The Butterfly Principle

Transitioning to the 'new normal'

Ask a historian and they'll tell you that the plague epidemic that ravaged Europe in the 14th century was a catalyst for modernization. It is at first blush strange to think that without the Black Death, Europe would not have become the global powerhouse that dominated the world for centuries. Extreme global cataclysms have a tendency to dissolve structures and undermine systemic persistence within society, economy, culture and science. This opens the way for a metamorphosis, a comprehensive, profound advancement. This process is much more than a transformation – it is the quantum leap to a new epoch, a worldwide transition.

Just to be clear, there is nothing the slightest bit good about the Covid-19 pandemic that currently has the world in a stranglehold. But the question is, can we counteract the effects of this crisis in such a way that when it ends, we move into a better, more conscious and more efficient world than the one we were in before? Can we use the unfreezing of structures to finally implement radical solutions? Can we at long last accelerate transformation processes that we have not yet tackled with sufficient determination – especially digitalization, sustainability, agility, ecosystem-based business models? Can we organize the transition to the new normal in such a way as to quickly overcompensate for the welfare losses of the recession caused by the pandemic?

The window of opportunity is here: Seize the chance

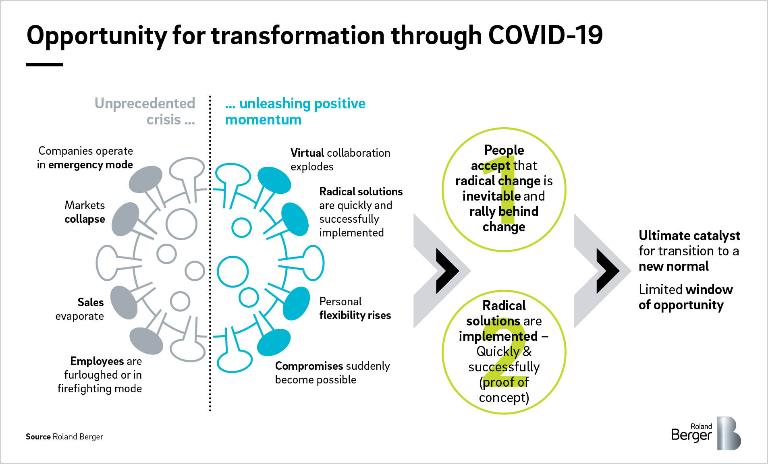

Such questions arise at the societal level. But they are the same questions that present themselves for almost every company in every industry. And they must be answered quickly. During the crisis we have been gaining experience as if in fast forward. We have seen many things on which we had made no progress for years suddenly become possible and radical solutions be implemented quickly and successfully.

On the one hand, the understanding and acceptance of far-reaching changes is high in the acute "unfreezing" phase as everyone rallies behind change. At the same time, the many opaque stakeholder interests, the securing of comfortable positions, the micro-political games have all been stripped of their basis, however briefly. For decades, they were what prevented radical solutions from being subjected to any kind of practical test in the real world. Now they have been superseded by a powerful global appraisal under extreme conditions. And suddenly you see that it works.

Both aspects together can serve as a catalyst for the transition. But if the implementation is not fast and decisive enough, commitment will wane. The window of opportunity for actively managing the transition will not remain open forever. Structures tend to freeze up again before too long and prevent radical change.

Radical solutions: We walked over hot coals and did not get burned

Let us look at some radical solutions that have been implemented during the crisis in regard to business, work organization or private life and which have already proven their worth – despite years of skepticism in some cases. In the healthcare system in particular, an area that was generally considered inflexible, over-regulated and complex, completely new processes have been implemented in short order. These include online doctor's appointments and online sick notes, or dramatically accelerated drug approvals among many other things.

E-commerce, which never took off for several product groups in many regions, has rapidly become routine almost across the board and is a trend that's likely to persist. The integration of VR headsets, not only for narrowly defined use cases but even for comprehensive coordination and cooperation processes, has been successfully tested. Shift models in completely new areas, e.g. administration functions, and remote working models have proven to cause virtually no social disintegration, quality problems or performance degradation. On the contrary, in many cases the intensity of cooperation and cohesion within teams has improved. After a few weeks in quarantine, we're wondering why it took us so long to realize that not every important meeting requires numerous participants to fly in from all over. It turned out that sales reps can also sell their products and services successfully in virtual customer meetings. This allows us to look at the optimization of sales processes and salesforce dimensioning through a completely new lens. The question of what interactions with which customers and which leads could now be virtual – and thus significantly cheaper and less time consuming – becomes a completely new control lever for the sales organization. Even in places where visiting the customer on site was previously regarded as indispensable. Virtual training and online university lectures have also passed the acid test. Of course, this is not all going to happen without there being some severe difficulties around adaptation. And certain organizations, schools for example, are struggling with digitalization. But our society is nevertheless making progress and discovering new ways of doing things and uncovering new potential. Welcome to the new normal.

