

Unlike the financial crisis of 2008/2009, this time the banks were not the cause of the problem. They were part of the solution. During the lockdown, arrangements were rapidly put in place for staff to work from home and branches were reorganized to comply with the new hygiene requirements. And systems and processes were adapted to enable digital solutions to be offered quickly and with a minimum of red tape for the immediate implementation of government subsidy programs. These measures, speedily taken, enabled banks to act fast and adopt a pragmatic approach, protecting employees and customers alike and maintaining or even expanding their day-to-day banking operations . So far, banks and financial institutions have therefore been less badly affected by the crisis than other industries. In the short term, banks have even seen positive one-off effects through heightened demand for loans and subsidies, as well as an increase in trading volume.

Closer analysis reveals, however, that while the long-term consequences cannot yet be foreseen in full, the possible implications paint a rather challenging picture. What the coronavirus crisis did make clear is that despite all the progress they've made in recent years, the majority of banks still have much of the work ahead of them when it comes to digital transformation. Only with considerable effort and major concessions from all sides was it even possible to implement the measures that had to be taken during lockdown. To prevent Covid-19 from threatening their very existence, banks must gear up now for the new normal and set themselves on the right track to deal with whatever comes after the coronavirus. We are currently seeing an openness and a tolerance of innovation from customers, employees and regulatory authorities alike that presents a unique opportunity to explore new avenues much faster, and indeed to see off the kind of resistance you often come up against when doing so. It's the perfect time to overhaul outdated business models and tackle long-overdue changes.

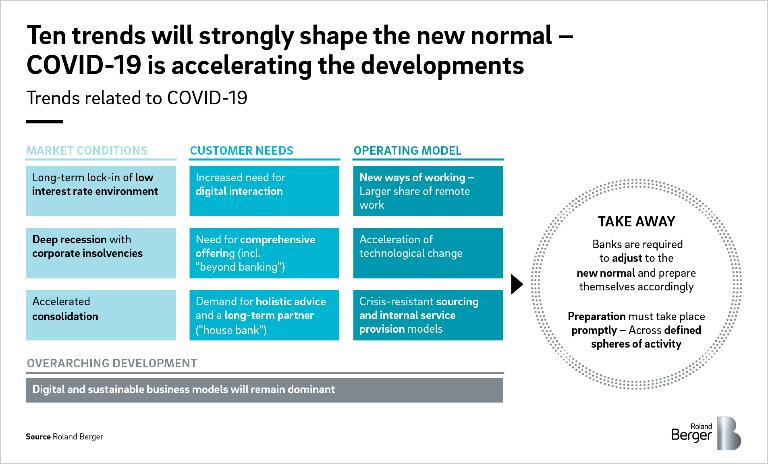

As our analysis revealed, ten trends that have been accelerated or created by Covid-19 will have a significant impact on the new normal:

So as we can see, Covid-19 affects the banking industry in two ways (by accelerating existing trends and creating new ones) and leads to a new normal, one that may not be entirely new but is coming sooner than expected, which means that it poses enormous additional challenges. Banks need to respond immediately in order to future-proof their business and operating model.

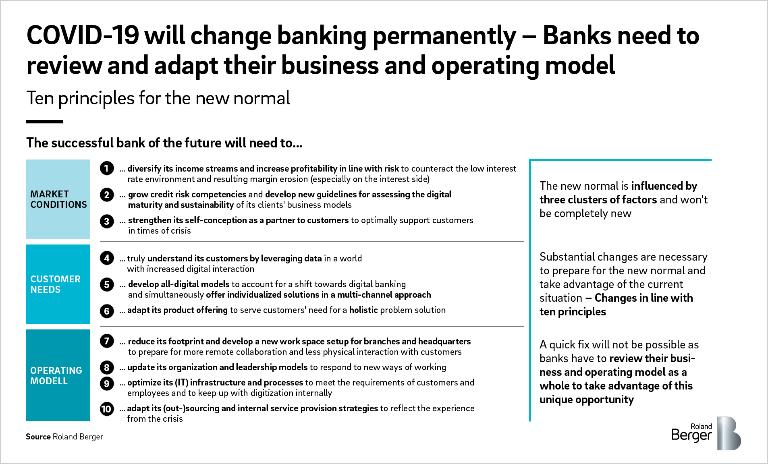

We have developed a set of recommendations to help banks gear up for the new normal.

