Roland Berger is a thought leader in environmental issues and the response demanded from organizations. Our publications cover all relevant areas.

Innovate and industrialize: Offshore wind energy

How Europe's offshore wind sector can maintain global market leadership and meet the continent's energy goals

"Further innovation and industrialization of offshore wind is key to Europe's energy independence and competitiveness"

The use of offshore wind energy (OWE) is seeing a tremendous rise. This once immature and expensive technology is now cost-competitive with electricity from fossil sources; enabling many countries to meet their decarbonization goals faster and at lower cost. Europe currently dominates, but global competition is rising. To maintain its market leadership, the European OWE sector must target advancements such as converting OWE to hydrogen and developing floating OWE technology to allow for deep water offshore wind farms.

A key pillar for decarbonization

A decade ago, OWE technology was considered immature and costly. Hefty financing costs, driven by the sector's high-risk status, combined with serious problems in offshore construction and operation, had pushed up the levelized cost of electricity (LCOE) from offshore wind in Europe to around EUR 190 per megawatt-hour (MWh).

In a bid to address the issue, the industry agreed on a cost target of EUR 115/MWh by 2020. Developments moved faster than expected. In 2016, a wind farm in the North Sea off the Dutch coast, published a strike price of EUR 87/MWh, significantly lower than the 2020 target. Subsequent projects announced even lower strike prices. Now, prices as low as EUR 49/MWh have been achieved, and zero-subsidy tenders have been successful in the Netherlands and Germany.

As a result of this unexpected progress, ambitions for OWE capacity have risen sharply. Many governments now see OWE as a key pillar of meeting decarbonization goals set by the UN Paris Agreement of 2015. The European Union, as an example, wants to develop 300 GW of OWE capacity by 2050 and make it a core component of Europe's energy system.

"Innovations in offshore wind often require close cooperation between several parties in the value chain."

The benefits of offshore hydrogen

Hydrogen has quickly proven to be one of the cornerstones of Europe’s energy transition, as well as of decarbonization efforts across the globe . Together with its derivatives, it offers a good option to decarbonize highly energy-intensive sectors, such as large-scale transportation and heavy industry (steel, chemicals, etc.). “Green” hydrogen produced from renewables can be readily stored in pipelines, salt caverns or depleted gas fields, helping to counteract the effects of renewable intermittency. And, at higher volumes, energy can be transported at much lower costs by being carried in molecular form (hydrogen through a pipeline) rather than as electrons (electricity through a cable).

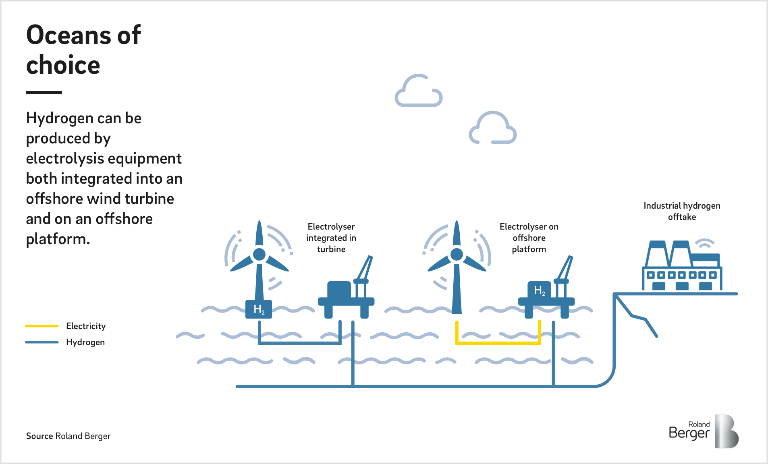

However, while hydrogen has the potential to help the world reach its post-2030 decarbonization goals, huge volumes are required. This is where OWE comes in. OWE is the most suitable renewable energy source in Northwestern Europe for direct coupling of large-scale electricity generation to industrial-scale hydrogen production. There are compelling reasons to locate electrolyzers for hydrogen production offshore at the OWE source rather than onshore: Hydrogen pipelines are cheaper than electricity cables; storage is easily accessible in offshore empty gas fields and salt caverns; and there is minimal environmental impact as a single pipeline can transport significantly larger amounts of energy than an electrical cable, thus requiring less disruption of often delicate ecosystems such as the Wadden Sea. What's more, redundant offshore natural gas pipelines can be repurposed to transport hydrogen. Electrolysis equipment for offshore hydrogen production can be integrated into an offshore wind turbine, or placed onto an offshore platform.

