Ambitious targets to increase share of zero emission commercial vehicle require truck manufacturers to fundamentally rethink their sales and service approaches.

Navigating uncertainty on the road to off-highway decarbonization

Electric and hybrid systems in commercial and off-highway vehicles

Overcoming the limitations of electric vehicles (EVs) – from product performance to worries about infrastructure availability and total cost of ownership – is essential to unleashing the full potential of electrification in off-highway and commercial vehicles. Until these issues can be resolved, opportunities exist for readily available alternative solutions such as hybrid vehicles and biofuels. Here, we examine the current state of electrification in the off-highway and commercial vehicle sectors, as well as ongoing trends, future prospects, and the likelihood of different technologies continuing to coexist.

"Integration is simplified when OEMs work with providers who can supply the full electric system—energy storage, electric motors (axial flux motors are ideal), inverters, and thermal components—or who builds strategic partnerships to provide the whole system."

Uncertainties and opportunities

Market expectations for EVs have followed a familiar hype cycle in recent years. The automotive industry experienced a peak of inflated expectations during 2021-22, marked by overvalued companies, optimistic projections, and widespread enthusiasm. By early 2023, the electric future remained promising, with thriving sectors, committed original equipment manufacturers (OEMs), and supportive regulations.

However, the market has since tempered its battery electric vehicle outlook, entering a trough of disillusionment. Across segments, EV adoption projections have become more cautious. Western OEMs face increased price competition from Chinese manufacturers, losses on EV investments, and delays or cancellations of EV programs. In the United States, regulatory uncertainty could further delay EV adoption, presenting challenges for market players, while creating opportunities for alternative decarbonization technologies such as biodiesel, renewable diesel, and hybrid vehicles.

Electrification of commercial vehicles

Achieving widespread electrification of commercial vehicles (CVs) hinges on simultaneously addressing three critical factors: product performance, charging infrastructure, and total cost of ownership (TCO). All three elements must align. If the product underperforms, infrastructure lags or TCO remains uncompetitive with internal combustion engines (ICE) – electrification will stall.

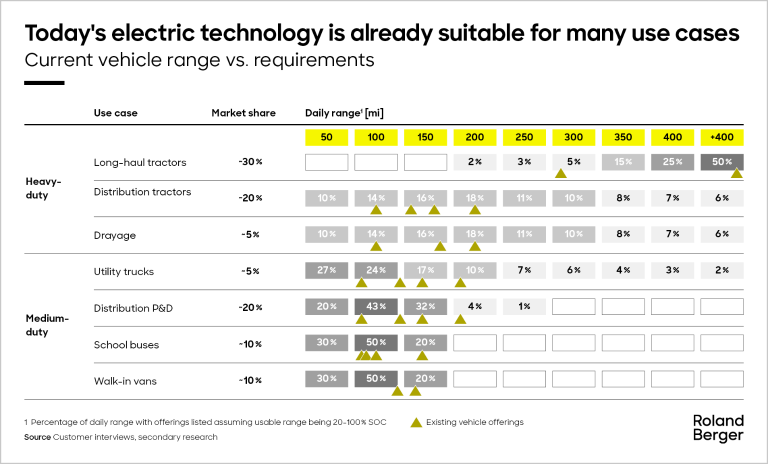

Despite concerns about vehicle performance, many on-road use cases are already suitable for electrification. Mapping vehicle performance against use-case requirements reveals that today’s technology can meet the needs of medium-duty, return-to-base operations such as last-mile delivery vans. However, heavy-duty segments, especially long-haul trucking, often demand ranges that exceed the capabilities of current electric trucks. Recent advancements, such as Daimler Truck’s introduction of a heavy-duty truck with higher-capacity batteries, are addressing this gap and enabling long-haul applications.

"Electrification comes down to a simple equation: the right product that can do the job at the right cost, supported by the right infrastructure. It's a multiplication—if the product can't do the job, the total cost of ownership doesn't match that of ICE vehicles, or the infrastructure isn't ready, electrification stalls."

