EV Charging Index: Expert insight from China

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/23_2077_art_ev_charging_index_deep_dive_china_cover_download_preview.jpg)

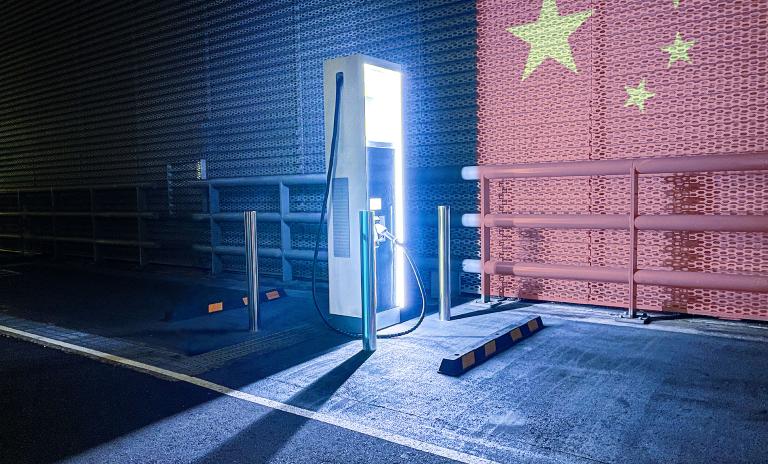

Amid soaring EV sales, China’s charging infrastructure is struggling to keep pace. Read more about Chinese e-mobility in Roland Berger’s EV Charging Index 2023

By Ron Zheng and Jack Zhuang

China’s EV market maintains its impressive growth amid increasingly stiff competition between domestic and overseas OEMs. While well above average, its public charging infrastructure is struggling to keep up, however. Meanwhile, Chinese OEMs and charge point manufacturers are looking to expand their international presence.

China continues to perform well in the global electrification era. Its EV sales penetration rate rose from 25% in H1 e2022 to 29% at the end of 2022, significantly outperforming the global average of 16%. The country’s initial period of fast growth between 2020 and 2022 was largely down to government policy, but future EV development in China will be driven by a variety of factors. Increasing adoption of 800V fast-charging technology, upgraded battery swapping and a return to normal for the price of battery raw materials will further reduce customer range anxiety and upfront purchasing costs.

In China, nearly 300 BEV models were available in 2022, with that number expected to continue rising. As choice expands, Chinese consumers are giving greater priority to driving and customer experiences such as charging ecosystems and aftersales. Excelling in these areas is becoming key to attracting more customers. Cost is still important, of course, and OEMs have entered a fierce pricing war in China. To tap into international growth potential away from the pressures of the domestic market, many Chinese OEMs are also now pursuing a more global sales strategy.

The same goes for charging companies. Compared to their European and American counterparts, Chinese players can offer first-mover and cost-efficiency advantages. Since 2022, major domestic charge point manufacturers have made progress in overseas standard certification and are opening up new markets.

While EV sales are continuing to rise, China has not enjoyed the same level of success with its charging infrastructure. Its vehicle-to-point ratio for public charging is 7.1 – much better than the global average of 15.9 but still some way off the top performers (1.8). What’s more, this ratio has actually increased since 2021, implying that the expansion of charging infrastructure is failing to keep up with the China’s soaring EV sales and car parc.

EV drivers in China still face charging issues, including distribution of charge points in certain areas, downtime due to insufficient maintenance and low charge speeds. After a period of fairly chaotic growth, China is now taking a more refined approach to charge point installation. It aims to avoid wasted resources and better harmonize supply and demand. The number of public DC chargers is now growing faster than AC chargers.

Expansion and sharing are the main themes for Chinese charging players. Leading operator NIO upgraded its battery swap stations earlier this year to enable faster, more efficient swapping and make it a viable alternative to charging. The company also plans to open more than 100 swap stations in Europe in 2023. What’s more, NIO is looking to branch out into cross-brand cooperation. But to establish ‘battery-as-a-service’ in the swapping model, a unified and complete standard system must first be established. Issues with reliability and connectivity need to be carefully addressed during this transition.

Tesla and local auto OEMs like Zeekr, XPeng and Aion have all decided to open up their own charging networks to other brands. Together with local partners, premium overseas OEMs are also becoming increasingly engaged in setting up their own charging networks in China. Audi China, for instance, has more than 75 high-speed charging stations in 25 Chinese cities, including Beijing, Shanghai, Guangzhou and Shenzhen. A high-quality branded charging experience can help OEMs enhance the overall driving experience for their customers.

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/23_2077_art_ev_charging_index_deep_dive_china_cover_download_preview.jpg)

Amid soaring EV sales, China’s charging infrastructure is struggling to keep pace. Read more about Chinese e-mobility in Roland Berger’s EV Charging Index 2023

Sign up for our newsletter and get regular updates on Automotive topics.