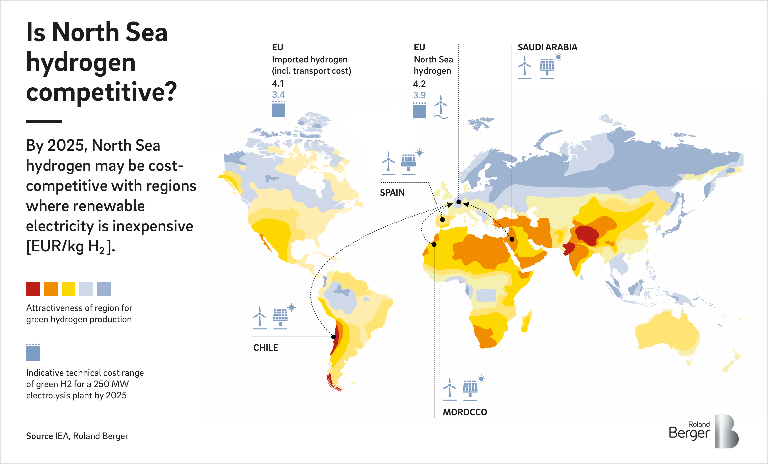

Global race for cost competitive hydrogen

It is expected that green hydrogen from North Sea OWE will cost around EUR 4/kg by 2025. This would make OWE-produced hydrogen competitive with hydrogen shipped from the Middle East, Chile, and other regions where renewable electricity is cheap, for which the cost – including transportation to Europe – is also around EUR 4/kg. However, it is uncertain whether North Sea hydrogen will be competitive in the longer term. As the prime, near-shore OWE locations in Europe fill up, OWE will have to move further out to sea, driving up costs in turn. It is also likely that the costs of vessel transport will go down, putting additional pressure on green hydrogen produced in European waters.

But even at higher costs, hydrogen from European OWE is still likely to remain attractive. Homegrown hydrogen reduces reliance on imports from other regions, some of which are politically unstable. Producing hydrogen at home also allows Europe to capture the downstream value added of hydrogen when it is used as a feedstock, such as in the production of synthetic fuels or green chemicals – value that otherwise moves abroad. Where OWE is converted to hydrogen, about two-thirds of the cost per kilogram of hydrogen is attributable to OWE itself. Cost reductions in OWE are therefore a major stepping stone to Europe's energy independence and industrial competitiveness.

How the European OWE sector can maintain its lead

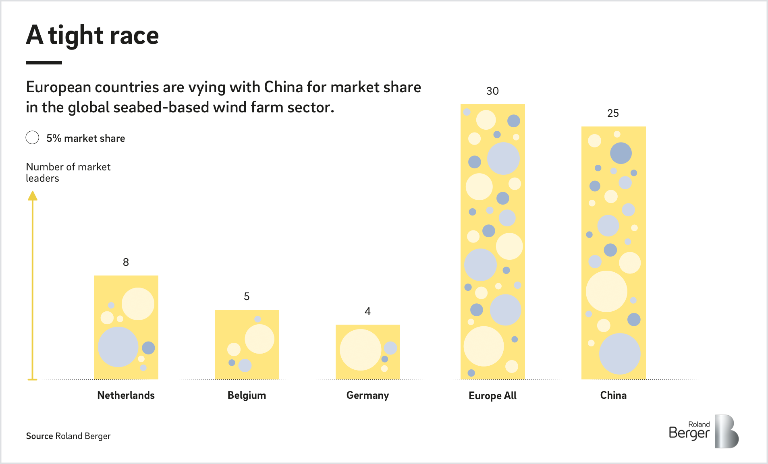

About 60% of investments into global OWE farms commissioned, or due to be commissioned, between 2020 and 2023 have been captured by European companies. But global competitors are gaining speed. China, in particular, is becoming increasingly competitive, as it learns from its fast-developing home market. The Chinese turbine manufacturer Mingyang, for instance, has already established a business and engineering center in Hamburg, Germany, and has secured a deal off the coast of Italy.

If the European OWE sector wants to maintain its dominance, it needs to act soon. Roland Berger’s latest study details some of the key areas where the European OWE sector can innovate and industrialize if it wants to compete with global competitors.

- Industrialization: Manufacturing of turbines and foundations can be further industrialized, but this requires further standardization of parts

- Integrated design: Smarter integrated designs enable more efficient offshore installation, and thus lead to important cost reductions.

- Digital maintenance: Remote digital structural health and condition monitoring of OWE installations is essential for reducing maintenance costs.

- Larger turbines: Manufacturers continue to produce larger and larger turbines, and 20 MW models are already on the drawing boards.

- Self-healing materials: The utilization of self-repair materials in blades can drastically reduce maintenance and repair costs over the wind farm's lifetime.

- Optimized wind farm control: Large-scale aerodynamic interactions within wind farms are still not well understood. Simulations and physical models are necessary to get a better understanding of these interactions.

To cement their place as global leaders in OWE, European companies must rapidly innovate and industrialize to expand the scope of offshore wind and reduce its costs. Doing so represents a crucial step towards producing globally competitive hydrogen and energy independence. It also promises to create more domestic value in downstream products and enhance the international competitiveness of Europe's energy-intensive industries.

To learn more, read our full study. See how Europe can fortify its position as the world's OWE leader, building a future above and beyond carbon for its own economies and citizens, and for the planet as a whole.

Innovate and industrialize: Offshore wind energy

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/RB_PUB_21_011_FOC_Offshore_wind_energy_Cover_download_preview.jpg)

Although Europe today dominates the offshore wind energy market, global competition is increasing. Learn more in Roland Berger’s latest study and see what steps Europe can take to maintain its control.

Sign up for our newsletter and get regular insights on newest publications related to Energy & Utilities.

_person_144.png?v=869993)