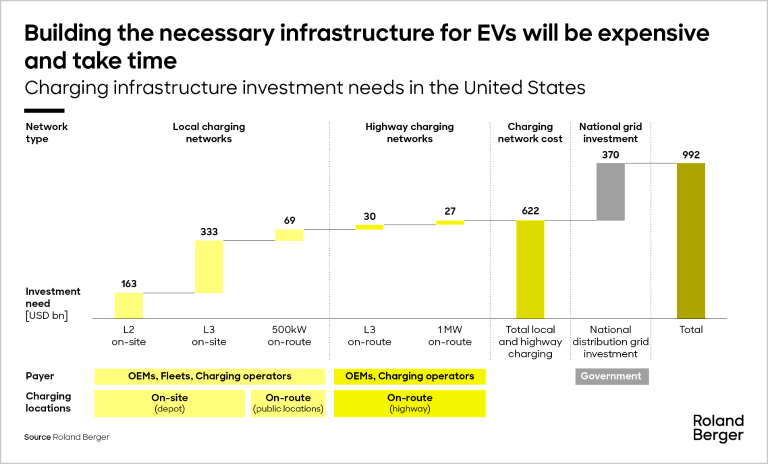

Charging infrastructure challenges fall into two main categories: lead times and costs. According to a survey by the American Trucking Associations, 80 percent of fleets report lead times exceeding one year, with nearly one third experiencing delays of three years or more. Electrifying larger depots often exceeds current grid capacity, requiring new substations and upgrades that are time-consuming to build.

Another significant barrier is cost. Roland Berger estimates that fully electrifying the US medium and heavy-duty truck fleet would require a trillion-dollar investment in charging infrastructure and grid upgrades. While this figure is daunting, not all investments need to happen immediately. Incremental progress is being made, including the development of charging corridors along major highways. However, the pace of infrastructure development will significantly impact electrification progress.

Total cost of ownership is also a major challenge, with EVs often costing twice as much as comparable diesel trucks. Without substantial price reductions, achieving competitive TCO scenarios for many use cases will remain difficult. To mitigate these challenges, OEMs are exploring pay-per-mile leasing models to lower upfront costs and reduce residual value risks.

Given these hurdles, electrification rates remain relatively low. Even in China, where EV adoption has outpaced other regions, penetration in the CV segment is still in the single digits. However, when viewed over a longer timeline, progress has been remarkable. In less than ten years, EV technology has advanced significantly compared to the 130-plus years of ICE evolution.

"Powertrain complexity in the off-highway segment will be significant, given the wide range of applications and use cases. OEMs must manage this complexity carefully to control costs and explore new business models to ensure their products deliver total cost of ownership benefits."

Regulation and policy change

Regulation will play a crucial role in shaping the future of electrification. In the United States, there is potential for rollbacks in incentives and relaxed emissions regulations. While a complete rollback is unlikely, enforcement delays could shift adoption timelines. In contrast, Europe and China remain steadfast in their commitment to driving electrification, with no significant policy reversals expected.

Delays in regulatory timelines for electrification could create opportunities for other decarbonization solutions. Fleet operators often pursue decarbonization targets that are just as ambitious as regulatory goals but adopt a technology-agnostic approach. This opens the door for alternatives such as biodiesel, renewable diesel, and hybrids.

Hybrid powertrains for CVs were extensively tested about a decade ago, but the results were underwhelming: Fuel savings often failed to justify the additional cost of the electric drivetrain. The challenge lies in the trade-off between annual vehicle mileage and usage patterns. Stop-and-go vehicles such as walk-in vans can benefit from energy recuperation but typically lack the annual mileage to generate meaningful savings. Conversely, long-haul trucks with higher mileage lack sufficient recuperation opportunities to offset incremental costs of a hybrid powertrain.

Since hybrid technology was last explored, battery costs have declined – but the fundamental difficulty of making the economics work remain. Hybrids, however, offer another advantage that might put them back in focus: They can operate in fully electric mode for specific distances, enabling zero-emission operation in low-emission zones or urban areas while leveraging ICE for longer trips. This flexibility could make hybrids a viable option for meeting decarbonization goals in certain contexts.

Decarbonizing the off-highway industry

The off-highway industry is early in its decarbonization journey, but both internal and external forces will drive the transition. External factors include corporate sustainability pushes among value chain participants and evolving government incentives and regulations. Internal forces include TCO benefits and improved operator experience.