The different forms of the new normal

The new normal does, though, have a number of different faces. It depends on the structures present within a given industry, on the markets, on customer behavior, even on the degree of government regulation. Whatever general trends can be identified today must therefore be viewed and interpreted through the specific lens of the sector concerned. The following three examples show how business models in discrete manufacturing industries with complex value chains each need to be reset in very specific ways.

Mechanical engineering – Even before the coronavirus crisis, the engineering sector was already severely challenged by disruptions taking place in the automotive industry, by digitalization, protectionism and increased global competition. Margins have been falling continuously , and the industry's share of world trade has shrunk. The shock of the pandemic simply turbo-charges this trend. In a post-Covid world, Europe's mechanical and plant engineering sector will have to redefine itself. We can expect to see the industry caught between progressively losing relevance (as it is displaced from electric drive production, for example) and increasingly focusing on value chain niches. With investment budgets tight in the present situation, some players will disappear from the market or will need to turn to partners to help them reposition their business to secure their market presence. As a result, they will either become M&A targets or be subsumed into the ecosystems increasingly forming around global technology and engineering groups. Only a few mechanical engineering specialists have the potential to become global players with their very own ecosystem, and when that happens, it'll always be on a limited scale. In order to successfully walk this path to the new normal, we in the industry must radically challenge pretty much everything we've ever known: starting with strategy and product portfolio, and moving on to digital capacities, R&D structures, talent management, partner management and even our culture, nay, our self-image.

Aviation – The aviation industry, which has been hit by unprecedented global restrictions on air travel coupled with extreme demand volatility, must gear itself up for an upheaval the like of which it has never seen. For years, aviation had been an increasingly challenging and complex market in which to operate, with bankruptcies, M&As and state intervention constantly on the rise. But the new normal that emerges after Covid-19 will reinforce this trend to a radical degree. A collapse in business travel meets a slump in private travel. New remote working practices, perceived health risks, safety regulations (reducing the number of passengers per aircraft, for example), a reluctance among businesses and individuals alike to spend money, and a social mindset that is increasingly skeptical about air travel – these will be the conditions facing the industry after the pandemic. In this difficult situation, aviation players will also have to deal with severe liquidity losses and operational challenges. The resulting pressure will fundamentally alter the market constellation. The industry will have to develop a new positioning and value proposition within the global value chains and travel & mobility ecosystems.

Automotive – Even before the pandemic hit, the automotive industry was already in the midst of the greatest upheaval in its history. The effects of the coronavirus crisis will massively accelerate the trends the sector has been grappling with in recent years. From a political perspective, electric vehicles might well be subsidized and promoted worldwide, which will radically change the competitive landscape. The role of software in the car is also growing exponentially, paving the way for new, ecosystem-based business models. In this changed constellation, OEMs as well as leading suppliers will have to reinvent themselves. They may see their global reach decline, primarily due to the political conditions and financial constraints they face. At the same time, margins will shrink as consumers become less and less willing to pay for the product and their interest in affordable and smart vehicles increases. On the other hand, there will be more and more competition as players strive to occupy the leading roles in mobility ecosystems, into which we will ever more frequently see the incursion of tech giants with very deep pockets. The very first task for the automotive industry is to define its role in this new normal .

