Roland Berger’s Aviation´s Roadmap to True Zero sets out a sustainable approach to eliminate climate effects from air travel.

Strategic pricing for airline sustainability

Leveraging revenue strategies to offset sustainability costs

International airlines are gearing up for a massive shift towards sustainability, facing hefty transformation costs in the coming decade. Governments worldwide are pressing for reduced carbon emissions, especially in the closely watched airline industry. Relying solely on increased ticket prices or absorbing costs won't cut it due to fierce competition and price sensitivity. Airlines must find ways to lessen the financial blow of sustainability transformations.

1. Sustainability costs – A massive challenge for airlines

1.1.Massive industry transformation towards sustainability ahead

The global society’s understanding to embrace sustainability throughout all facets of the world economy calls on corporations to mitigate carbon emissions and undertake massive transformations. Especially airlines are under pressure to make the sustainability transformation work, facing long-ranging changes over the coming decades. With massive costs ahead, airlines are struggling to embrace science-based targets and, partially, resort to only implementing those requirements mandated as per regulations.

1.2. Significant head-wind caused sustainability costs

Airlines, as one of the most closely eyeballed industries in terms of their climate impact, have defined emission roadmaps to drive their sustainabilitytransformation. This, however, inevitably requires significant investments and creates additional costs due to regulatory requirements (e.g., sustainable aviation fuels ) and investments into new technologies (e.g., fleet renewal, airplane modifications). And this does not even factor in any changes relevant to operations, processes and airlines’ organizations themselves which would add further costs.

1.3.Limited means to involve customers by commercializing sustainability

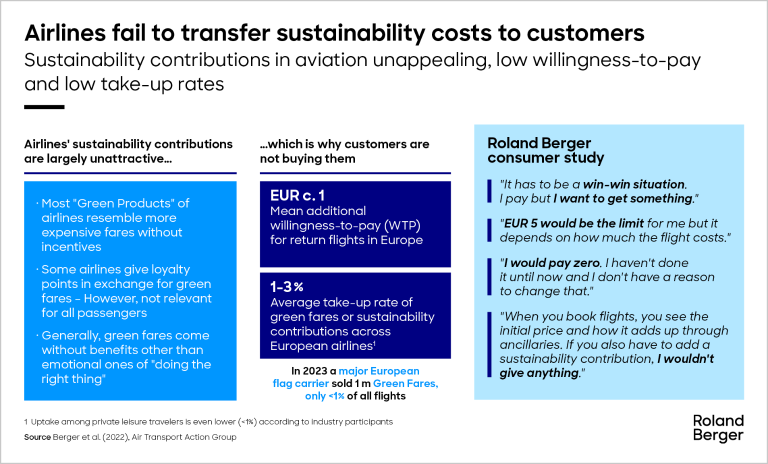

A change in the general narrative regarding sustainability shows that society, and as a result customers, would prefer to be part of the solution rather than the problem, expecting sustainability wherever they consume. Albeit still limited, customers’ willingness to contribute has not yet been captured by airlines’ commercial practices, as, oftentimes, it does not benefit their immediate travel experience. Most efforts extend solely towards airlines offering fares including emissions compensation mechanisms. Limited uptake of such offerings has been a hurdle for many players in the market despite ongoing efforts to tailor such offerings.

Alternative ways to commercialize sustainability through generally increased prices and fares come at the risk of alienating customers. Due to high competition, especially from low-cost carriers, aviation fares have been exhibiting increasing price elasticities over recent decades. With air travel evolving into a mass-market commodity, airlines’ ability to increase prices beyond competitive price benchmarks is limited to mitigate the impact of growing sustainability costs, resulting in a need for alternatives to generate revenue.

2. Taking control – Mitigating the cost impact through revenue-up levers

2.1.Gauge and anticipate competitive price developments

Leveraging market price increases as an initial Revenue-up lever

Over the next decade, regulatory requirements pertaining to carbon emissions reductions will cause massive costs for airlines. We have assessed the extent to which relevant players from within the airline industry will be exposed to increasing sustainability transformation costs. To do so, we have conducted an industry-wide assessment of the various adaptations necessary to fulfill regulatory requirements and, where applicable, requirements related to self-set science based targets.

Considering the price development of Sustainable Aviation Fuel (SAF), certificates (ETS and CORSIA) and fixed asset investments based on airlinespecific fleet sustainability performance, we are able to delineate the marginal cost individuals airlines will face from 2024 until 2030. Roland Berger’s unique dataset allows the quantification of market-price movements and airline-specific cost pass through rates until 2030.