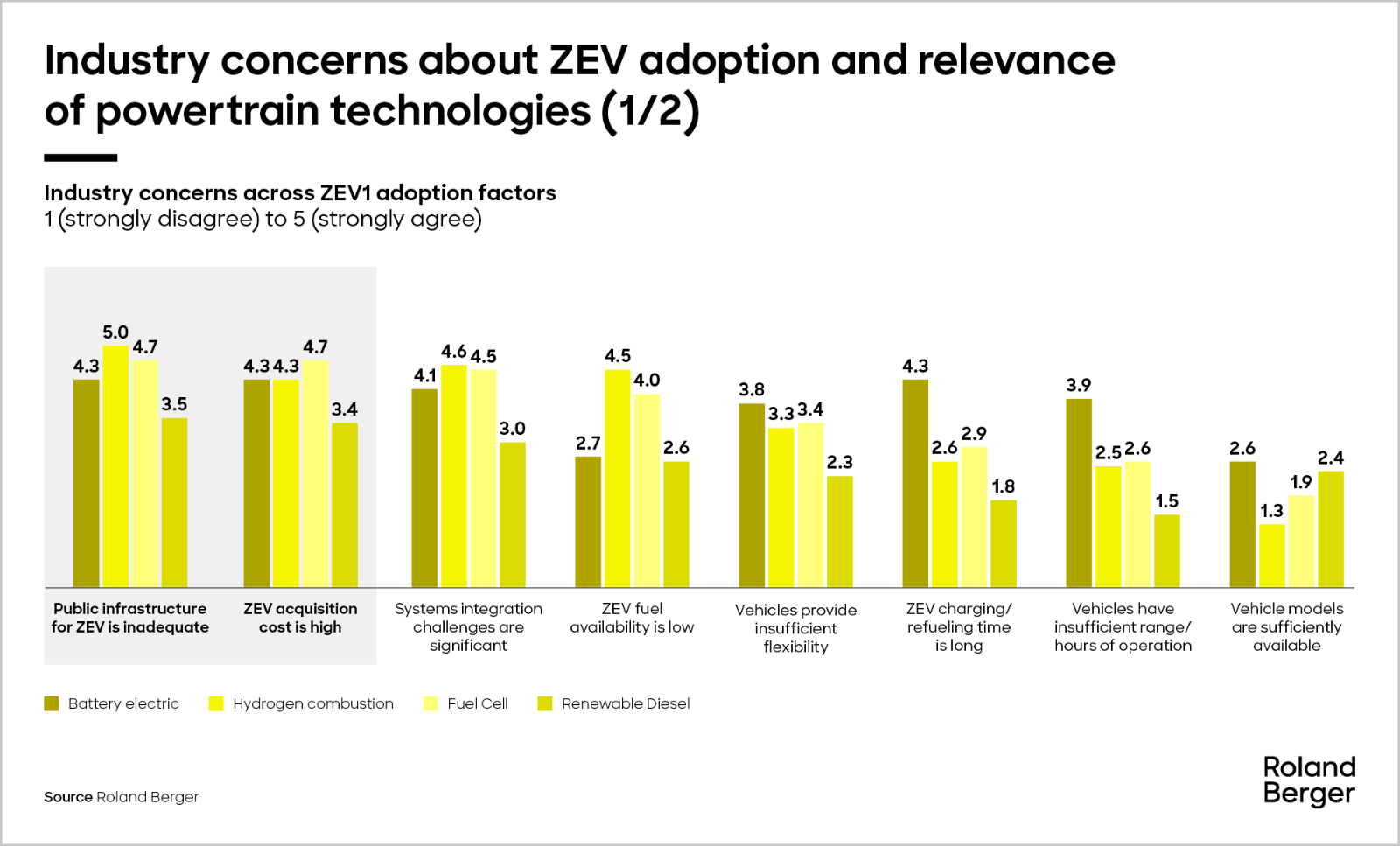

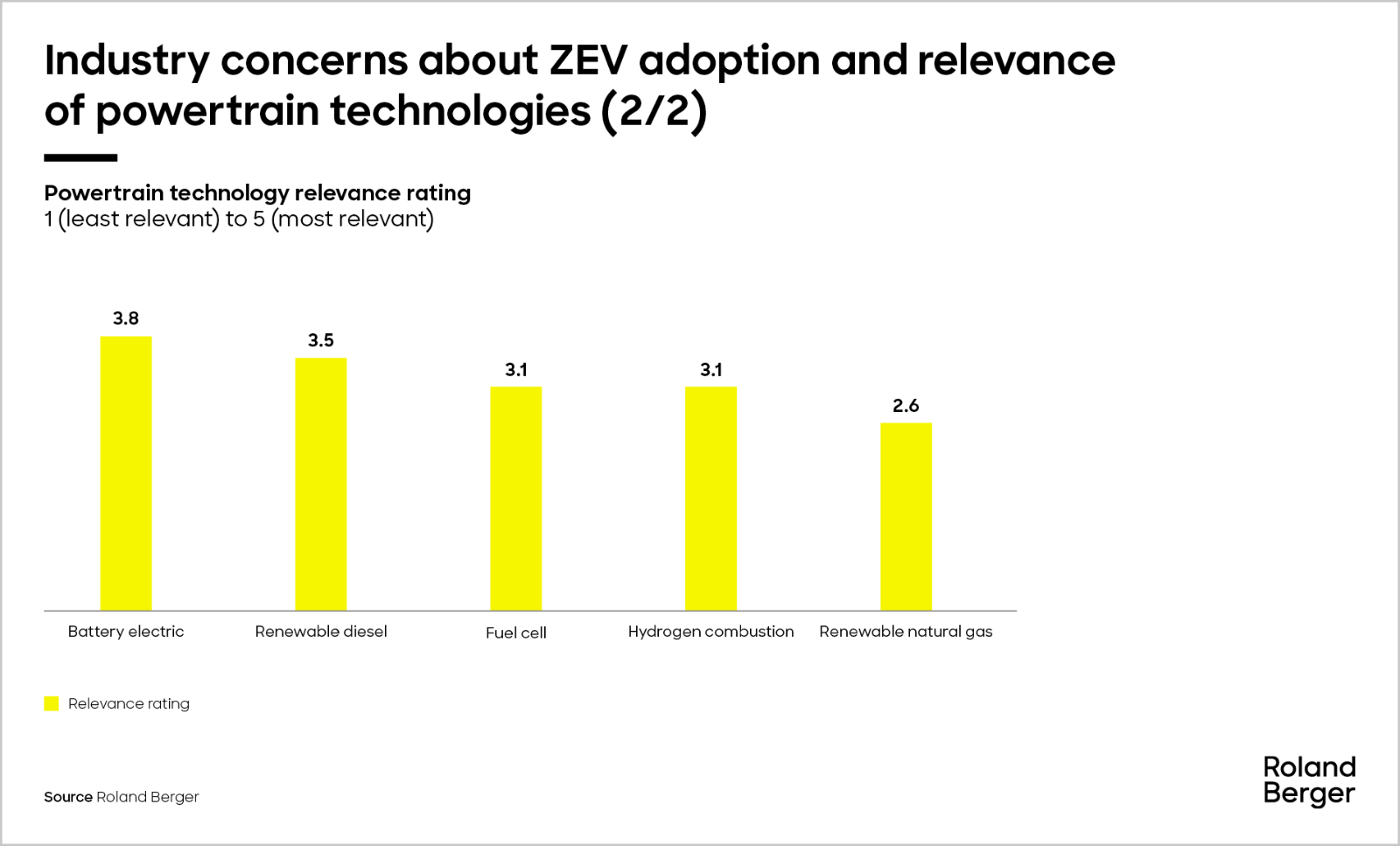

To assess the current industry perspective on zero-emission vehicles (ZEVs), we partnered with Off-Highway Research in 2023 to conduct a global survey of off-highway OEMs and suppliers in the construction, agriculture, and heavy machinery sectors. The findings indicate that industry professionals view battery-electric and renewable diesel technologies as the most viable paths to decarbonization. In contrast, fuel cells, hydrogen combustion, and renewable natural gas are considered less relevant for future powertrain solutions.

However, a number of concerns remain, especially with battery electric. Respondents were worried about the lack of charging infrastructure as well as the cost of acquiring vehicles and challenges integrating them into existing systems.

"Much of the construction equipment used in Europe is compact, making it easier to electrify – but its operating hours are limited. In contrast, larger equipment, which accounts for the majority of emissions, is primarily used in developing countries and is significantly harder to electrify."

While some smaller battery electric off-highway vehicles in China already claim a positive TCO case, medium and large vehicles are unlikely to become TCO-positive before 2028-32.