Breeding a butterfly: Four steps to metamorphose your business

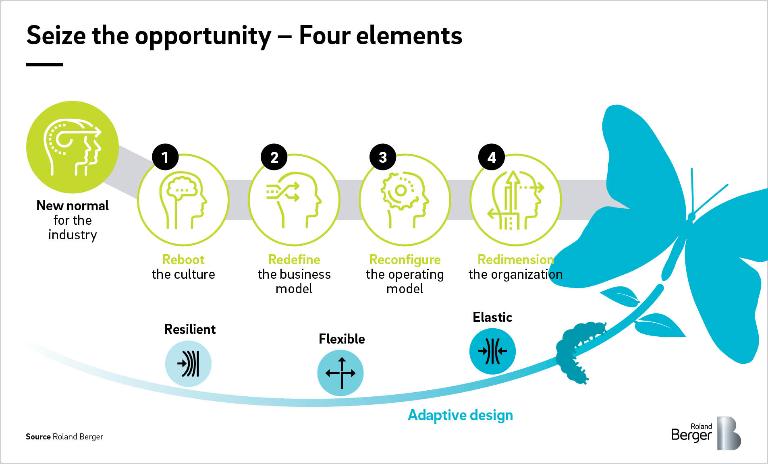

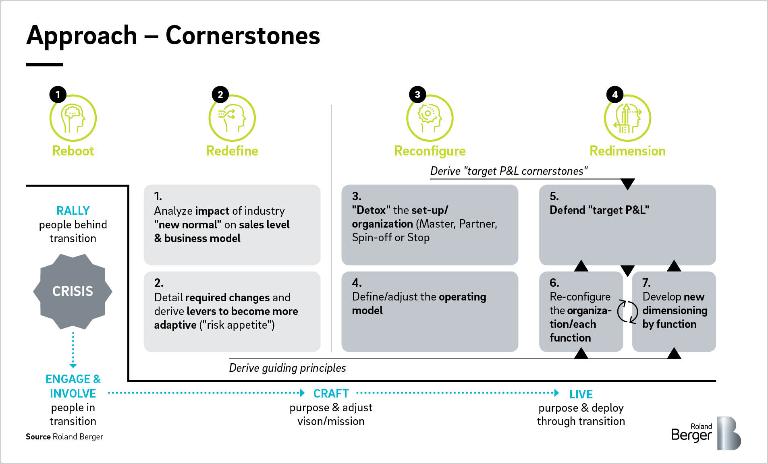

So, what is to be done given this new normal and the pressing need for action? Roland Berger has developed a four-step framework for companies to successfully take full advantage of the unique opportunities and embark on a smart and determined transition. We focus on four elements, each of which will be specific to each company and each industry.

1. Reboot purpose and culture

Transitioning into a new world leaves no part of the company and barely a role in the organization untouched. You must therefore start by initiating a permanent change of culture and mindset. A butterfly and a caterpillar do not share the same mindset. But what must happen for one to become the other?

First, you'll need to convince a broad swath of the organization that the transformation offers enormous potential – for the business and the employees alike. So you must make use of people's openness and their willingness to change the current order. That is a prerequisite for breaking open ingrained structures and creating a new, cost-conscious and performance-oriented culture and a common sense of purpose.

Such purpose and culture are indispensable, because challenges will abound on the road to the new normal. Even more important is the realization that the new mindset, not to mention the requisite level of commitment, cannot be dictated from on high. It must be based on real conviction, a shared understanding of where you're going and how you're going to get there, and it must be built on intensive communication and open exchange.

2. Redefine the business model

To be able to act, we need to understand what the future into which we are moving will look like. On the one hand there is the social and cultural dimension. Nobody can yet predict with any degree of accuracy how that will turn out, but it could manifest itself in many aspects, be it a stronger role of the state, greater willingness to share data, growing altruism and interdepartmental cooperation, or changes in consumption habits, health behaviors, leisure activities or the ways in which work and education are organized. On the other hand, the economic dimension will also be massively impacted. There will be new and different standards, each industry specific and each requiring business models to be reshaped in discrete ways. So your business model will need to be examined from several perspectives: What level of revenue can be expected? How quickly will the expected revenue level be reached? What are the implications for the existing business model? What changes are required?

3. Reconfigure the operating model

Based on the picture we'll have gained of the new world, we then need to ask ourselves what role we want to play in this world. What should the central business model be? And to drill down a good deal further, what are the implications for our operating model? How should we reconfigure the organization as a whole as well as each separate function – the production network, the purchasing footprint, the engineering setup? This goes way deeper than the classic make-or-buy decision. Along the lines of what we explained in our "Detox your business" publication, companies operating in the post-pandemic world should focus exclusively on activities within their sphere of competency, things they are in a position not just to "make" but to "master". Moreover, considerations shouldn't just focus on a single function but must take in the entire organization end to end. This new approach suggests that businesses need to detox their business operations in order to move towards a new level of operating model.

This is a process that comes with serious consequences for your operating model configuration, be it production footprint, purchasing network, or engineering setup.

4. Redimension the organization

Once these steps have been taken, discussions should focus on what resources will be needed and how the organization can be right-sized to realize a business and operating model geared to the new normal.

