Outlining the key challenges and identifying the key enablers to drive the low carbon hydrogen ecosystem forward in the Middle East.

Value capture in green hydrogen

How business models will develop in the emerging hydrogen market

The path to climate neutrality and the energy transition away from relying on fossil fuels is at the top of the agenda for more and more companies around the world. Green hydrogen is the key to decarbonizing sectors that cannot be electrified. As with any emerging market, the value chain for green hydrogen projects is not fully structured at the moment. However, companies currently have the opportunity to help shape the industry and secure a leading role for themselves by the end of the decade.

_image_caption_none.jpg?v=813901)

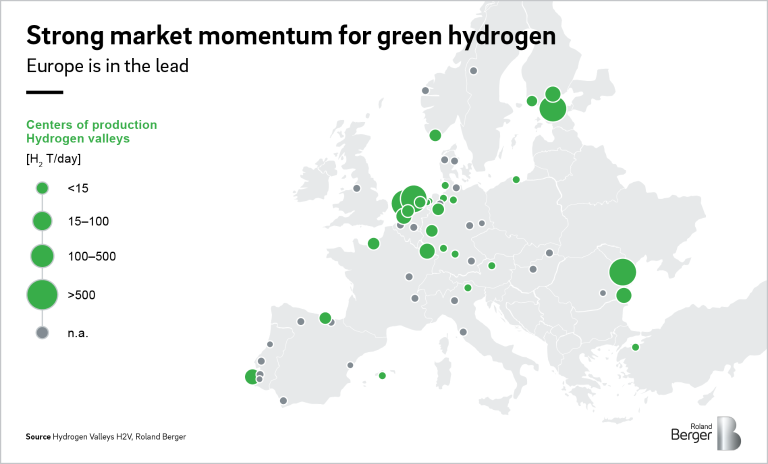

Production centers and international trade routes of the future

Green hydrogen - also referred to as "green H2" - is produced using renewable or low-carbon energy sources to split water into its components through electrolysis. Green hydrogen and derived products are on the rise. To decrease their emissions and increase their energy sovereignty, many countries have developed strategies to introduce green hydrogen.

By 2030, the market will grow strongly due to incentives offered by the governments of the European Union, the United States and Asia, combined with falling costs of production. After that, the market will most likely be self-sustaining. In this context, Europe will play the role of a green hydrogen importer and a major demand center in global hydrogen supply chains. Oil and gas companies, steel companies and manufacturers of synthetic fuels have a great interest in green hydrogen.

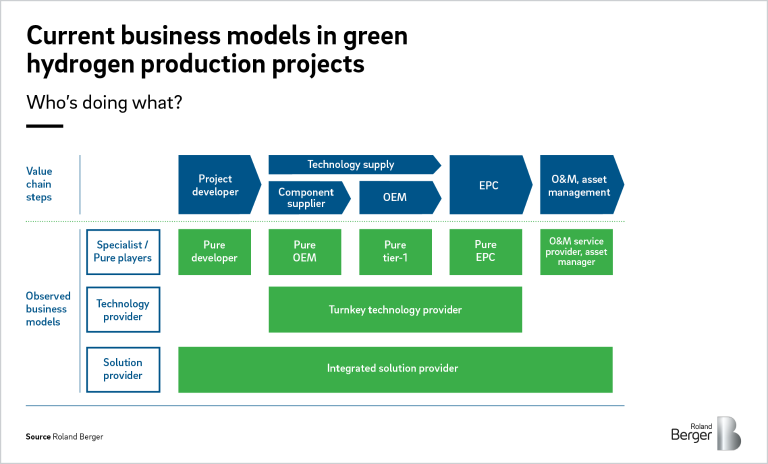

First business models are evolving

Although the potential of green hydrogen is high, there are currently no strongly established business models or standard structures on the market. Many international players are only participating in various projects to gain experience and share potential risks with other stakeholders. However, as the market matures over the next few years and companies better understand project risks and profit pools, we believe they will adapt their business models to capture more value and be successful in the long run.

Choosing the right business model will be essential. Companies across different sectors participating in the green hydrogen industry need a model that is right for them because there is no one-size-fits-all solution. A key factor in this context are the capabilities that are relevant for the hydrogen supply chain, gas supply chain or project development in general. In addition, it depends on what resources the companies have in these areas and whether they can form partnerships with differently positioned players to jointly cover several links in the production chain.

Beneficiaries of the green hydrogen market

For green hydrogen projects, market participants currently still have to reckon with high capital investments and increased risks, as the market is still in the growth phase and the technology is not yet mature. We expect business models to converge in the upcoming years along the lines of the traditional roles found in energy infrastructure projects. This is because the structure and customer preferences of green hydrogen projects are similar to those found in the energy market in general. The development of green hydrogen projects requires the mobilization of international market players to play one or even multiple roles, for example in project development, financing, engineering procurement and construction, operation and maintenance, or asset management.

In the future, which business model is most profitable will depend on the project type. Many factors will be decisive, such as access to renewable energies, willingness of the off-taker to be involved in hydrogen production, the pace of innovation, and the decline in costs for hydrogen transport and storage.

In our latest Roland Berger report – "How to capture value in the emerging hydrogen market" – you can find the most recent research results and expert assessments on the opportunities and risks for international market players, as well as the development potential of green hydrogen in the upcoming years. Below you can download the insightful and comprehensive report.

Register now to download the full PDF including key insights, new developments as well as future challenges and new opportunities regarding the business models in the emerging hydrogen market.