Your path to tomorrow, today

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/tam_future_cover_en_download_preview.jpg)

The actions of the present lay the foundations for the future. What does this saying mean in turbulent times? Consider a mix of solidity and flexibility!

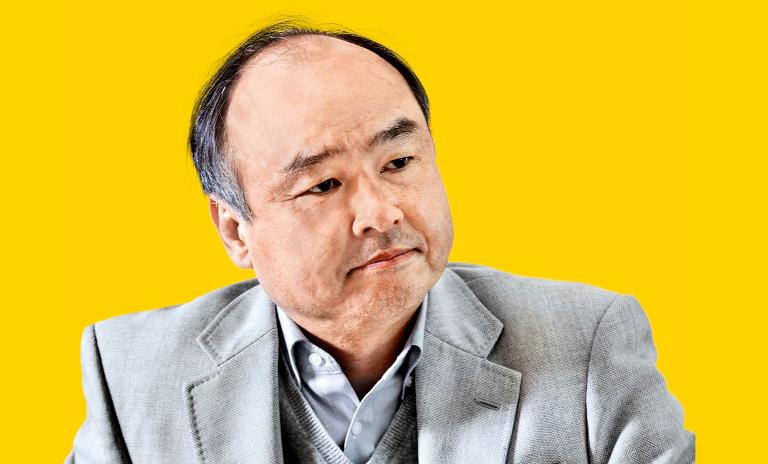

He may come from humble beginnings, but the Japanese self-made billionaire Masayoshi Son keeps surprising the world with his bold bets on emerging tech trends and an unusually long-term vision that keeps the SoftBank founder and CEO thinking 300 years ahead.

When it comes to big bets in the technology world, they hardly come any bigger – or any bolder – than those made by Masayoshi Son, the at times eccentric founder and CEO of SoftBank Group, a multinational holding based in Tokyo. From the consumer web and mobile networks to the internet of things and the rising gig economy, Son keeps making his mark on emerging tech trends with an investment strategy that's as much driven by his intuition as his unique vision for the future. The 61-year-old Japanese businessman has gone on record saying he thinks three centuries ahead. With that kind of ultralong-term perspective, it's perhaps not surprising that he named his investment operation Vision Fund. Launched in 2016, it has $100 billion under management, making it the largest fund ever raised.

While some people have declared him simply crazy, Son himself admitted something similar in an interview with Bloomberg TV. With a smile, he explained his vision as a single bet on the concept of "singularity," the moment when artificial intelligence becomes smarter than the human brain, something Son strongly believes will come to pass within the next three decades. All of his current investments, one might argue, are preparing for that future. So, whether you are a fan or a critic of this self-declared visionary, with capital thrown around at a scale dwarfing the budgets of many countries and with SoftBank driving the valuations of companies into uncharted territory, it is worth looking at what makes Son – and his long view – tick.

"The big game today is about the internet of things and artificial intelligence."

Masayoshi Son grew up in a Korean immigrant family on the Japanese island of Kyushu. "Son had a difficult childhood and youth, with Japanese kids throwing stones at him and discriminating against him," says Eurotechnology Japan CEO Gerhard Fasol, who has been interpreting Japan's tech landscape for outside investors for the past 35 years. He adds that traditional Japanese executives still cast a wary eye on Son's rise and, in private conversations, will add "but he’s Korean" to detract from his success. Son was an avid reader and, at 16, he was fascinated by a book written by Den Fujita, the founder of McDonald's Japan. He wanted to meet him, so he called Fujita's assistant 60 times. When he was finally granted a 15-minute audience with the entrepreneur, he asked what line of business he should choose. Computers, he was told. So Son went off to the University of California, Berkeley, to study computer science and eventually major in economics.

Back in Tokyo, Son founded SoftBank in 1981 at the age of 24. Since the connected world was in its infancy, Son settled on the internet and the mobile internet as the trends of the future. Starting in the 1990s, SoftBank started to place bigger bets, investing in companies like Yahoo! Japan and Vodafone Japan, which eventually became SoftBank Mobile. His biggest and – to this day – most famous gamble came in 2000 when he invested $20 million into the fledgling Chinese e-commerce site Alibaba. The intuition paid off. When Alibaba went public in 2014, Son parlayed his stake into $60 billion.

When the dotcom crash struck in 2000, it wiped out some $70 billion of Son’s wealth. "Somehow," he recalled in an interview, "I survived," and by 2019 he had fought his way back to rank number 43 on the Forbes list of the world's billionaires. His success, argues Fasol, is at its core an arbitrage game. "Son realized that the tech industry and its business models were more advanced in the US compared with Japan and China, and he invested in that time lag. Now that the knowledge has balanced out, he has changed his approach. The big game today is about the internet of things and artificial intelligence.