Market price increases can only partially cover Projected sustainability costs

Knowing when and where market prices will move and how competitors might react to competitive price maneuvers empowers airline companies to take control, adopting new price regimes in line with dominant market motives. Our analyses, however, reveal that cost pass through rates driven by market prices will not be enough to close the gap of the impending sustainability transformation costs.

We have devised various scenarios in which competitive moves come into play, whereby individual airlines with higher profitability might take advantage of the cross-industry cost increase to keep prices lower than competition and, thereby, capturing market share. Our initial analyses forecast that scenario dependent estimates would see only about half of the sustainability costs being covered through general market prices. Hence, further revenue-up initiatives are needed.

2.2. Appeal to customers’ willingness to pay for sustainability

Current practices in the airline industry fall short: Pure reliance on emotional appeals

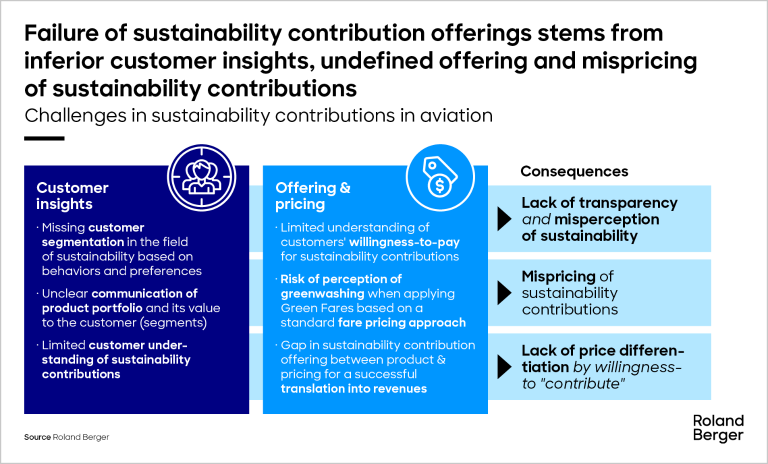

While customers’ increasing awareness of sustainability is undeniable, their actual willingness to pay for sustainable products is lagging behind. Many airlines offer customers a way to pay a voluntary contribution to mitigate the climate impact of their travels. Currently, such contribution schemes rely on customers’ urge to “do the right thing”, a purely emotional motivation. Emotional motives, however, are often outweighed by the very costs of such voluntary contributions (e.g., additional SAF purchase). Thus, despite increasing environmental awareness and concern, participation in contribution schemes remains low; a clear indicator for a significant attitude-behavior-gap in customers’ willingness to pay for sustainability.

Understanding customers’ perception of Sustainability features

Airlines fail to realize which sustainability features (e.g., SAF-induced flights, waste reduced flights, sponsored offsetting projects) customers are willing to pay for. Additionally, companies struggle to commercialize sustainability as part of their value proposition, leaving the burden of high transformation costs with the company, damaging their bottom line. To guide corporations on their quest to identify ways to commercialize sustainable products, it is relevant to answer, among others, the following questions:

- Which sustainability features do customers perceive as most impactful in reducing emissions?

- Which sustainability features drive customers’ willingness to pay?

To identify the levers driving willingness to pay for sustainable products is at the core of the Roland Berger approach. Knowing which sustainability features customers perceive as worth paying for, companies can adjust their pricing accordingly. A gap analysis can be used to reveal underpriced products, offering revenue-up potential.

Turning the conversation around: leveraging Rational appeals

Sustainability is still a comparably weaker purchase motive for airline passengers, as our recent studies indicate, especially when compared to main motives such as price, brand, and value. Hence, airlines need to change the conversation around sustainability in order to motivate the entire range of customers to contribute to a company’s sustainability transformation.

Instead of positioning sustainable (and oftentimes more expensive) products as a means for customers to do their “fair share”, sustainable behavior should “pay off” for airline customers. We coined sustainability contributions as a way to rationalize sustainability payments, granting customers tangible benefits in exchange for such contributions that render their travel experience more convenient and enjoyable. Reconciling both emotional and rational motivations at the same time, sustainability contributions can reduce cognitive dissonance especially for those customers with rather low sustainability awareness. To implement sustainability contributions in the most effective way, however, consumers’ needs and preferences need to be known so as to be able to provide real value for customers.

Using proven pricing methods, Roland Berger identified a sweet spot in which sustainability contribution schemes can thrive. Recent studies of ours have shown that asking customers for sustainability contributions of a certain value as part of the general book flow while granting unique services and benefits in return may well appeal to 75% of an airline’s customer base taking up such sustainability contributions. Identifying the right services and benefits that provide high value to customers while only requiring little production costs can generate significant liquidity for an airline’s sustainability contributions.

We would like to thank Dr. Severin Bischof and Max-Gerrit Meinel for their significant contribution to this article.