"What the coronavirus crisis did make clear is that despite all the progress they've made in recent years, the majority of banks still have much of the work ahead of them when it comes to digital transformation."

Low interest rates and elevated risk costs are the new normal for banks

Many market players had held out hopes that interest rates would rise, but these were dashed by the crisis. The persistently low interest rate environment is forcing banks to increase profitability in other ways – by growing their margins in line with the level of risk, by identifying new business areas or perhaps through increased cross-selling. Especially being less dependent on interest income by launching innovative product bundles – with "beyond banking" products, for instance – can help banks address this challenge.

Huge numbers of companies were hit hard by the crisis, and the actual effects will only become apparent in the coming months. But what is clear is that there will be an increase in borrowers defaulting on loans in the new normal. Banks will therefore need to rebuild or grow their in-house capacity to deal with the wave of defaults and to adjust their internal risk and early warning systems based on lessons learned from the crisis. Not all institutions will be able to rise to these stiffer challenges, so we do expect to see an increase in consolidation.

Greater customer demand for digital, cross-channel solutions that enable banks to offer their clients holistic advice to suit individual needs

Customer demand for digital solutions has been drastically accelerated by the pandemic. Customers expect an all-round service offering fast processes and an easy way to do their banking – any time, any place.

In the new normal, banks will have to interact digitally with customers across all channels – from the first point of contact to closing a product sale to back-office processing to further support. Interaction between customers and their bank will also be much more digital during the consultation process (e.g. via video chat or regular chat functions). Physical interaction with the customer will take place at the customer's request or in the case of complex needs.

Banks will enter into new collaborations with third-party providers (e.g. via platform solutions) to develop "beyond banking" products (such as liquidity planning or accounting tools) and offer these to their customers as integrated solutions.

To better understand their customers in a more digitalized world, banks must systematically use what customer data they have internally and supplement it with externally available data from sources such as social media platforms. The data can be put through data analytics tools to form the foundation of needs-based, individualized support and problem-solving for customers.

In the new normal, customers now demand greater security and want to be holistically advised on all of their banking needs. The issue of trust and the role of a bank as a dependable partner, even in times of crisis, or as a house bank is becoming increasingly important again.

A more digital and crisis-proof operating model with greater flexibility

The crisis has shown that there is another way. In the first half of the year, banks made hardly any losses in spite of the lockdown. In the new normal, banks will manage with significantly fewer branches and offices – and what physical spaces they do occupy will be different than before. Customers have grown accustomed to digital banking and employees are making use of flexible working models to facilitate virtual collaboration with customers and coworkers. An increasingly agile way of working has become established across many functions and is being reflected in the management structure and the culture of the banks.

In order to embrace the new developments that have emerged out of the crisis and embed them in their businesses, banks will have to adapt their internal processes, tackle digitalization even more stringently and adapt their (IT) infrastructure to the new conditions on the ground. Particularly with regard to crisis-proofing their services, banks will zero in on the value-adding aspects of their business to ensure that they continue to be able to serve their customers even in times of crisis. Activities that add less value will increasingly be provided by third parties or industry solutions, partly with a view to achieving cost reductions. Banks' service delivery models must of course be made crisis-proof.

Digital and sustainable business models continue to dominate

Although the crisis did not directly affect the fundamental evolution towards increased digitalization, there has been an unmistakable quickening of the pace of digital transformation – and the sheer importance of digital has been highlighted, both internally and towards customers. The issue of sustainability will also significantly shape the new normal.

We have developed ten guidelines to assist banks in defining their own future in line with the new reality.

The trends outlined here may well vary in strength depending on the specific focus (retail banking, wholesale banking, etc.), but all banks will need to review their business and operating models. Even though it was both right and important to take the short-term measures that were implemented during the lockdown, they alone are not sufficient to successfully address the new normal going forward. On the one hand, banks must use this crisis as an opportunity, because there is definitely no turning back the changes that have been made. But equally, banks have to take all the things that worked during the crisis and embed them in their business so that they do not fall back into old habits. Actively investing in modernization is important to this. Where costs must be pared back is in areas that do not endanger a bank's ability to adapt to the new normal.

We offer a holistic approach to support banks and financial institutions in realigning their business – we offer solutions to your problems. We would be happy to discuss our ideas with you and can help you determine where you should have a physical presence and guide you through your transition to the new normal. Don't hesitate to get in touch.