Paul X. McCarthy, an Australian innovation and digital strategy consultant, has devoted a chapter in his book "Online Gravity to SoftBank" as one of eight really global companies dominating the internet economy alongside Google, Facebook and Alibaba. He agrees that Son's vision has paid off. "What he has understood is that since the rise of the web, the new technology has changed economics," he says. Son grasped how competition had changed early on. "In the past, in each country or segment of the economy, you had a number of dominating companies, but also challenger companies like Coca-Cola and Pepsi." Nowadays, he adds, being number two is already a problem. "Just like in our solar system, in the world of business we are nowadays left with either planets like Facebook, Amazon or SoftBank, or with small satellites and niche operators. There is not much left in the middle, just like in outer space. Such are the forces of online gravity," says McCarthy.

Famously having lost more money than anyone else in history during the 2000 dotcom crash – an estimated $70 billion – Japanese business magnate and investor Masayoshi Son is still ranked as one of the richest men in Japan with a net worth of $23 billion. He is the founder and current CEO of Japanese holding conglomerate SoftBank, the CEO of SoftBank Mobile, current chairman of US-based Sprint Corporation and chairman of UK-based Arm Holdings.

It's all about scale and winners need to create platforms or ecosystems of businesses that help each other beat or swallow up more and more of the competition like the gravity of a new planet aggregates intergalactic dust. It’s a useful metaphor to understand Son’s biggest endeavor. His Vision Fund pulls together companies of seemingly unrelated expertise, among them the British chipmaker Arm Holding (which SoftBank had acquired in 2016) and newer entrants with less proven business models such as co-working company WeWork and ride-sharing phenomenon Uber, complemented by dozens of startups in AI, robotics and automation. The fact that Son's gargantuan Vision Fund has cobbled together such a peculiar solar system and, so far, kept its parts together speaks to the charisma of its founder. When Son met Mohammed bin Salman, who is now the crown prince of Saudi Arabia, it took him 45 minutes to get him to commit $45 billion to the fund. Other investors, from Apple to Daimler to a government-owned investment fund in Abu Dhabi, were equally willing to accept mind-boggling valuations as the price to building this new planetary system. SoftBank's own contribution to the Vision Fund is reported to stand at $21.8 billion.

But size can slow you down and bring new risks. A fund this big can only make very large investments in a limited number of companies with a valuation of a billion or more, or "unicorns." "Given their size and the limited number of unicorns, an exit that yields two to three times their initial investment is good for them. But you can achieve that by investing in a public company as well," says Victor Orlovski, managing partner at Fort Ross Ventures. For him, Vision Fund is not a traditional venture play anymore, but a new breed of investment vehicle. Lars Leckie, managing director at Silicon Valley firm Hummer Winblad, agrees with this assessment. "They are certainly disrupting the venture space by anointing category winners early and have forced a lot of later-stage firms to react by raising larger funds," he says. "They seem to be in a race to build the biggest checkbook to compete, and with history as our guide I don’t know if large funds have any chance of venture returns." Some academics go further, wondering if Vision Fund distorts the innovation game because it deters competitive entry and could slow down technological change, as a Harvard Business School case study recently examined. Orlovski also doubts that Son's Midas touch, largely based on his Alibaba gamble, can last. "Mr. Son is making very risky bets on companies whose business models aren't yet proven. The question is what will be their big failure, and how will markets react to it?"

Son himself is consumed by another question: Who will be the successor to his ambitious 300-year vision? While he initially wanted to retire at age 60 and had groomed former Google executive Nikesh Arora to take over the helm, he changed his mind in 2016 and decided to stay on another 5-10 years. "It's not good to hand over the company when I'm not emotionally ready," Son said. The entrepreneur instead appointed a trio of executive vice presidents – fueling speculation who will be the future star in SoftBank's outsized solar system.

The tech entrepreneur's cosmos of influence and investment includes mentors and businesses. Here's a view of just some of the leading figures and companies that SoftBank and Vision Fund have in their orbits.

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/tam_future_cover_en_download_preview.jpg)

The actions of the present lay the foundations for the future. What does this saying mean in turbulent times? Consider a mix of solidity and flexibility!

Curious about the contents of our newest Think:Act magazine? Receive your very own copy by signing up now! Subscribe here to receive our Think:Act magazine and the latest news from Roland Berger.