Easy-to-electrify vehicles tend to represent a smaller share of the total installed engine power, so other solutions will be required to achieve decarbonization. The off-highway sector can leverage passenger vehicle and commercial vehicle technology, benefiting from increasing scale and cost reduction, while ICEs face cost escalation and supply chain challenges. As a result of these factors, we will see a highly complex product mix involving BEVs, hybrid, biodiesel, renewable diesel, renewable natural gas (RNG), and more.

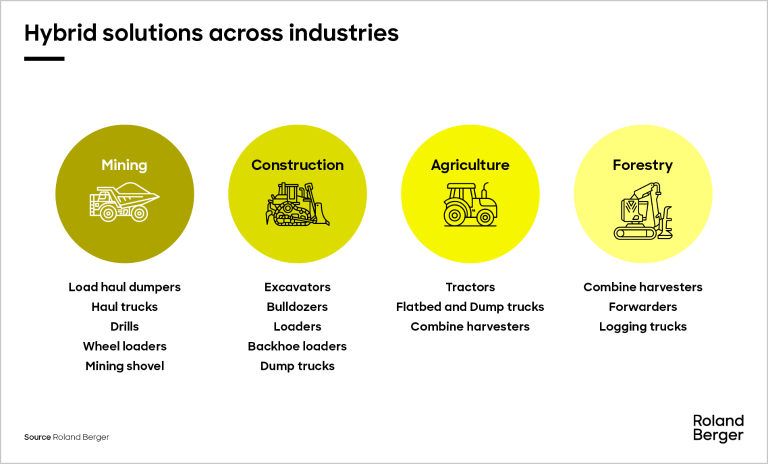

Hybrid solutions

Hybrid solutions are widely used as a bridge between ICE and ZEV in all vehicle systems, such as drivetrain, motion system and auxiliary systems. Hybrid is particularly relevant where certain conditions apply – for example, where the duty cycle requires high energy consumption and sustained operation, or where the work site lacks charging infrastructure or access to a reliable power supply.

Often, the transition to a full electric fleet would require substantial upfront investment. Hybrid systems additionally offer operational flexibility and the ability to accommodate power spikes. Applications range from the mining industry to forestry. Use cases that provide opportunity for energy recovery, such as mining trucks driving up and down an open pit mine or large excavators that need to accelerate and decelerate the boom movement, are most suitable for hybridization.

"If electrification mandates for commercial vehicles get delayed but fleets remain committed to their decarbonization targets, we can expect the adoption of a wider range of decarbonization technologies, including drop-in biofuels."

In addition to hybrid powertrains, biofuels such as biodiesel and renewable diesel are gaining attention in the off-highway segment, particularly for agricultural equipment. With battery-electric machinery facing the challenges already mentioned, plus the added drawback of increased weight leading to higher soil compaction, OEMs are exploring these drop-in fuels as alternatives.

Biofuels not only offer a pathway to decarbonize this hard-to-abate sector but also create demand for farm products like soybeans. This is especially relevant in the United States, where soybean exports are under pressure from tariffs, prompting farmers to seek alternative domestic markets for their crops.

Perspectives for 2025

The perspectives for the commercial vehicle and off-highway industry are shaped by the ongoing transition to low-emission solutions. In the coming years, we are likely to see the coexistence of multiple powertrains, including traditional diesel engines (fueled with fossil and biomass-based diesel), hybrid, and full electric solutions. Players will focus on providing the right solutions for specific use cases and requirements. This means hybrid solutions will continue to dominate in high-energy density, long, and rough-duty cycle use cases. At the same time, more fully electric equipment will be introduced focusing on compact urban applications. Mining trucks and equipment will increasingly adopt full electric powertrains due to emission regulations, fuel costs, and advancements in battery technology.

Commercial vehicle and off-highway players are likely to continue investing in battery and energy management, as well as smart fleet and autonomous vehicle technologies. Their aim will be to build a zero-emission ecosystem in their target segments. In parallel, we will see a collaborative approach to technology development, with cross-industry collaborations accelerating developments in batteries, fleet management, data-driven performance, and autonomous technology.

The commercial vehicle and off-highway industry will continue to face challenges related to infrastructure, cost, and integration, but the potential benefits of decarbonization and improved operator experience will drive progress. Companies that can navigate these challenges and capitalize on the opportunities will be well-positioned for success in the coming years.

Register now to to discover the latest insights, emerging trends and upcoming challenges in the EV and EV charging markets.