The German export industry needs answers to global crises

How Germany can defend its export-based business model even in times of uncertainty

The German economy is facing its biggest challenges since the end of the Second World War. Following on from the Covid-19 pandemic, the Ukraine war has further increased the pressure on raw materials prices and exacerbated the supply situation, bringing the vulnerability of our globalized world painfully to light. Added to this are rampant inflation, rocketing interest rates and the growing fear of a possible recession that is worrying many industry players. For export-dependent industries, this is a particularly onerous development – it means companies must prepare now for lasting changes if they are to remain competitive in the new normal.

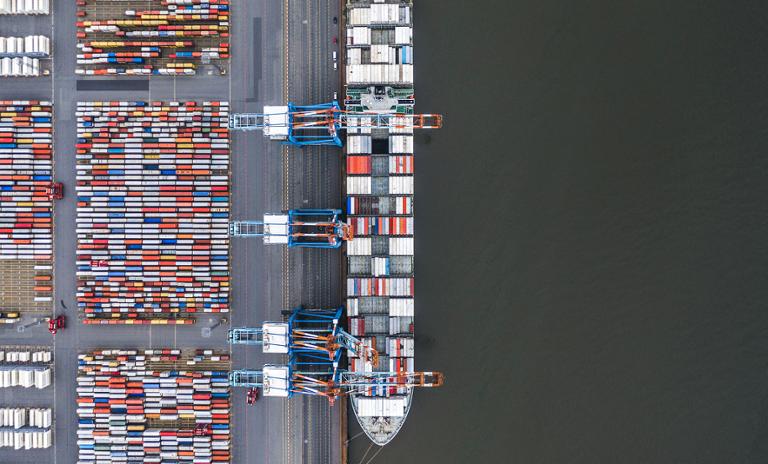

Germany is the world's largest export nation after China and the USA. In 2021, Germany exported goods to the value of almost 1.4 trillion euros and services worth more than 320 billion euros – equating to a total export ratio of around 48 percent. By comparison, the corresponding figures for Italy and France were 33 and 30 percent, respectively. The German economy's dependence on the global world market has never been so high – exports are a key pillar of the country's economic development. This is also reflected in employment, with one in four jobs in Germany dependent on exports. After the eurozone, which marks the destination for almost 38 percent of Germany's exports, the USA and China are the country's biggest trading partners. However, there are growing signs of stagnating or even declining economic activity in Germany's key export markets. That is because the global economy is now struggling with high inflation rates, ongoing supply chain problems and exposure to the effects of the Ukraine war, such as sanctions, counter-sanctions and rising prices for energy and primary products. Against this backdrop, forecasts for economic growth in key regions and countries have already been revised downward several times. The OECD organization of industrialized nations expects the US economy, for example, to grow by just 1.5 percent this year (September 2021: 3.9 percent) due to rising uncertainty – and only 0.5 percent growth is forecast for 2023. The OECD puts China and the eurozone on a downward trajectory too – the corrected growth rates for 2022 now stand at 3.2 percent (down from 5.8 percent) and 3.1 percent (down from 4.6 percent), respectively. The trend is not expected to turn in 2023 either: For the Chinese economy, the OECD's experts anticipate growth of 4.7 percent, and a mere 0.3 percent for the eurozone. The significantly gloomier export prospects for companies in Germany are reflected in the overall figures for the country, the OECD having revised its forecast for gross domestic product (GDP) growth in 2022 down from the original 2.9 percent to 1.2 percent. GDP is even predicted to fall by 0.7 percent in 2023. Only marginally more optimistic is the forecast of Germany's leading economic institutes in their latest autumn report: They expect GDP to fall by around 0.4 percent.

"The skyrocketing costs of gas and electricity are putting German companies at a competitive disadvantage that threatens their very existence. Despite the government's 200 billion bailout, a great many companies will have to fundamentally adapt their energy-intensive value chain."

Diversification to replace deglobalization

The gloomy economic outlook for key exporting nations and the persistently high energy and raw materials prices will continue to have a significant impact on Germany's further economic development for the time being given that there is no end in sight to the various crises (Ukraine, geopolitical situation, energy, inflation and interest rates). In particular, rocketing energy prices are now threatening the very survival of some companies. Many are unable to pass through the high production costs to their customers to the extent they need to. Exchange rate fluctuations remain a risk factor that is hard to predict. The steady devaluation of the euro against the dollar for the past several months is making imports more expensive, which is particularly noticeable in the case of energy and raw materials. If the trend continues, it risks further exacerbating inflation.

Either way, companies with high export shares, such as those in the automotive , mechanical engineering and chemical industries, will have to become more flexible and resilient in the face of future crises and adapt their business models as well as processes and structures to the new conditions under which they will be operating. Both operational and strategic measures will need to be taken.

Besides fundamentally improving efficiency, for example through higher levels of digitalization in core functions, companies will above all need to significantly reduce their dependency on single suppliers and individual countries. Diversifying sales markets and the supplier pool with an eye to the future while at the same time forging new partnerships will make their business model more resilient and enable them to build more stable and robust supply chains. Adjusting the product portfolio towards products that require less input (energy, raw materials, etc.) and substituting scarce raw materials for more readily available ones can also help businesses sustainably optimize costs and thus protect margins.

Developing new markets despite the disruptions in world trade

To be in a position to grow even in times of crisis, companies would be well advised to keep their focus on the domestic market and continue to build on their existing strengths here. For small and medium-sized enterprises (SMEs) in particular, the domestic market is an important pillar for revenues and profits in volatile times. At the same time, businesses should reduce their dependencies on individual export markets and work on developing new markets. Firms with a strong brand and a clear USP can drive the internationalization of their business with their existing product lines. For companies in highly competitive industries, on the other hand, it makes sense to diversify the product portfolio. But building networks within the industry and making use of platforms are also suitable ways for players to open up markets on their own, especially in an uncertain market environment. That is because partnerships or cooperative ventures will enable them to achieve economies of scale faster and more sustainably and to mitigate risk.

Irrespective of the current high level of uncertainty in world trade, companies with a high export share should maintain their business relationships in key export markets – where necessary with the temporary implementation of a leaner setup by flexibly adjusting (production) capacities to match demand levels. This will enable them to hit the ground running in the export market when the economy recovers.

Scenario planning for successful crisis management

The multiple crises we have seen since the start of the Covid-19 pandemic have turned customer needs and supply chains – as well as conventional forecasting methods – on their heads. Companies often lack the tools and fundamental processes to make informed decisions and react to changes fast. To cope with the increased dynamism in the markets and the growing complexity, a new approach to planning and monitoring (operational) developments is needed. Plans must be reviewed more frequently and adapted flexibly to whatever new situation has arisen. Consequently, linear planning models that extrapolate the present into the future are no use. Instead, companies will need to plan their strategy with the help of scenario analysis in order to uncover opportunities and risks more quickly and make them more transparent. That is the only way they will be able to make key strategic decisions and build in the necessary adaptability to make their business model more resilient. And that is essential for all companies – to make them able to successfully navigate through crises, now and in the future.

Register now to download our joint study "Compass for Germany - Pressure to act in uncertain times". You can find numerous articles on the current "state of the nation" as well as the global crises and their impact on companies and the economy.