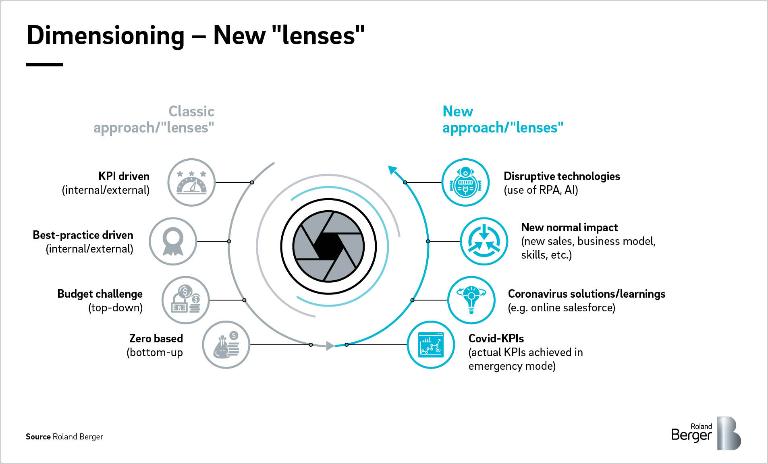

A raft of new questions will arise based on the experiences you'll have had in the course of the pandemic: Can we build on what has worked surprisingly well in emergency mode, only adding in what's absolutely necessary? What resources are essential for our survival? And what additional resources do we need to attain the "new normal" revenue level and operating model configuration?

Against this backdrop, we think business owners should look at their organization through a series of new lenses. The practical experience you'll have gained in operational crisis management, in interpreting and analyzing developments and identifying methods of dealing with them can be helpful in discussing the right focus and dimensions for the organization more effectively and objectively, ultimately enabling you to arrive at better quality decisions and achieve stronger buy-in from relevant stakeholders. As explained in our publication "Purpose", for many companies a strong 'purpose' can become a game changing element in reboot the culture.

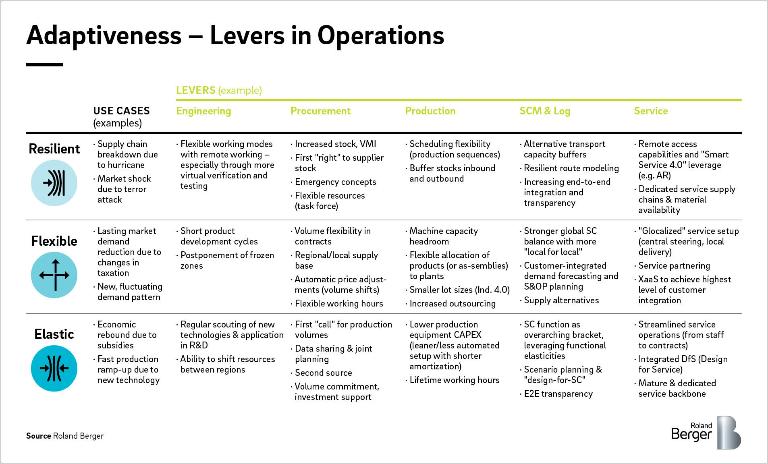

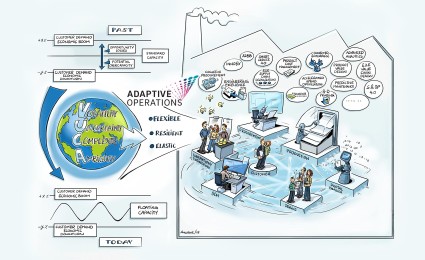

The end point of the transition: Adaptive organizations

The path to a new normal can therefore take different routes. The actual route will depend on which industry we're talking about and what the market and company structure look like on the ground. These specifics are what determine how our framework should be applied in detail. But for all the differences, all paths point towards one thing in common, a common vision of change. At the end of the transition, an organization must emerge that is better able to cope with the challenges arising from the VUCA world, an organization for whom adaptiveness is hardwired into its DNA. In our view, adaptive organizations necessarily combine three particular elements. First, resilience, being able to cope with sudden changes without becoming unable to deliver on your promises. Second, flexibility, being able to seamlessly adjust to fluctuations and medium-range changes in demand. And third, elasticity, being able to scale your business and capable of bouncing back fast if you experience, say, a sudden, steep increase in demand. These three dimensions are reflected in different ways in how the individual corporate functions should ultimately be designed. As increasing adaptiveness comes at a certain cost, companies must consciously decide how much they are willing to invest to make their company more resilient, flexible and elastic.

Adaptiveness, meaning the combination of resilience, flexibility and elasticity, had already become a core requirement in the VUCA world we faced before the current crisis. A world in which you have to float like a butterfly to roll with the punches. The Covid-19 crisis shows us that our highly connected and hugely accelerated world is even more fragile than we thought – it illustrates just how vulnerable the engines of our growth are to unexpected shocks.

We should do everything we can to be better prepared for the future. It is time for a transition – time for a metamorphosis.